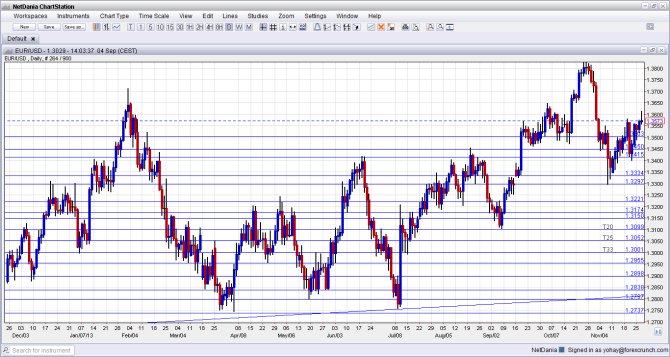

The ECB surprised by cutting the rates deeper into negative territory. While the pair might still bounce back on some kind of disappointment from the press conference, here are some lower levels.

The first and most obvious level is the round number of 1.30, which is not only round but also worked as support in July 2013.

Update: Draghi announces sizable ABS – EUR/USD dips below 1.30

Below, we have 1.2955 was support in April 2013 and is an immediate cushion under the round line. Next down is 1.29, which is minor support after working as resistance back in July 2013.

1.2840 is another support line after supporting the pair twice in May 2013 and this is followed by 1.28, which is only a minor line.

The “line in the sand” is the double bottom of 1.2750, which supported the pair more than once.

If we go even below this level, 1.2737, which was a low back in March 2013. This is a minor level. Much more significant support awaits at 1.2660, which was the low seen in November 2012. It is also a clear separator of ranges.

Below this line, the round number of 1.25 could be important because it reflects 0.80 on USD/EUR, even if it didn’t really work as support or resistance in the past few years.

Here is a daily chart that focuses on 2013: