Euro/dollar climbed within the range, despite the reawakening of the debt crisis in the larger euro-zone countries. The week ahead provides important surveys as well as inflation figures, which became more important since the last rate decision. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Worries about Spain were heard left, right and center and yields rose once again. The chances of another bailout for Portugal or a restructuring are higher on the agenda. Also the growing signs of a deeper recession don’t shine on the euro. In the US, a wide variety of speakers provided a wide array of views. For some, QE3 is still on the agenda, and this weighed on the dollar. How will the pair end the first quarter?

Updates: German Ifo Business Climate came in at 109.8, as predicted by the markets. This marked the fifth consecutive month that the indicator has risen. German Consumer Climate was down, dropping slightly t0 5.9. German Consumer Climate disappointed, dropping to 5.9. German Import Prices fared no better, falling to 1%. EUR/USD edged up following Bernanke’s speech on the U.S labor market in which he left open the possibility of another quantitative easing plan. M3 Money Supply rose 2.8%, a five-month high. Private Loans fell to 0.7%, the lowest figure since July 2010. German Unemployment Change showed strong improvement, dropping by 18K. The markets had predicted no change in the indicator. EUR/USD is down, trading at 1.3271.

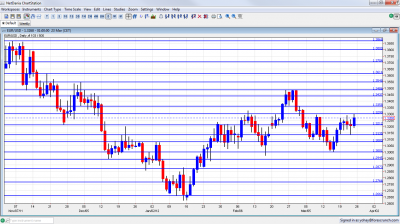

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Import Prices: Publication time unknown at the moment. In the latest rate decision, ECB president Mario Draghi put some fresh emphasis on inflation. So, also this second tier figure becomes more important. After a surprising and strong rise of 1.3%, a modest move is expected now.

- German Ifo Business Climate: Monday, 8:00. Germany’s No. 1 Think Tank surveys around 7000 businesses for its highly regarded indicator. A fifth rise in a row is expected now, from last month’s 109.6 points. Also the less-optimistic ZEW survey rose nicely. Note that the accompanying statement from the head of IFO also impacts the market.

- GfK German Consumer Climate: Tuesday, 6:00. German consumers are gradually becoming more confident. The score ticked up in recent months, reaching 6.0 points. Another small rise, in line with previous rises, is likely now.

- German CPI:Wednesday. Germany’s states release the figures during the day. After a drop of 0.4% two months ago, a strong comeback was seen in consumer prices last month, 0.7%. A similar rise once again will be problematic for the ECB, as it will be called to fight rising inflation at a time of recession.

- M3 Money Supply: Wednesday, 8:00. Also in this inflation related figure, we saw a big comeback, with an annual pace of 2.5% recorded last month, much higher than the previous 1.5% pace. The ECB can claim that one of the reasons is the LTRO, which prevented a credit squeeze. Another acceleration in the pace will add to hawkish pressure.

- German Unemployment Change: Thursday, 7:55. No change was seen in the number of unemployed people last month, yet the general picture is very good. Europe’s No. 1 economy usually sees drops in unemployment, and a small drop is expected now as well.

- French Consumer Spending: Friday, 6:45. The euro-zone’s second largest economy disappointed with two consecutive drops in consumer spending. After the 0.4% drop seen last month, a small rise is likely now.

- CPI Flash Estimate: Friday, 9:00. For the euro-zone as a whole, inflation remains above the 2% target, at 2.7%. This isn’t likely to change now. The main driver of higher prices is oil. Core inflation is under 2%. This publication is important towards the rate decision in the following week.

* All times are GMT

EUR/USD Technical Analysis

Euro/$ started the week with a jump, and from there it saw range trading throughout the week: between 1.3135 and almost 1.33, finally closing at 1.3268.

Technical lines from top to bottom:

Note that some lines have been modified since last week. 1.3615 switched from support in October to support in November and is now resistance and remains far. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3486 was a distinctive double top in February 2012 and is a strong cap. It’s closely followed by minor resistance at 1.3437. The pair struggled there.

1.3360 provided some support in February 2012, when the pair was trading on high ground, and is now weak resistance. Quite close by, 1.33 was tough resistance 4-5 times, with two attempts very recently. It remains key resistance.

1.3212 held the pair from falling and switched to resistance later on. It now returns to support but isn’t that strong. This was the bottom border of tight range trading in February. 1.3135 provided support for the pair in late March 2012 and is now key support for the recent range trading.

1.3080 provided some support in March 2012 and also had a role in early 2011. The round number of 1.30 is psychologically important and is now stronger than earlier. It managed to keep the pair from falling.

The 1.2945 line is stronger once again and still provides support. 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges.

1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year. 1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

The reaction in markets to the strong jobs report resembles a similar move in December 2009, and could point to an avalanche in EUR/USD. See the charts here.

I turn bearish on EUR/USD

With less euro shorts to squeeze, growing fears about Spain, a delay in Greece’s foreign law PSI, the threat of the IMF to cut off Greek aid if more cuts aren’t made soon, and the inability of the pair to rally, it can now turn south, and confirm the head and shoulders pattern.

In the US, housing remains depressed, but employment continues improving. Bernanke can always spoil things for the dollar, but the general direction is dollar-positive in the long term.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.