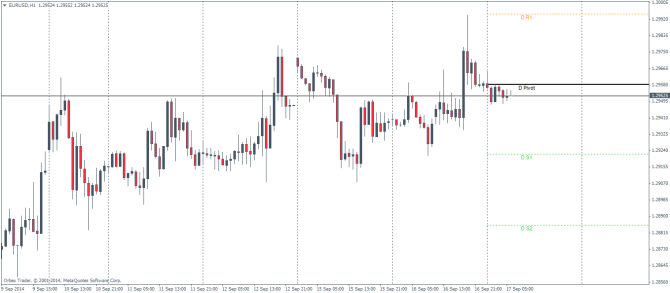

EURUSD Daily Pivots

| R3 | 1.3067 |

| R2 | 1.303 |

| R1 | 1.2994 |

| Pivot | 1.2958 |

| S1 | 1.2922 |

| S2 | 1.2885 |

| S3 | 1.2849 |

The Euro staged a short lived turn around making an intra-day high of 1.29942 before giving back its gains. The Euro was largely unaffected by the weak German ZEW economic sentiment. Key risks today come from the Eurozone final CPI ahead of the FOMC meeting later this evening. Noticing the current price action on the H4 charts, EURUSD looks to be consolidating into a bearish flag pattern posing potential downside risks, targeting the multi-year support level region of 1.265. Daily and weekly Stochastics do point to a bullish undertone, especially the daily charts, which show the Stochs oscillator pulling out of the oversold levels. Nonetheless the EURUSD has been in a significant bearish trend with minimal pullbacks.

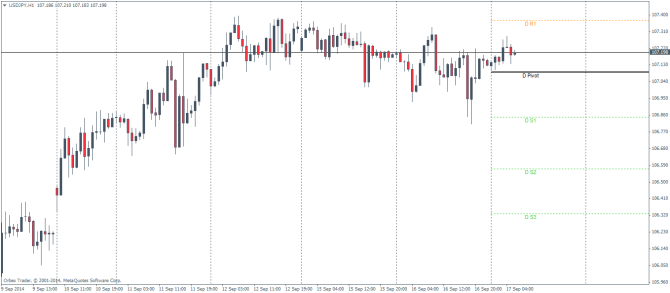

USDJPY Daily Pivots

| R3 | 107.888 |

| R2 | 107.607 |

| R1 | 107.369 |

| Pivot | 107.09 |

| S1 | 106.847 |

| S2 | 106.569 |

| S3 | 106.327 |

USDJPY retreated from its highs, marking a second consecutive day of making a lower high before closing near to the opening price. A downward move is likely to be confirmed only with the weekly close. The Gap remains unfilled in the region of 106.219 which is a few pips below today’s daily support level 3. With USDJPY ranging between 107.389 and 106.932 look for potential breakouts to either side. From a larger perspective, the USDJPY monthly charts show price breaking out of a long term down trend channel ahead of the key resistance at 110.7.

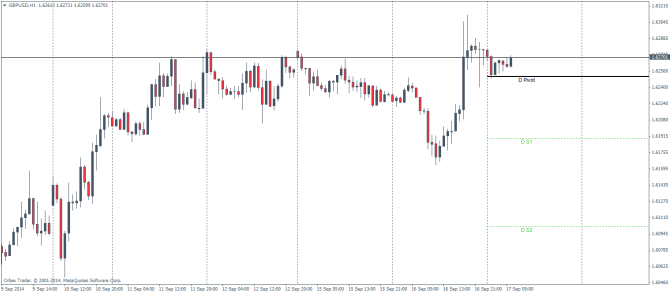

GBPUSD Daily Pivots

| R3 | 1.6486 |

| R2 | 1.6399 |

| R1 | 1.6338 |

| Pivot | 1.625 |

| S1 | 1.6189 |

| S2 | 1.610 |

| S3 | 1.604 |

GBPUSD has been making consistently higher lows with yesterday’s candle closing as an inside bar. The gap from two weeks ago is yet to be filled in at 1.63289. With the monthly labor market data, FOMC meeting and the Scottish vote tomorrow, expect some volatility and spikes in this pair.