EUR/USD wobbled in the post-Brexit week, but basically did not go too far. More PMIs as well as the postponed ECB meeting minutes are eyed. Will EUR/USD choose a new direction? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

In the week after Britain’s decision to leave the EU, there were some doubts that this would really happen and this provided some support also to the euro. In general, things seem calmer, and the ECB is not in any rush to act, different from the BOE. This provides the main support for the common currency. Spanish politics remain messy after the elections, but there is hope for a stable government. Inflation in the euro-area edged up to 0.1%. Both events also support the euro. In the US, final GDP slightly beat expectations but the Fed is in no rush to raise rates.

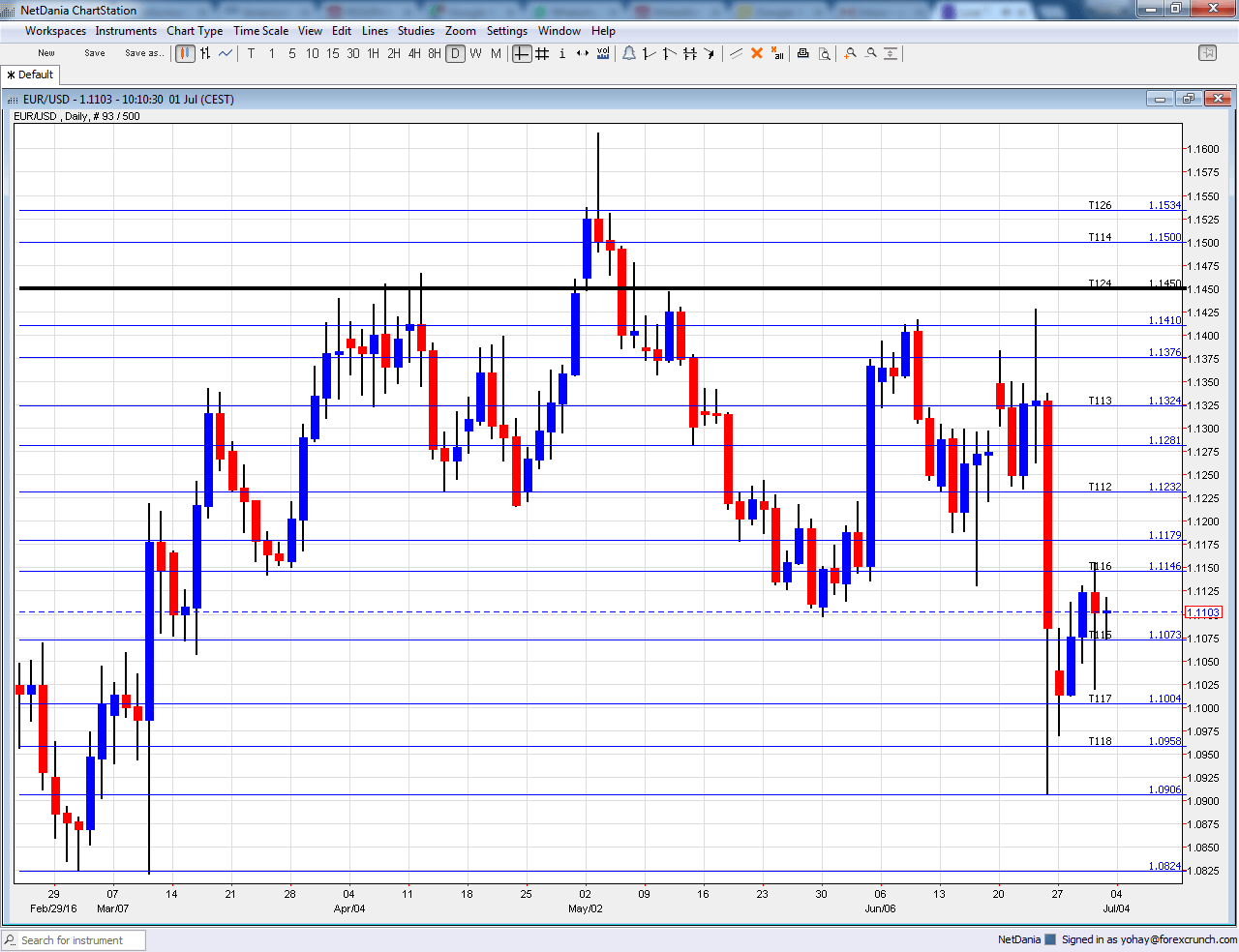

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Unemployment Change: Monday, 7:00. This monthly gauge of the labor market where the unemployment rate is one of the highest is a good barometer for the whole continent. The zone’s fourth largest economy saw the number of unemployed drop by 119.8K in May, at the beginning of the tourism season. Another fall is on the cards now: 74.3K.

- Sentix Investor Confidence:Monday, 8:30. This survey of investors advanced to 9.9 points, the highest since December. A slide to 8.1 points is on the cards for July.

- PPI: Monday, 9:00. Producer prices eventually feed into consumer prices. Prices dropped by 0.3% in April, and we could see a bounce of 0.3% now.

- Services PMIs: Tuesday: Markit releases the data for Spain at 7:!5, Italy at 7:45, the final French figure at 7:50, final German number at 7:55 and final euro-zone number at 8:00. Spain saw robust growth in its services sector in May with 55.4 points, above the 50 point threshold separating expansion and contraction. A score of 55.2 is expected for June. On the other hand, Italy suffered from slight contraction with 49.8 points. 50.3 is predicted now. The initial read for France for June showed a weak 49.9 points. Germany contrasted that with 53.2 and the whole euro-zone with 52.4. These 3 numbers will likely be confirmed in the final read.

- Retail Sales: Tuesday, 9:00. Despite being released after the German and French numbers, this figure still moves markets. A flat read was seen in April and an advance of 0.6% is on the cards now.

- German Factory Orders: Wednesday, 6:00. Factory orders in the continent’s largest economy dropped by 2%. A bounce back is expected in this volatile indicator with +1.1%.

