EUR/USD lost ground after 5 weeks of gains, as the Fed finally announced QE tapering. Is it set to continue falling or can it stabilize in the week of Christmas? Here is an outlook for the market moving events and an updated technical analysis for EUR/USD.

The Fed finally announced QE tapering, worth $10 billion. While the size is small and the move was accompanied with stronger forward guidance, it is still tighter monetary policy, resulting in a stronger dollar. Solid German PMIs and business surveys were far from enough to battle the USD rally, especially as the other core country, France, saw weaker PMIs. The ECB is ready to act with further monetary stimulus as the Fed begins going in the other direction. Yet a major crash in EUR/USD is still to be seen.

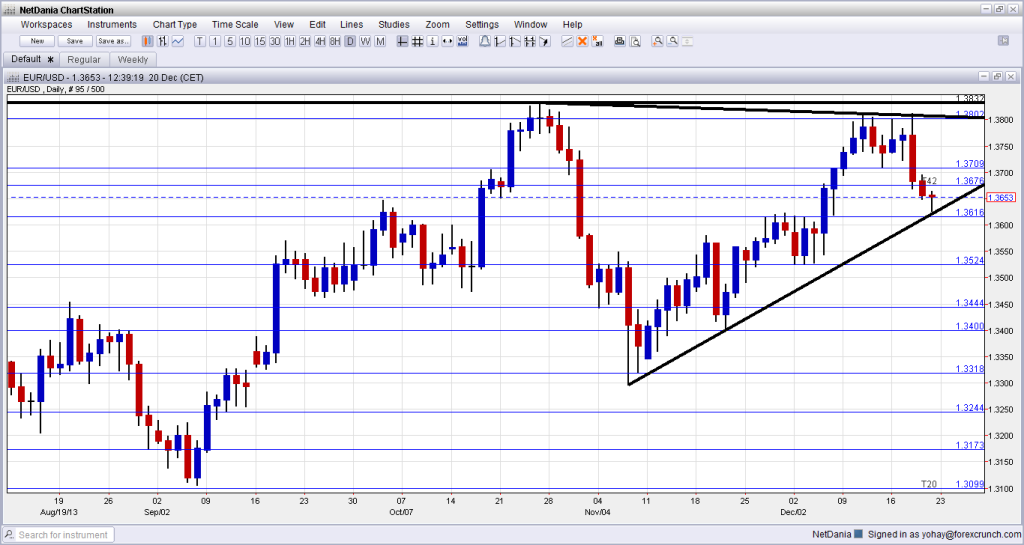

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Belgian NBB Business Climate: Monday, 14:00. This wide survey of 6000 businesses has been improving in recent months, but still remained in negative territory. From -4.3 seen in November, a score of -3.9 is expected now.

- French Consumer Spending: Tuesday, 7:45. Europe’s second largest economy suffered from three consecutive drops in spending. After a drop of 0.2% in October, a correction with a rise of 0.3% is forecast now.

Wednesday, December 25th is Christmas Day, and Thursday the 26th is Boxing Day. Trading volume will remain limited during all the week.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a climb to the 1.38 line mentioned last week. A short lived false break was quickly followed with a big downfall. After a struggle with the 1.3675 level, EUR/USD continued dropping and found support only above 1.3615.

Technical lines from top to bottom:

1.4036 was a separator back in 2011, and awaits the pair if it breaks above 1.40. 1.3940 was a peak in September 2011, over two years ago, and is just before the round number of 1.40.

1.3832 is the 2013 peak so far. The failure of the pair to get close to this line for a second time might make it a top for a long time. 1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013.

1.3710 was the previous 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line, and when it lost it again, the fall was painful. 1.3675 capped the pair in December and also provided some support back in October.

1.3615 worked as resistance in December, as an upper bound for the range. This is the key line to the downside. It is followed by 1.3525, which was the lower bound during this period and also had the opposite role in early 2013.

1.3440 worked as a clear separator in early November 2013 and is a key line to the upside. The round number of 1.34 worked as resistance several times in 2013, and is strengthening now.

1.3320 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges. It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September.

1.3175 capped the pair during July 2013. 1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September.

Lower high respected, uptrend support holds.

From early November, the pair is trending higher, riding above an uptrend support line that currently provides support above 1.36. This has successfully provided support so far, but it may not hold for a long time. The downtrend black thick line emphasizes the lower high the pair reached: from 1.3830 in October to 1.38 in December, and was fully respected.

I remain bearish on EUR/USD

Any taper is still a taper, and the dollar hasn’t fully materialized this change in monetary policy. Also the technical indicators show a change of direction with the lower high. Uptrend support should be watched.

The week of Christmas could slow down the markets, and moves may be limited, but with the ECB thinking about more moves and the Fed having changed direction, there is certainly room to the downside. We have seen that no news is good news for the euro, but this cannot continue for too long.

More:

- FX Outlook 2014 – Conditional Dollar Strength

- Monetary policy divergence will guide future price actions of currency markets

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.