EUR/USD enjoyed the dollar’s weakness but traded with relative caution after Draghi’s press conference. The upcoming week features a mix of PMIs, a key German survey and other measures are eyed. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The European Central Bank did not move policy and more importantly, did not change its view about inflation. By dismissing the recent rise as energy-related, Draghi sent the euro lower. Germany’s ZEW business survey showed higher confidence, but slightly below expectations. Inflation was confirmed at 1.1%, as projected. In the US, the heat was rising ahead of Trump’s inauguration.

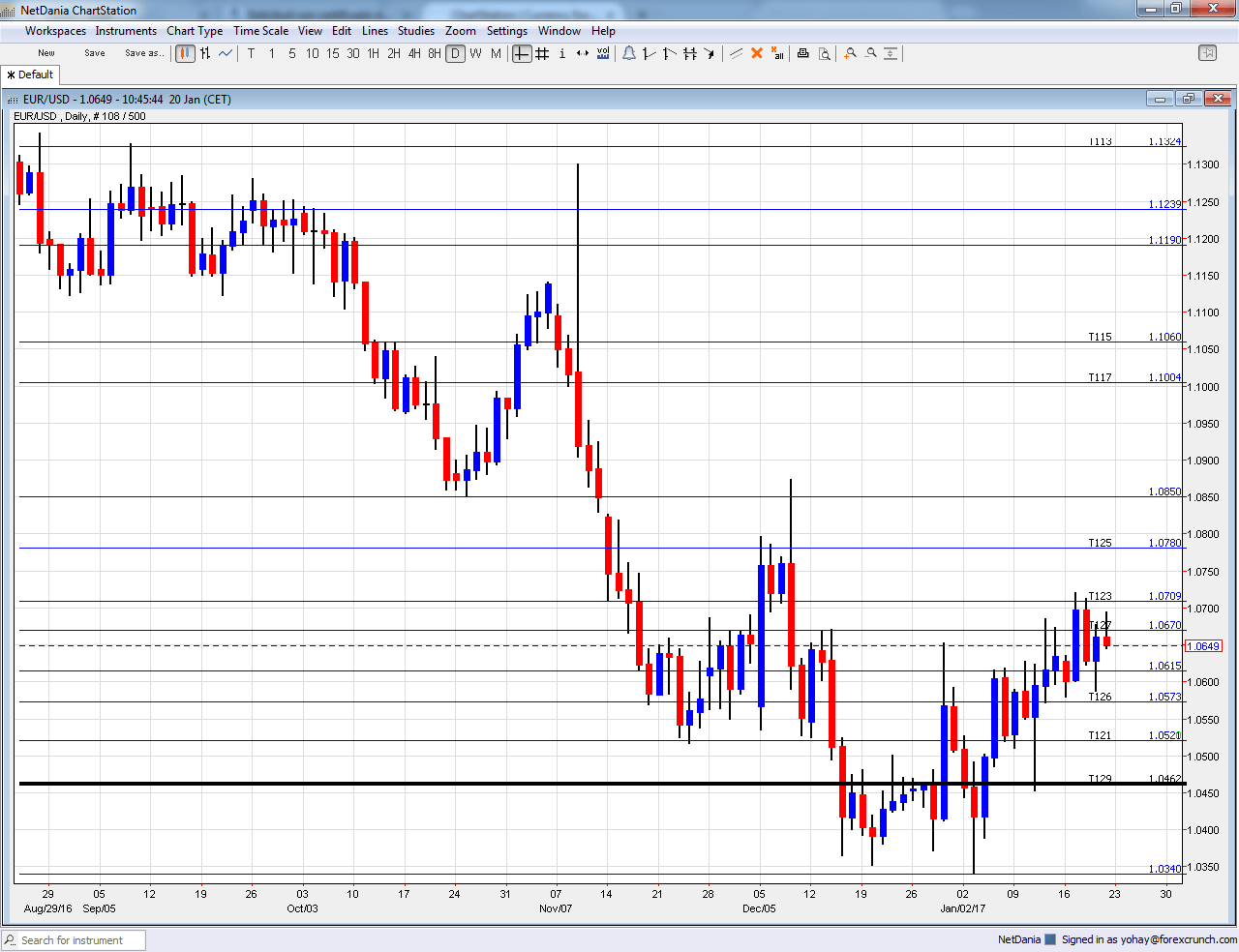

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Bundesbank Report: Monday, 10:00. The German central bank publishes a monthly report on the state of the largest economy in the euro-zone. They have a significant influence on the ECB.

- Consumer Confidence: Monday, 15:00. Eurostat’s consumer confidence measure advanced to -5 points in December, beating expectations but remaining in negative ground, reflecting pessimism. A repeat of this score is on the cards.

- Mario Draghi talks: Tuesday, 11:30. The President of the ECB has another chance to impact the euro in a speech in Torino, Italy, his home country. Another mention of downside risks to the outlook could weigh on the currency. It will be interesting to hear him respond to the first days of Trump in office.

- Flash PMIs: Tuesday morning: 8:00 for France, 8:30 for Germany and 9:00 for the whole euro-zone. Back in December, Markit showed the French manufacturing sector in growth territory, with 53.5 points, above the 50 point threshold separating expansion and contraction. A tick down to 53.4 points is on the cards. The services sector was lagging with 52.9 points and is now expected to score 53.2. Germany, the continent’s No. 1 economy, saw stronger levels. Manufacturing was at 55.6 and is now projected to slide marginally to 55.5. Services stood at 54.3 in the final read and 54.6 is on the cards now. For the whole euro-zone, manufacturing was at 54.9 and services at 53.7 points. The scores are expected to hit 54.8 and 53.9 for manufacturing and services respectively.

