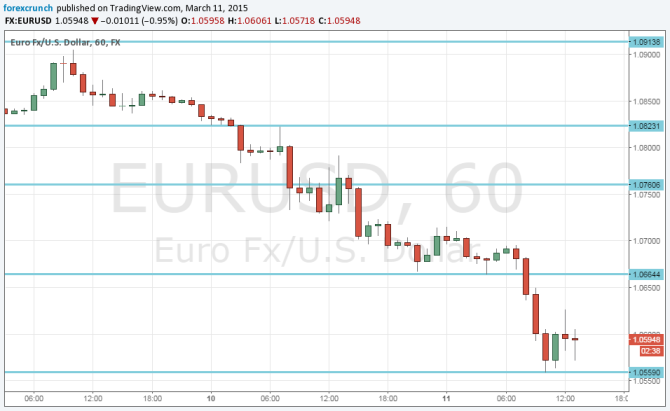

Euro/dollar has been experiencing an avalanche, losing ground and pausing only temporarily before the next move. Volatility has certainly increased in the pair.

And now, following one of the sharper moves, EUR/USD may have found a base at 1.0560. However, this is not where real support lies.

Update: EUR/USD: the big picture – guide to the next low levels

In the past, it found some recovery following Non-Farm Payrolls releases – it bottomed out and only fell lower for days. We expected this bottoming out, but were wrong.

After this release (+295K), which wasn’t as good as the previous ones but still cemented the removal of forward guidance, the euro just keeps falling and falling.

On Friday, it closed on the lows at 1.0846, and continued downhill. The loss of 1.0760 was significant, and it left the pair with real support only at 1.05 – a round number and also a level of support in the distant past: early in the previous decade.

Yet looking at the charts, we can see a more significant bounce at 1.0560. The pair jumped back all the way to 1.0627 before clinging to the round number of 1.06.

Here is the chart:

In the fresh podcast, we talk about the US economy, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb

Follow us on the iTunes page