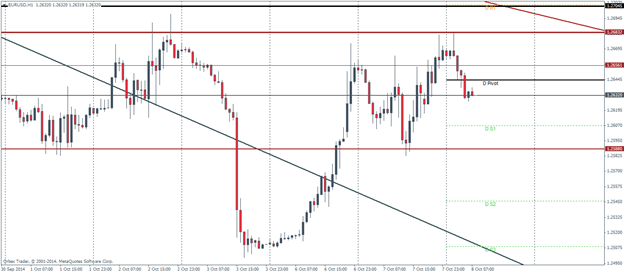

EURUSD Daily Pivots

| R3 | 1.2803 |

| R2 | 1.2742 |

| R1 | 1.2705 |

| Pivot | 1.2644 |

| S1 | 1.2607 |

| S2 | 1.2545 |

| S3 | 1.2508 |

Yesterday’s price action saw, EURUSD oscillating between the two technical support levels of 1.2688 and 1.2588. Price action currently seems to be forming an inverted head and shoulders patterns after finding resistance at 1.2688. If price holds and doesn’t fall deeper than the daily support level 1 at 1.2607, we could expect to see further gains if the neckline resistance at 1.265 is broken, with a possible rally towards 1.272. Alternatively, if the support level of 1.2588 gives way, we could see the EURUSD continue its decline back to the main falling trend line acting as support.

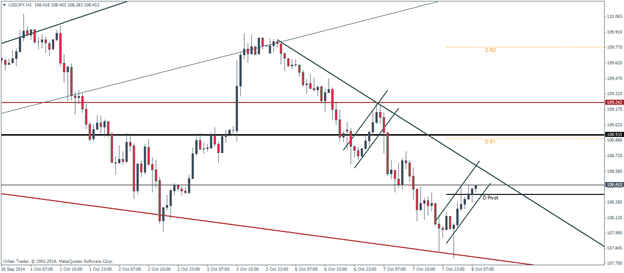

USDJPY Daily Pivots

| R3 | 110.315 |

| R2 | 109.775 |

| R1 | 108.901 |

| Pivot | 108.361 |

| S1 | 107.487 |

| S2 | 106.947 |

| S3 | 106.073 |

USDJPY is looking like the pair is entering a period of consolidation after finding soft support at the main down sloping trend line, marked by two sharp reversal pin bars. A break out of price is more likely to the downside in what seems to be a bearish flag pattern being formed. Upside gains could find resistance near the short term down sloping resistance trend line. If the bearish flag is validated, we could see USDJPY decline towards lows of 107.5

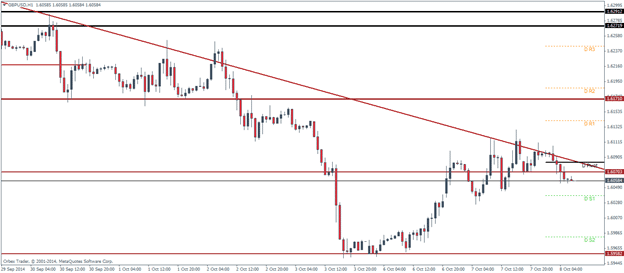

GBPUSD Daily Pivots

| R3 | 1.6243 |

| R2 | 1.6186 |

| R1 | 1.6141 |

| Pivot | 1.6083 |

| S1 | 1.6038 |

| S2 | 1.5981 |

| S3 | 1.5935 |

GBPUSD looks like it is forming a descending triangle pattern after the rally was capped by the main down trend line. Key support has been the region of 1.605. A break of this support could see GBPUSD decline towards daily support 2 of 1.5981.