The Core PCE Price Index is the favoured measure of inflation by the Federal Reserve. It shows that underlying inflationary pressured continue dropping and may contribute to a more dovish tone.

The data for the month of May was no surprise: the PCE follows the CPI, which was already published and also showed a drop. Nevertheless, it is important for FOMC officials to see it in the data they cherish most.

Other figures were mixed: personal spending advanced by 0.4%, better than expected, but on top of a downwards revision. Personal spending increased by 0.1%, as expected, yet at a lower pace than 0.4% seen beforehand.

The revised version of consumer sentiment, which had the last word of the week, saw an upgrade to 95.1 points and provided a sweetener.

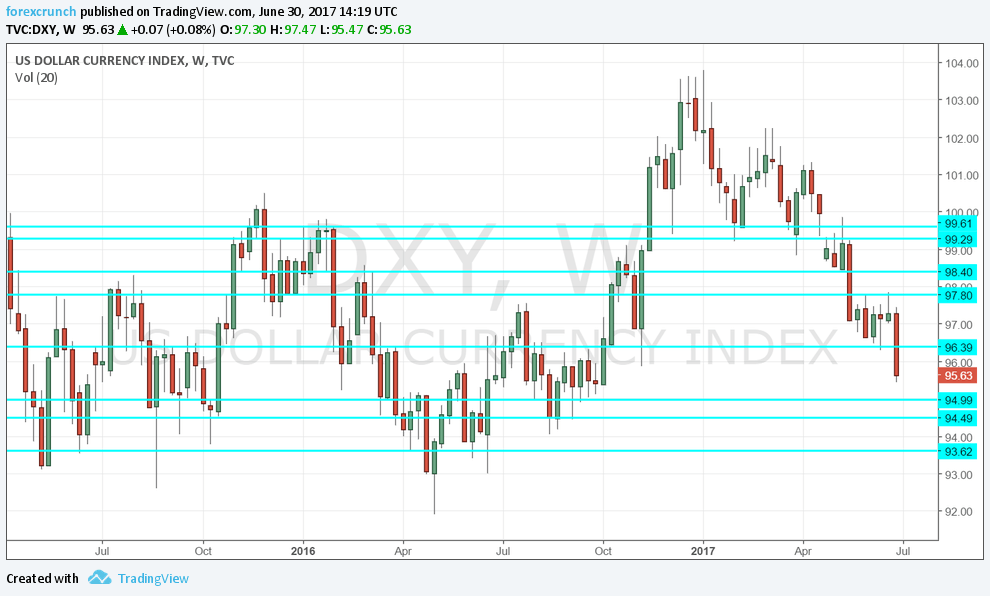

USD had a bad week – more to come?

All in all, the US dollar is closing a negative week. It managed to match the yen but saw substantial losses against the euro, the pound, and also to commodity currencies, with the loonie standing out amid higher oil prices.

The hawkishness of other central bankers exposed some dovishness at the Fed, even if this dovishness does not come from the top.

A new month and a new quarter begin next week, and we’ll get the all-important Non-Farm Payrolls. The dollar will need a salary rise to get some fresh energy. Otherwise, falling inflation and a falling potential for future inflation could push the Fed to abandon its hawkish tone.

Some members are already concerned but we haven’t heard a change of mind from the Fed.

More: Dollar demise: no place to hide, at least for now

Here is the dollar index weekly chart, showing the big fall in the value of the greenback.