Euro/dollar fell to critical support but made a huge comeback. While Draghi disappointed markets with no immediate action, he opened the door to full QE and is now waiting for Spain to walk through. Spain took a big step. Is this a significant positive change in the debt crisis? Many problems still remain. The upcoming features Italian GDP and important German figures. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Contrary to previous performances, Draghi was not at his best and the absence of bond buying from the only factor able to act was disappointing. Nevertheless, the readiness to buy bonds without sterilization and the fact that only Germany opposed the move and not other northern countries, is definitely worth noting. Before acting, internal ECB committees need to work and more importantly, countries have to ask for aid. This U-turn is very hard for the Spanish government, but for a change, they didn’t reject this option – this is a big step forward. Will the ECB take the extra step and help Greece? Perhaps that’s too much to ask.

Updates: Sentix Investor Confidence dropped for the fifth straight month, posting a reading of -30.3 points. This was the indicator’s worst release since July 2009. The poor reading indicates deep pessimism among investors and analysts, which does not bode well for the euro. After pushing above the 1.24 line on the weekend, EUR/USD retraced. The pair was trading at 1.2355. Italian Industrial Production disappointed, posting a 1.4% decline. The market estimate stood at -1.0%. Italian Preliminary GDP contracted by 0.7%, matching the market estimate. The drop in GDP means the Italian economy has now been in recession for one full year. The markets are awaiting German Factory Orders, which will be released later on Tuesday. The euro pushed across the 1.24 level, on positive market sentiment that the ECB will take action to curb Spanish and Italian borrowing costs. EUR/USD was trading at 1.2407. German Factory Orders declined by 1.7%, well below the estimate of -0.9%. German Trade Balance was a bright spot, posting a surplus of EUR 16.2 billion. The market forecast stood at 14.9B. French Trade Balance was less positive, as the deficit widened to EUR 6.0 billion, a four-month low. The German 10-y Bond Auction posted an average yield of 1.42%. This was higher than the previous auction, with a yield of 1.31%. German Industrial Production declined 0.9%, just below the estimate of a 0.8% drop. Standard and Poor’s lowered its outlook for Greece from stable to negative, and warned that the country was likely to miss the targets set out in the bailout package, which would increase the possibility of a default. The euro was slightly down, as EUR/USD was trading at 1.2361. In its Monthly Bulletin, the ECB revised downwards it growth forecast for 2012, from -0.2% to -0.3%. It did predict positive growth in 2013 and 2014. Italian Trade Balance sparkled, posting a surplus of EUR 2.52 billion. The estimate stood at a much smaller surplus of 0.97B. US Trade Balance and Unemployment Claims will be released later on Thursday. The euro is dropping, and is testing to 1.23 line. EUR/USD was trading at 1.2308.

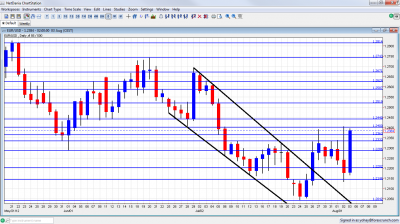

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Sentix Investor Confidence: Monday, 8:30. This survey of around 2800 investors has been in negative ground since September, deteriorating in recent months. Another fall from last month’s -29.6 points is expected now, to -30.7 points. The negative number expressed investor pessimism.

- Italian GDP: Tuesday, 8:00. The euro-zone’s third largest economy receives more attention due to its importance in the debt crisis. The Italian economy contracted for three quarters in a row, and will likely complete a full year of recession. Q1 was especially bad with negative growth of 0.8%. Unemployment and PMIs point to another quarter of rapid contraction, of 0.7% this time.

- German Factory Orders: Tuesday, 10:00. Europe’s locomotive enjoyed growth in factory orders during May: by 0.6%, exceeding expectations. This volatile indicator likely changed course and fell during June to 0.8%.

- German Trade Balance: Wednesday, 6:00. Germany enjoys a high trade surprise that stood on 15 billion euros last month. This is bigger than the deficit of all other countries and enables the euro-zone to enjoy a surplus. A similar number is expected now: 14.9 billion.

- French Trade Balance: Wednesday, 6:45. Contrary to Germany, the zone’s second largest economy has a trade deficit. A similar number to last month’s -5.3 billion is predicted now: -5.1 billion.

- German Industrial Production: Wednesday, 10:00. Also this industrial figure is somewhat volatile, but more important than factory orders. Also here, a surprise was seen last time with a rise of 1.6%. A small slide is likely now, of 0.7%.

- ECB Monthly Bulletin: Thursday, 8:00. One week after the dramatic decisions by Mario Draghi, the ECB will release the figures on which it based its decision. This will provide an insight to how grave the situation really is, in the eyes of the central bank.

- German CPI: Friday, 6:00. According to the initial publication, prices rose by 0.4% in Germany. The final release will likely confirm this figure.

- French Industrial Production: Friday, 6:45. France disappointed last month with a relatively sharp drop in industrial output: 1.9%. A small recovery is expected now: 0.4%.

* All times are GMT

EUR/USD Technical Analysis

€/$ was capped under the 1.2330 line (mentioned last week) before spiking to 1.24 and plunging down to support at 1.2144. The huge comeback sent it back towards 1.24 before it closed at 1.2384.

Technical lines from top to bottom:

The very round 1.30 line is a very important line in case of huge rally. In addition to being a round number, it also served as strong support. 1.29 is also notable on the upside, followed by 1.2814.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is now of higher importance. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

1.2623 is the previous 2012 low and remains important despite recent battles over this line. Below, 1.2587 is a clear bottom on the weekly charts but is only a minor line now.

1.2520 had an important role in holding the pair during June, in more than one case, but it’s much weaker now. 1.2440 provided support for the pair at the same time. and worked as double bottom.

It is closely followed by 1.24 that provided some resistance in June 2010 and switched to resistance in July. It is now of higher importance after capping a recovery attempt at the end of July and also at the beginning of August. 1.2360 was temporary support in July 2012 but quickly switched to resistance. It is minor now.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. It’s stronger after working as strong support. It should be closely watched if the pair falls. The now previous 2012 low of 1.2288 is now minor support.

1.22 is now a more serious support line, after serving as such in June 2010. 1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout. Also in July and August 2012, it worked as a separator.

The new 2012 low of 1.2043 is the next line, although it may prove to be weak on a downfall. Next we have the 1.20 line, which is a round psychological figure.

The post crisis low of 1.1876 is the final frontier before lines last seen in the good years. The launch price of 1.17 is the next line.

Small downtrend Channel Broken

As the chart shows, the pair made a breakout of out of the short term downtrend channel, breaking above downtrend resistance.

I turn from neutral to bullish on EUR/USD

Things move slowly and choppily in Europe, and it takes time for events to materialize. Nevertheless, we might look back at August 2nd and see it as a date when the tables turned, and not as another can kicking event. The expected course of events is that Spain asks for a bailout and the ECB uses its full firepower to cap the yields at low levels. A determined move, that is now on the cards, would be very different from the ECB’s bond buying so far. Also Spain takes its time, but it’s certainly moving. The risk later on this month is Greece (August 20th deadline), but at least for now, optimism will likely outweigh the fear.

In the US, the QE3 camp found some encouraging words in the FOMC Statement, even though the changes were subtle. With US yields at low levels and a better than expected jobs report, hopes will likely be pushed back, and not for the first time.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast