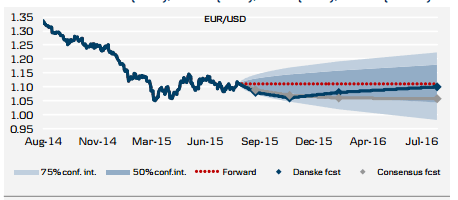

EUR/USD made an attempt to move higher but fell back into range and all eyes are on the Fed.

What’s next for the pair? The team at Danske explains:

Here is their view, courtesy of eFXnews:

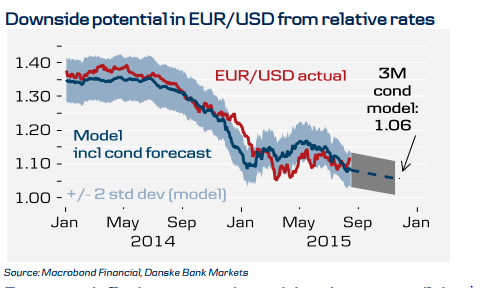

The potential from relative rates remains! With the Greek issue largely put aside in the FX market for now, and the scene set for a marked divergence on short term rates as the ECB sticks to QE and the Fed to its policy normalisation strategy, the scene is set for the USD leg to provide renewed downward pressure on EUR/USD.

Projecting EUR/USD based on a simple cointegration model incorporating our rate projections, oil forecast, etc. leaves us with a conditional model forecast for the cross at 1.06 in 3M; the model broadly suggests that with a 95% probability EUR/USD will fall into the 1.01-1.11 range.

Oil challenging ECB on inflation − The latest drop and a weaker long-run target for oil prices mean that the autumn inflation pick-up will be moderated somewhat. However, the fall-out of negative base effects and a gradual increase in core inflation due to weak potential growth still imply a return to above 1% inflation in the euro zone around New Year. − On the whole, we thus maintain that the FX market could make a first attempt to send the euro higher on a 6M horizon as an ECB exit from QE gradually comes into view.

Growth. The data surprise gap between the euro area and the US has narrowed since the spring peak. A stabilisation in the wedge has been seen in recent months as both US and euroarea data have come out broadly in line with expectations. US data have generally confirmed that the economy – including the labour market – is in decent shape, and household real income growth is set to be a source of US strength in H2. Euro-zone growth is notably supported by past EUR weakness at present.

Monetary policy. We maintain that the Fed-ECB asymmetry has further to run via relative interest rates. The short end of the euro yield curve is kept in check by ECB determination to carry out its QE buying through September 2016. In contrast, the US curve is set for a level shift and steepening as the Fed delivers on policy tightening with a first hike during the autumn (base case is September). Euro-zone inflation is set for a marked rise in H2 (despite the recent sell-off in oil prices) and will be a focal point for the ECB: while Draghi will be keen to focus on ‘inflation trends’, the market may speculate on an early QE exit.

Flows. Speculators remain net long USD but less so than was the case in late 2014. At the same time, EUR shorts have been covered from early-2015 highs.

Valuation. PPP is around 1.23, suggesting the cross is undervalued. Our short-term financial models suggest 1.07 as ‘fair’.

Risks. The Fed hesitating on rate hikes due to missing inflationary pressure.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.