- EUR: The GDP data is a revision and more detail to the preliminary release, so not a major event risk. Focus will be turning to the ECB meeting tomorrow. There is some talk of a rate cut, but it seems a low probability at this point in time. On Bloomberg survey, 5 of 62 institutions are calling for a cut in rates to 0.50% (from current 0.75%). More: The key to an ECB rate cut is the unwinding of the LTRO

- USD: The ADP data is seen as the best clue on the tone of the employment report on Friday, although naturally economists can’t agree on how useful it actually is! Market sees 170k gain from 192k last month. Stronger than 200k would be dollar positive.

- CAD: Interest rate decision at 15:00 GMT. Rates are seen on hold, but as always it’s a close eye on the statement. The CAD has rebounded a little vs. the dollar after recent weakness and the expectation is that the statement will be softened as growth has disappointed recently.

Idea of the Day

The excitement yesterday was with the new record highs in the Dow Jones index in the US above the 14,000 level. Once again we are hearing talk of bubbles and at the margins ‘irrational exuberance’ words uttered by the previous Fed Chairman Greenspan in the US to describe the stock market in the late 90s.

The main concern with stock markets is that investors are just chasing returns because bond markets are now offering such poor returns, rather than they are confident of the ability of stocks to produce returns (through price appreciation and dividends). So what does this mean for FX? Basically, keep a close eye on stocks, because if they do start to turn, all talk of ‘currency wars’ driving FX rates will be out of the window and the risk dynamics will return, which would mean a stronger dollar against pretty much everything, with the yen not that far behind.

Latest FX News

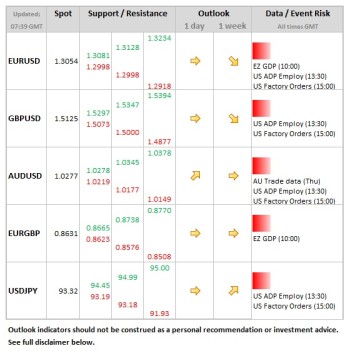

- EUR: After the breaches below 1.30 seen Friday and Monday, EURUSD has recovered but at a modest pace. This has more to do with the weaker dollar across the majors, although the upward revision to services PMI yesterday provided some modest support.

- JPY: Equities back in buoyant form and this has undermined the yen towards the end of the Asian session. What’s become noticeable though is that words alone are not enough to weaken the yen now. Market is looking for action.

- GBP: Sterling in the bunch of currencies that have done comparatively better so far this week vs. the USD. Cable has moved back into a more comfortable range above 1.51, with focus falling onto the Bank of England meeting tomorrow.

- AUD: GDP data confirmed 3.6% growth for the Australian economy last year, having grown 0.6% in the final quarter. Exports were playing a big part in the final quarter, with domestic demand expanding 0.3%. The data has put another spring in the step of the Aussie, briefly moving above 1.03 during the Asia session.

Further reading: Forex Analysis: AUD/USD Turns Up from Trading Range Support