The Federal Open Market Committee made its most recent rate decision this past Wednesday, unsurprisingly electing to leave rates untouched.

Despite the result being as expected, markets moved heavily on the Fedspeak that followed. The market had priced-in some hawkishness on the heels of May’s strong employment data, expecting the Fed to be increasingly conspicuous in divulging its plans a 2015 rate hike.

Instead, the Fed acknowledged that a range of indicators suggest that the slack in the labour market is dissipating, but expressed concern over wage growth. The statement was overall much more dovish than expected, with Fed Chair Yellin attempting to downplay the importance of the timing of the first rate hike. In the question and answer period held by Yellin following the FOMC decision, she stressed that the Fed will be looking to raise rates “gradually”, at a rate of about 100 basis points per annum. She further assured that the Fed won’t follow the 2004-2006 script highlighted by 25bp hikes every meeting, offering that “it might have been better to raise rates more rapidly” during that period. Despite this, a rate hike in either September or December remains firmly on the table.

Canadian Dollar Impact

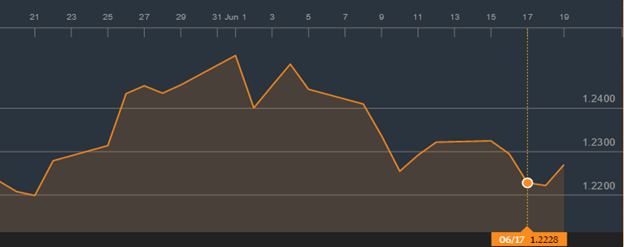

The FOMC decision galvanized a Canadian dollar rally that received further momentum from a slight uptick in oil prices and uninspiring U.S. inflation data. How impactful will the FOMC statements be to the long-term Canadian dollar outlook?

Firstly, we must consider whether the FOMC statement has materially altered the outlook of the USD for the remainder of 2015. Despite the short-term dovishness conveyed at June’s meeting, the Fed really didn’t make any statements that were incongruous with prior statements. Essentially, they reaffirmed their commitment to a data-driven path to normalization. Expectations for a hawkish statement may have been unrealistic with consumer confidence and labour market growth remaining tepid. The Fed firmly left the possibility of two rate hikes in 2015 on the table, which will serve to catalyze the USD towards the end of 2015.

Additionally, the Bank of Canada remains on the sidelines, reaffirming its neutral-dovish tone focusing on non-energy export led growth. With oil prices rangebound between $57-61 over the last month, oil is flat, and is expected to remain that way. A dovish central bank and stable oil prices leave the Canadian dollar lacking a catalyst, which the Bank of Canada is content with. A strong dollar would be problematic for Canadian export growth, making it unlikely that we’ll see a hawkish BoC any time in 2015.

Bottom Line

For the aforesaid reasons, it is reasonable to assume the USD will continue to strengthen against the CAD over the latter half of 2015. It is also reasonable to expect the USD to strengthen with alacrity if/when the Fed finally does decide to raise rates. It is possible the USD/CAD will be flirting with its 52-week high of $1.28 by years end, and there is likely very little downside from the current rate. While the RSI for the USD/CAD remains at 44, far from being oversold, the Canadian dollar’s lack of a catalyst should service to limit its upside.

By: Rahim Madhavji is the President of Knightsbridge Currency Exchange Toronto, a currency exchange company. Mr. Madhavji has been featured on BNN TV and the Globe and Mail.