EUR/USD stormed higher, breaking resistance and hardly stopping to breath. Can this impressive rally continue? PMIs are among the important releases in a busy week that will also have one eye on Greece. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Greek jitters continued rattling markets. Reports about despair and compromise in Greece helped the common currency, as did hopes for a solution even before the deadline. The rise in German bunds and a squeeze of EUR/USD shorts also helped on the European side, where the euro ignored weak euro-zone data. In the US, poor GDP sent the pair shooting above the critical 1.1050 level. When the Fed sounded more optimistic and consequent US data also improved, the greenback recovered, but hardly so against the euro. Can the pair sustain these high levels?

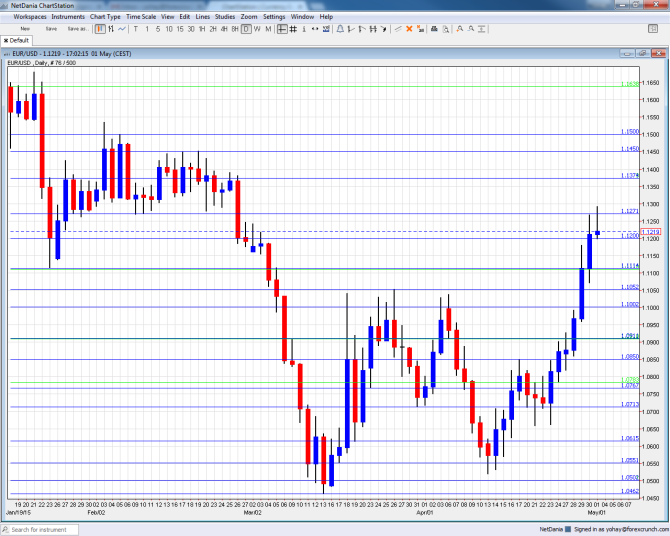

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday, Spain at 7:15, Italy 7:45, final French at 7:50, final German at 7:55 and final euro-zone at 8:00. The flash figures for France, Germany and the euro-zone fell short of expectations. The figures from Spain and Italy could help shape the final number for the euro-zone, which is also composed of updated numbers for the bigger countries. Spain enjoyed a score of 54.3 points in March, significantly above the 50 point mark separating growth from contraction. 54.6 is expected now. Italy had a lower score of 53.3 points and a marginal rise is on the cards. France’s initial number for April reflected contraction at 48.4 points while Germany and the euro-zone at large had the same score: 51.9 points, reflecting slow growth. These last 3 numbers will probably be confirmed.

- Sentix Investor Confidence: Monday, 8:30. This 2800 strong business survey has been advancing in recent months, hitting 20 points in April, the best since mid-2007. A small slide to 19.5 is on the cards.

- Spanish Unemployment Change: Tuesday, 7:00. The zone’s fourth largest economy suffers from one of the worst unemployment rates, with little improvement, as we’ve recently learnt. The monthly level of jobless claims is heavily influenced by the tourism sector. After a drop of 60K in the number of unemployed in March, another significant drop is on the cards: 64.8K.

- EU Economic Forecasts: Tuesday, 9:00. The European Commission releases economic forecasts three times per year. After upgrades from the German government and the ECB, we can expect an upgrade to the 2015 and 2016 forecasts from the EC as well. A small upgrade or no upgrade at all would be worrying for the euro.

- PPI: Tuesday, 9:00. Producer prices also feed into the calculations of the ECB, as they are related to headline CPI. After a jump of 0.5% in prices in February, a smaller rise is on the cards for March: +0.3%.

- Services PMIs: Wednesday: Spain at 7:15, Italy 7:45, final French at 7:50, final German at 7:55 and final euro-zone at 8:00. The services sectors are doing better than the manufacturing ones across the continent. Spain enjoyed strong growth in March, with 57.3 points and 57.4 is predicted now. Italy was far behind with 51.6 and a rise to 52.1 is expected. France’s initial number for April stood on 50.8 points, while Germany had 54.4 points. The euro-zone as a whole received an initial score of 53.7 points. The preliminary numbers for France, Germany and the euro-will be probably be confirmed now.

- Retail Sales: Wednesday, 9:00. After 4 consecutive months of rises, the volume of sales fell by 0.2% in February. The German number, which is already out, gives us an indication about the number for March: a slide of 0.4% is on the cards.

- German Factory Orders: Thursday, 6:00. Germany suffered two consecutive drops in orders in the wake of he new year. However, it is important to note that this indicator is extremely volatile. A bounce back is expected for the month of March: +1.6%.

- French Industrial Production: Thursday, 6:45. Industrial output in the zone’s second largest economy remained unchanged in February after two consecutive rises. No big changes are on the cards, only a small rise of 0.1% At the same time, French trade balance is also likely to remain around a deficit of 3.4 billion euros or rising to 3.5 billion.

- Retail PMI: Thursday, 8:10. According to this purchasing managers’ indicator, the retail sector is still contracting with a score of 48.6 in March. A small advance could be seen for April.

- German Industrial Production: Friday, 6:00. Contrary to factory orders, industrial output has actually risen in February with a moderate +0.2%. Another small tick up is on the cards for March: +0.4%.

- German Trade Balance: Friday, 6:00. Germany’s wide surplus, thanks to its vast exports, is one of the things pumping up the euro. A positive figure of 19.7 billion was seen in February, and the surplus could exceed 20 billion this time with 20.3 billion.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar moved up early in the week, testing the 1.0910 level (mentioned last week). It then floated around 1.10 before smashing the 1.1050 level which quickly turned into support. Further gains didn’t reach the round 1.13 level and saw the pair stabilizing at high ground.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

We start from higher ground this time. The round level of 1.15 has a psychological impact and it also worked as support in the past. 1.1450 capped the pair during February’s recovery attempts.

Below, the historic line of 1.1373 (from November 2003) still has a role as resistance. 1.1270, which was briefly breached recently, served as support in February and is still relevant.

The round number of served as resistance to a recovery attempt and is now a pivotal line. It is followed by a low seen in January of 1.1113 which is nearly 0.90 on USD/EUR.

1.1050 was a high point in March 2015 and now works as important support before the round level of 1.10. This is still a battle line.

The next line was minor support back in October 1999: 1.0910. It was resistance back then and was tested once again in March 2015. This is followed by 1.0815 which worked in both directions.

The next line is 1.0760, which was the low point in both July and August 2003. 1.0715 joins the chart after temporarily capping the pair in April 2015.

1.0660 worked nicely as support in April 2015. 1.0615, which worked in both directions during March 2015 and is better at support.

Another minor line is 1.0550, for a role as support in the same period of time. The very round level of 1.05 served as support during 2003. The lowest level in over 12 years is 1.0462 and this makes it critical support.

Below this point we have the very obvious level of 1 – EUR/USD parity, which is already eyed by more and more analysts

I am bullish on EUR/USD

The correction we are seeing in the pair is now well established. This does not change the bigger picture which is lower (and could change later in the year), but after the breakout of 1.1050, the turn around in German bunds and the momentum we are seeing, it could get worse for EUR/USD bears before it gets better. The US dollar needs impressive data to recover, and this isn’t at hand. The euro could remain bid also with mediocre figures. The chickens will come home to roost, and May is usually a bad month for EUR/USD, but this may happen after the first full week of the month.

In our latest podcast we ask: Did the market get it right on the Fed’s hike? And cover the big upcoming events.

Subscribe to Market Movers on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.