EUR/USD was looking for a new direction as politics continued moving markets. The upcoming week features PMIs and some business surveys. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

German GDP came out below expectations, dragging the overall GDP figures lowers. However, the European Commission marginally upgraded growth forecasts, in a cautiously optimistic move. In the US, data came out better than expected and also Yellen sounded upbeat. However, the US dollar struggled to gain and even reversed the initial gains before balancing things out at the end of the week.

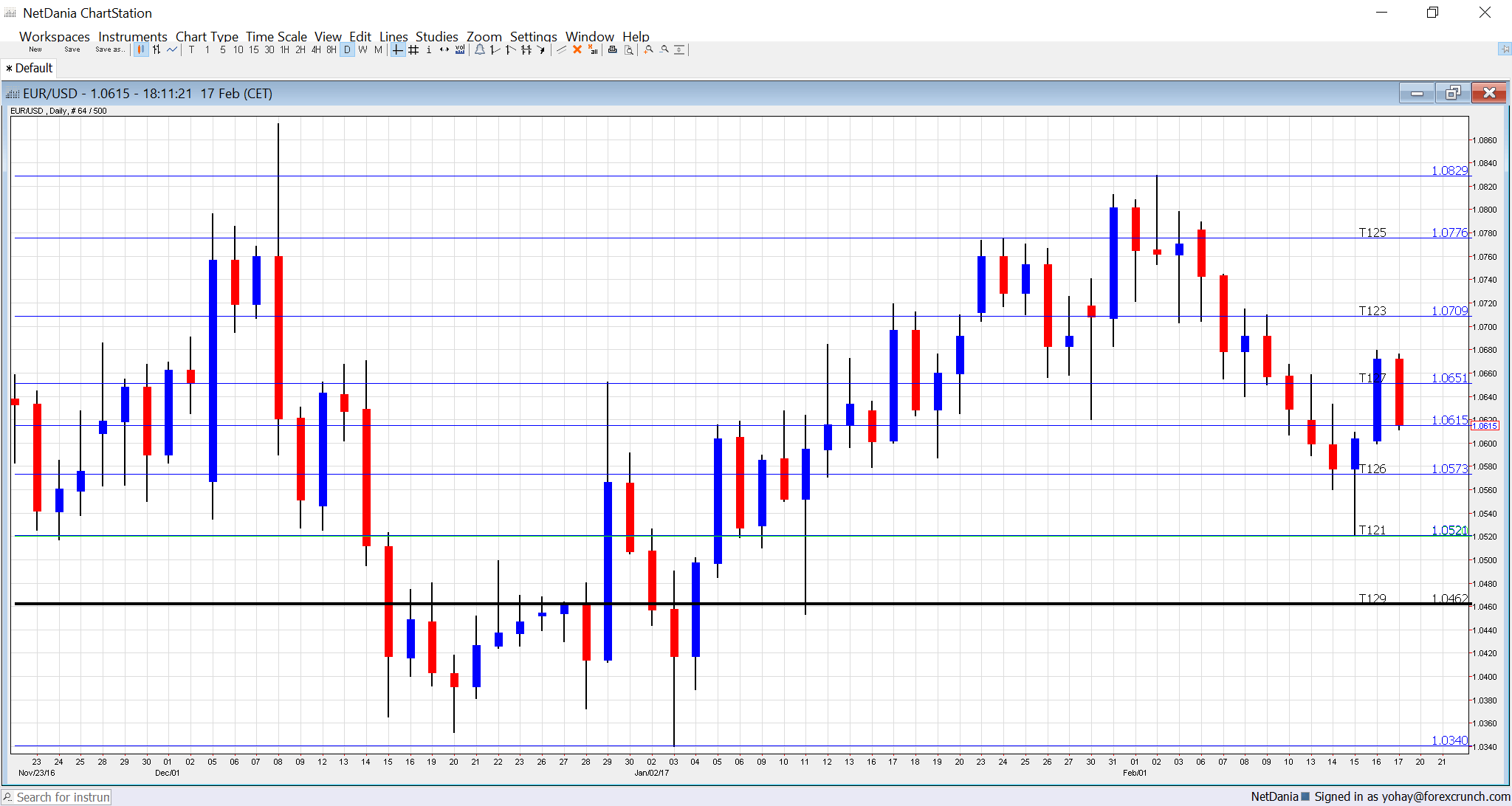

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German PPI: Monday, 7:00. Producer prices have been moving higher, and this eventually feeds into prices consumers are paying. A rise of 0.4% was seen in December. We now get the first read for January 2017. A rise of 0.3% is on the cards now.