- German Ifo Business Climate: Wednesday, 9:00. IFO is Germany’s No. 1 Think Tank. Business sentiment improved back in December with a score of 111 points, continuing the uptrend. Yet another improvement is on the cards this time: 111.3.

- Belgian NBB Business Climate: Wednesday, 14:00. The wide survey from the small country is flirting with stability, around 0 points. Back in December, it beat expectations but failed to turn positive, reaching -0.2 points. The forecast is for a positive score of 0.45 this time.

- Spanish Unemployment Rate: Thursday, 8:00. Spain has seen big improvements in its still sky-high unemployment rate. The fourth-largest economy’s unemployment rate dropped to 18.9% in Q3 2016. Estimations stand at a repeat of the same unemployment rate.

- German GfK Consumer Climate: Thursday, 7:00. This 2000-strong consumer survey ticked up in December, reaching 9.9 points, the highest since December. Are German consumers more confident now? Expectations stand at 10 points.

- Monetary data: Friday, 9:00. The ECB publishes its measures of monetary growth. M3 Money Supply grew by an annual rate of 4.8% in November, bouncing back to levels seen beforehand, after a dip in October. The volume of private loans increased by 1.9%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar traded in range, challenging the 1.0710 level (mentioned last week).

Technical lines from top to bottom:

1.10 is the ultimate high level in current trading ranges. It is followed by 1.0950. More importantly, the swing high of 1.0870 is fierce resistance.

1.0710 is the upper resistance line on the chart after temporarily capping the pair in April 2015. 1.0670 is a high level reached in December, after as the pair attempted a recovery.

The early high of January, at 1.0615 is the next line. 1.0570 was a stepping stone on the way down.

Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen. 1.0460 seems to carry more weight.

Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground. The 101.50 level was a peak seen in 2002, on the first attempt of the pair to break above parity.

And then, there is EUR/USD parity.

I turn from neutral to bearish on EUR/USD

Our latest podcast is titled Monetary Matters – FED, ECB and BOE movements

Follow us on Sticher or iTunes

Safe trading!