Euro dollar is now extending the rise it began from the lower range, as rumors of Chinese cut of the RRR are cheering the markets. Nevertheless, the fundamentals haven’t changed: the debt crisis still weighs on various European countries, and the US continues improving, although quite slowly. Today we’ll get another short appearance from Bernanke, as well as the US New Home Sales to close the week.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

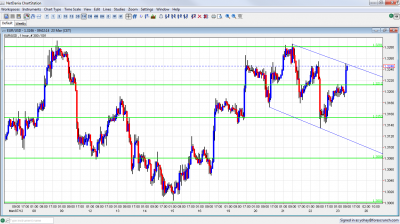

EUR/USD Technicals

- Asian session: A very quiet session saw the pair consolidating a small recovery under 1.3212. This was broken in the European session.

- Current range: 1.3212 to 1.3280.

- Further levels in both directions: Below: 1.3212, 1.3150, 1.3080, 1.30, 1.2945, 1.2873 and 1.2760.

- Above: 1.3280, 1.333, 1.3430, 1.3486, 1.3550 and 1.3615.

- Small downtrend channel: A rather parallel downtrend channel can be seen on the chart.

- 1.3150 is now further away and not so strong. 1.30 serves as strong support once again, and not only a round number. It also provides the shoulder of the head and shoulders pattern.

- 1.3280 proved to be strong on the upside once again. Yet another breakout attempt failed.

Euro/Dollar sliding on new worries – click on the graph to enlarge.

EUR/USD Fundamentals

- 14:00 US New Home Sales. Exp. 326K. See how to trade this event with EUR/USD.

- 17:45 US Federal Reserve Chairman Ben Bernanke talks.

- 18:30 US FOMC member Dennis Lockhart talks.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- China slows and reacts?: Rumors that China will cut its Required Reserve Ratio support the euro and push it higher against the dollar. The unofficial HSBC Flash Manufacturing PMI dropped deeper in contraction zone to 48.1 points. Many find Chinese figures hard to believe, yet HSBC”s number and comments from Australia’s BHP regarding lower demand from the economic giant are taken more seriously. This joins drops in real estate prices in the economic giant. Shifting from an export based economy to domestic consumption isn’t easy, and this has an effect on the global economy.

- European Recession looms: Is the LTRO euphoria behind us? Fresh purchasing managers’ indices are very worrying, and point to a deeper recession than thought. A “mild recession” seems optimistic once again.

- Spanish worries: Citigroup chief economist said that the chance of a Spanish default is now higher. This joins the persistent rise in Spanish yields. Europe remains very fragile. A general strike is planned in Spain on March 29th.

- Portugal in trouble: There are heavy doubts if Portugal could return to the markets anytime soon. A second bailout program is certainly on the cards. Even worse, this may not be enough, and the peripheral country might be needing a restructuring similar to Greece.

- Dollar returns to safe haven status: Perhaps the changes in correlations were temporary. The dollar not only returns to a safe haven currency, but it can quickly return to rise when stocks fall and when doubts over the whole world return.

- FOMC Split: The FOMC left policy unchanged, as expected. The statement included an acknowledgement of higher oil prices and a more upbeat wording regarding employment, such as “the unemployment rate has declined notably”. Indeed, fresh jobless claims figures dropped to a four year low. What’s next? Several FOMC members have spoke lately and each one has his own message. Some want to exit soon, while others are still considering QE3. Bernanke leans towards the dovish camp, but the prospects of QE3 still remain low. Apart from employment, also housing is an area of concern to the Fed. We will get some more data today. Existing home sales came out as expected and now we’ll get new home sales.

- PSI – deadline open for foreign law bonds: Greece completed the PSI for Greek law bonds. The new ones are already trading at a quarter of a euro on the euro, reflecting a high chance of another default. CDS payments were settled yesterday. There is a small portion of bonds under international law. The deadline for the PSI on these bonds is March 23rd.

- Iran conflict heating up: In an unprecedented move, SWIFT announced it will cut off Iranian financial institutions from Saturday. This joins heightened rhetoric in Israel and elsewhere, and keeps oil high. See 5 signs that a war with Iran is getting closer.

- Draghi warns about inflation: The ECB left rates unchanged and made no policy changes. In the press conference, Draghi was very satisfied with the LTROs. He also warned about inflation, and said that the ECB has tools to fight it. Today’s CPI will provide more insight.