EUR/USD began the new trading week with a drift below 1.36. The various regional German states have begun releasing their preliminary inflation numbers for May, and they look weak. The all-German number is released later in the day. As the ECB decision gets closer, the tension rises. And then, the focus shifts to the first NFP hint from the US.

Here is a quick update on what’s moving the pair.

- Previous sessions: EUR/USD dropped from the highs seen late on Friday.

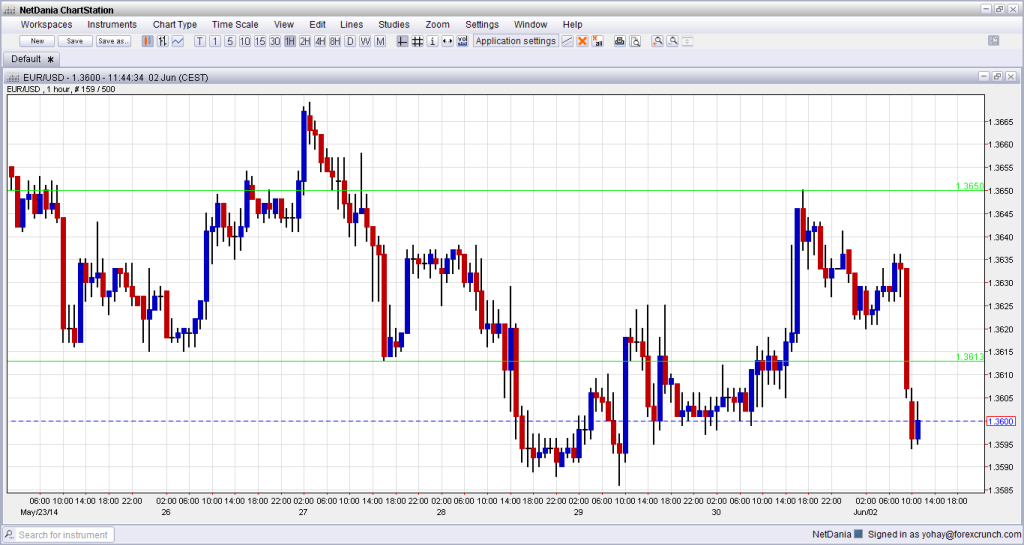

Current range: 1.3560 to 1.3650. Further levels in both directions:

- Below: 1.3560, 1.3515 and 1.3475 and 1.34

- Above: 1.3650, 1.37, 1.3740, 1.3785, 1.3830, 1.3865, 1.3905, 1.3964 and 1.40

- On the upside, 1.3650 is the next resistance line. The round number of 1.37 follows.

- 1.3560 continues to provide strong support.

EUR/USD Fundamentals

- 7:15 Spanish Manufacturing PMI. Exp. 52.6, actual 52.9 points.

- 7:45 Italian Manufacturing PMI. Exp. 54.3, actual 53.2 points.

- 12:00 German CPI. Exp. 1.1% (y/y), HICP exp. 1%.

- 13:45 US Markit Final Manufacturing PMI. Exp. 56.2 points.

- 14:00 US ISM Manufacturing PMI. Exp. 55.7 points.

*All times are GMT

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Every inflation figure matters: After Spanish and Italian inflation numbers were weak, we now see some more weakness from within Germany. A few examps: Bavaria reported an annual rise of 0.6% after 1% beforehand, North Rhine Westphalia printed 1.1% vs. 1.7% and Saxony 0.8% against 1.3%. It seems that we could have a harmonized inflation level of less than 1% also in the biggest economy. While the ECB looks to the medium and long terms for its decision, it is important to remember that October’s weak figure triggered a rate cut in November.

- ECB prepares markets: ECB president Mario Draghi denied deflation concerns again and and again, but changed his mind in the ECB conference this week. Noting that deflation was a serious threat and made it clear once again after the shock comment earlier in the month, that ECB action is imminent. A cut in interest rates seems obvious and also asset purchases, liquidity injections and heavy hints about further actions are on the cards. Any one of these moves would likely have a strong impact on EUR/USD, which has retracted somewhat since testing the 1.40 level earlier in May. Is the ECB decision already priced in? Not so fast. Join a free webinar towards the event.

- NFP buildup begins: This month, the non-farm payrolls figure is released after a full buildup of top tier figures. The manufacturing sector is in the limelight today. The employment component of the ISM report will carry more weight towards Friday’s action.

- US GDP contracts: The first revision of US GDP in Q1 showed a squeeze of 1% (annualized). This was worse than expected and blamed on the weather and on an inventory squeeze once again. Indicators for Q2 already look much better, with jobless claims dropping to 300K. Next week’s NFP will be closely watched.

Further reading: EUR Precariously Balanced Into End of Week