- Retail PMI: Wednesday, 8:10. The retail sector returned to growth, albeit weak growth in May with 50.6 points. Markit’s indicator is not expected to show significant improvement this time.

- German Industrial Production: Thursday, 6:00. The continent’s locomotive enjoyed growth in industrial output in April, with 0.8%. A rise of 0.1% is on the cards now.

- French Trade Balance: Thursday, 6:45. Contrary to Germany, France suffers a trade deficit. A wide deficit of 5.2 billion was seen in April: A similar figure is on the cards now: -4.8 billion.

- ECB Meeting Minutes: Postponed from last week. Thursday, 11:30. The ECB releases minutes from its June meeting, when the ECB did not announce new measures but described the implementation of corporate bond buying and the new TLTROs. In that meeting, they also provided new forecasts which were not too optimistic. The minutes can show how worried members really are regarding their inflation mandate. It can also expose the internal debate. What could be more interesting is if we get details about the members’ view on the potential of Brexit

- German Trade Balance: Friday, 6:00. Germany’s surplus expanded to 24 billion in April, but that was mainly due to a fall in imports. A narrower deficit of 22.3 billion is likely now.

- French Industrial Production: Friday, 6:45. The second largest economy in the continent enjoyed a bounce in output, 1.2% in April. A slide could be seen now with -0.4%. Note that the French government publishes its budget balance at the same time.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week with a small weekend gap, but recovered and eventually settled above the 1.1070 level (mentioned last week).

Technical lines from top to bottom:

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1410 capped the pair in early June. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and works as resistance.

1.1175 was the low point in the mid-May fall. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0905 is the swing low seen in June and serves as weak support. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I remain bearish on EUR/USD

Contrary to doubts and hopes, Brexit is here to stay and it takes its toll on Europe as well. And while the ECB is not keen to act quickly, it seems likely that they will need to follow the BOE in looser monetary policy. Also in the US, monetary policy is not expected to be hawkish, but the country is better positioned to continue growing.

Our latest podcast is a Brexit Breakdown