- Bundesbank monthly report: Monday, 11:00. The German central bank releases its monthly report, laying out its views on growth, inflation, and employment. Of particular note will be the signs of growth: while the economy grew by 0.4%, this is below previous levels.

- Consumer Confidence: Monday, 15:00. This official measure from Eurostat has been improving, but remains negative, below zero, reflecting pessimism. A score of -5 points was seen back in January. We now get fresh data for February. The same score is expected now.

- PMIs: Tuesday morning: 8:00 for France, 8:30 for Germany and 9:00 for the whole euro-area, showing the preliminary assessment for February. According to Markit’s final data for January, the French manufacturing sector enjoyed growth, with a score of 53.6 points, above the 50 point barrier that separates expansion from contraction. A level of 53.5 is on the cards now. The services sector was doing better with 54.1 points and 53.8 is predicted now. In Germany, the continent’s largest economy, the manufacturing sector already enjoyed robust growth with 56.4 points and a small dip to 56.2 is on the cards now. The services sector lagged behind with 53.4 points and 53.6 is projected for February. In the euro-zone, the manufacturing sector saw 55.2 while services stood at 53.7. Scores of 55 and 53.7 are forecast for the manufacturing and services sectors respectively.

- German Ifo Business Climate: Wednesday, 21:00. Germany’s No. 1 Think Tank surprised last month with a lower assessment of German business confidence in January. The score came out at 109.8 points, below expectations. The influential 7000-strong survey will likely show a similar score in February: 109.6 points.

- CPI (final): Wednesday, 10:00. According to the flash inflation numbers, headline inflation accelerated to an annual pace of 1.8% in January, above expectations and mostly reflecting the rise in oil prices. Core inflation remained low at 0.9% y/y. The final read will likely confirm the initial data.

- LTRO: Wednesday, 10:30. The European Central Bank’s Long Term Refinancing Operations are eyed as a measure of economic activity. In the previous auction back in December, lending picked up to 62.2 billion euros. The figure is still of importance, but carried more weight at its initial auctions, before QE was introduced.

- Belgian NBB Business Climate: Wednesday, 14:00. This wide assessment from the country that hosts most EU institutions has turned positive recently, scoring 0.5 points in January. A small advance to 1.1 is on the cards now.

- German GDP (final): Thursday, 7:00. The growth rate in Europe’s No. 1 economy has accelerated according to the initial read, pulling the whole currency bloc forward. The final read is expected to confirm this.

- GfK German Consumer Climate: Thursday, 7:00. This 2000-strong survey probes consumers and has surprised to the upside in January, hitting a score of 10.2 points, last seen in August 2016. A score of 10.3 is estimated now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week on the back foot, reaching down to the 1.0570 level (mentioned last week). It then fell to support at 1.0520 before bouncing back and trading at the 1.06 level.

Technical lines from top to bottom:

1.10 is the ultimate high level in current trading ranges. It is followed by 1.0950. More importantly, the swing high of 1.0870 is fierce resistance.

1.0775 is the high line seen in late January. 1.0710 is the upper resistance line on the chart after temporarily capping the pair in April 2015.

1.0650 was the bottom end of the range seen in late January. The early high of January, at 1.0615 is the next line.

1.0570 was a stepping stone on the way down. Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen.

1.0460 seems to carry more weight. Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground.

The 101.50 level was a peak seen in 2002, on the first attempt of the pair to break above parity. And then, there is EUR/USD parity.

I am neutral on EUR/USD

After a few busy weeks, the world’s most popular pair could take a break. While worries still persist around elections in the euro-zone, the economy balances this out. More or less can be said about the US. The longer trend could be to the upside, as a disillusionment from Donald Trump could take root.

Our latest podcast is titled Fed refocus as monetary matters once again

Follow us on Sticher or iTunes

Safe trading!