Euro/dollar turned back and retreated as relief for Greece still isn’t at hand. The Greek drama continues with hopes and doubts regarding a final approval for the Greek bailout. Among the regular events, the rate decision stands out. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

The ECB lent almost €530 billion to banks in the second LTRO, or indirect QE. Together with the delay for Greece and the subtle hints of improvement in employment by Bernanke, 1.35 couldn’t be broken. At least 5 things could still go wrong with Greece. Will the pair make another attempt to rise, or is this the beginning of an avalanche?

Updates: Moody’s joined other rating agencies and lowered Greece’s rating to C, the lowest possible. It said that the Greek deal is a distressed exchange, and hence a default. There is a growing concern that the deal will not find enough “volunteers”. The Euro continued to sag on the news that Greece might declare bankruptcy, dropping below the 1.32 level to 1.3197. EUR/USD continued to lose ground, trading at 1.3139, as the Greek bond swap is still not a done deal. Retail sales posted a 0.3% gain. Revised GDP dropped by 0.3%, its worst reading since 2009. German Factory Orders surprised the markets, plunging 2.7%. Euro broke through the January Support Line, as the trend is clearly bearish for EUR/USD. German Industrial Production climbed 1.6%, a sixth-month high. EUR/USD barrelled above the 1.32 level, trading at 1.3225.

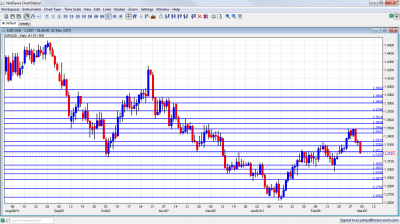

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Final Services PMI: Monday, 9:00. The services sector in the euro-zone is still contracting, but the pace has slowed. The initial score was at 49.4 points, a bit short of the 50 point line separating contraction and expansion. This will likely be confirmed now, or slightly revised to the upside.

- Sentix Investor Confidence: Monday, 9:30. After falling as low as -24 points three months ago, this survey of around 2800 investors and analysts rose to -11.1 points. The negative score means pessimism. Another rise is predicted now, to -6.3 points.

- Retail Sales: Monday, 10:00. The volume of sales has been rather weak recently. The last time it rose was 3 months ago, and it was only 0.1% at the time. Afterwards it dropped twice. ANo change is expected after last month’s 0.3% drop.

- Revised GDP: Tuesday, 10:00. The initial read for Q4 2011 showed a contraction of 0.3%. Some countries officially entered a recession, while France stood out with surprising growth during this time. This negative growth will probably be confirmed now.

- German Factory Orders: Wednesday, 11:00. This volatile indicator rose by 1.7% after 3 consecutive months of stronger moves. A small rise is predicted now, of 0.8%.

- German Industrial Production: Thursday, 11:00. This indicator is somewhat less volatile, and tends to have a stronger impact. It disappointed with a strong drop of 2.9% last month. A correction is likely now, with a gain of 1.1%.

- Rate decision: Thursday, 12:45. Press conference at 13:30.

The ECB will likely leave the interest rate at 1% for another month. This level is the lowest ever, and the situation isn’t extraordinary enough to go below this level. A “mild recession” was already discussed in previous meetings and the updated ECB forecasts aren’t likely to shock the ECB. Headline inflation is still above the 2% target, even if the blame is mostly on oil. The single mandate of the ECB is inflation, and even though Draghi has shown impressing flexibility, a rate cut now is unlikely.The press conference will likely focus on the results of the second LTRO. The ECB was pleased with the first operation as providing tentative signs of stabilization. Draghi recently said that these signs are stronger. It’s interesting to note that the Greek bond swap offer currently expires on March 8th, the same date as the meeting. Draghi will likely be asked about this by the reporters

- Eurogroup conference call: Friday. European leaders decided to wait for the bond swap results and the “final assessment” of Greece’s prior actions before releasing funds to Greece. A conference call is scheduled for Friday to give the final green light. A delay until Monday, March 12th, is certainly possible as well.

- German Trade Balance: Friday, 7:00. Germany enjoys a high trade surplus that floats around 10 to 15 billion euros. It is expected to tick up from last month’s 13.9 billion and reach 14.3 billion.

- French Industrial Production: Friday, 7:45. Also France saw a drop in industrial output last month. It dropped by 1.4% after a rise of 1.1% beforehand. A small drop of 0.6% is predicted now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar slid lower at the beginning of the week, but then made another attempt on 1.3486, a new line that didn’t appear last week. After this attempt failed, the pair fell and lost a lot of ground, closing much lower.

Technical lines from top to bottom:

In case the rally resumes, we’ll start from relatively high ground. 1.38, that stopped the pair in September and also later on is weak and now not so distant resistance. 1.37 had a similar role at the same time and also worked as support afterwards. It is stronger resistance.

1.3615 switched from support in October to support in November and is now resistance. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3486 was a distinctive double top in February 2012 and is a strong cap. It’s closely followed by minor resistance at 1.3437. The pair struggled there.

1.3333 provided some support for the pair during December 2011 and remains important despite being fought over at the beginning of March 2012. Quite close by, 1.3280 proved to be strong in both direction, including in recent weeks.

1.3212 held the pair from falling and switched to resistance later on. This was the bottom border of tight range trading in February. 1.3150 is the lowest point recorded in October 2011, is now a pivotal line in the middle of the range.

1.3050 was the top border of a very narrow range that characterized the pair towards the end of 2011. It is now serious support on the downside after serving as the bottom border of the range and despite a temporary move under this line. The round number of 1.30 is psychologically important but is much weaker now. It was a pivotal line before Bernanke’s rally.

The 1.2945 line is stronger once again and still provides support. 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges.

1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year. 1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

I remain bearish on EUR/USD

The delay in announcing a credit event and a curious need for another “final assessment” for Greece’s prior actions raise the suspicion that Greece will never get the bailout funds. At least 5 things could go wrong and trigger another delay, yet time is running out and the chances of a Greek bankruptcy announcement on March 23rd are rising. This is the baseline scenario of the special report for Greece. Join the newsletter below to download it.

In addition, the LTRO also has two negative consequences for the euro: banks are now better prepared, and Greece could be let ago. Secondly, the ECB’s balance sheet is now larger than that of the Federal Reserve. This indirect QE will eventually indirectly devalue the euro.

On the other side of the Atlantic, things are OK. Ben Bernanke was indeed soft, but didn’t supply a convincing case for QE3 in March. If the NFP isn’t a disaster, QE3 will be delayed like the Greek bailout.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.