EUR/USD is on the up and up once again, rising thanks to the Trump Tumble. The US President complained about the strength of the US dollar and said he favored low interest rates.

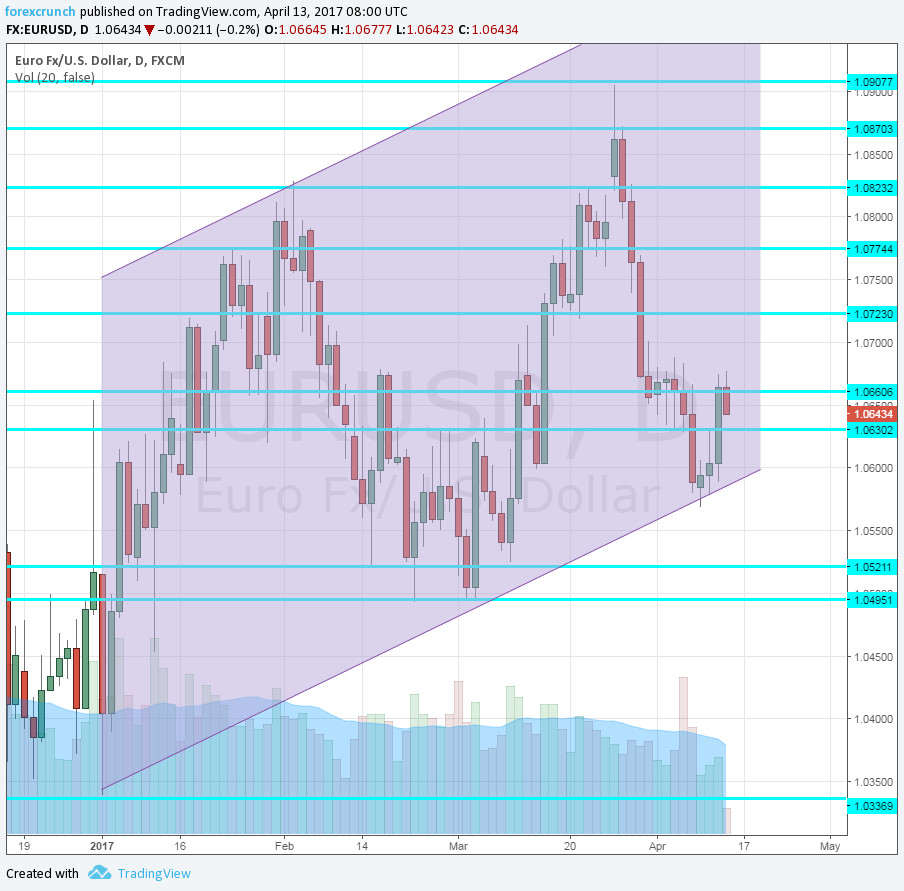

Looking at the wider technical picture, we see that the most recent trough is the third higher low of the year. EUR/USD reached a 14-year low at 1.0340 at the wake of 2017. It then dipped to 1.0490 in early March. And now, in mid-April, the pair hit 1.0560, extending the trend.

On the upside, we can also see higher highs: 1.0830 at the beginning of the year, followed by 1.0950 in late March.

If the pair continues trading in this wide upwards channel, it has a lot of room to the upside. At 1.0643, the pair is struggling with resistance at 1.0660. A further cap awaits at 1.0720, followed by 1.0775 and 1.0830, the initial 2017 high.

The next move depends on France

A lot depends on the outcome of the French elections. The first round of the presidential elections is held on April 23rd. If centrist Emmanuel Macron makes it to the second round, the pair has immediate room to the upside. If Fillon sneaks it, uncertainty regarding a Le Pen presidency could hurt. And if the second round is Melenchon vs. Le Pen, this chart can be scrapped and EUR/USD could crash.

Macron and Le Pen are currently leading the polls. If they make it to the second round, Macron’s 25% lead over Le Pen looks insurmountable.

More: EUR/USD: Asymmetric Risk But Short Preferable Into French Elections – BofA Merrill

Here is how it looks on the chart: