Bullard gave one for the dollar bulls, but it is not enough against the safe haven Japanese yen. A fall in US stocks and US bond yields send money away from the dollar to the yen.

The euro has a reason to fall on its own, as reports emerge that the ECB could further cut rates, contrary to what Draghi said.

EUR/USD

Bullish Bullard: FOMC member James Bullard said that the Fed is closer to its goals than the market thinks. He also mentioned that inflation could be easily reach 2% by year end. Bullard is not a hawk, and his comments help the dollar against more dovish central banks such as the ECB, with EUR/USD tackling support at 1.3585.

Dovish Drag: Speaking of the ECB, we have a report that the central bank of the euro-zone has not reached its lower bound.

USD/JPY

USD/JPY dipped below the frustrating range and reached a 7 month low.

The US stock market has not had a meaningful correction in quite a while, and many are waiting for a crash. The current dip is certainly not a crash, but perhaps it was enough to trigger a sell off in USD/JPY.

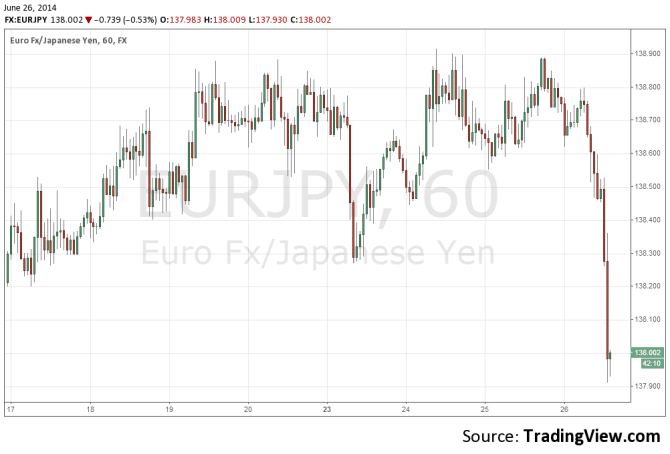

EUR/JPY

Here’s how it looks on the cross: