The minutes from the FOMC Meeting back on March 15th contained some hawkish commentary. Most officials in the Federal Reserve saw the institution beginning to shrink its balance sheet is warranted and mentioned starting the process later this year.

They discussed communicating the reduction of reinvestment well in advance and including both Treasuries and MBS in the mix. This sounds quite significant and would compound the rate rises. All in all, the institution led by Janet Yellen is pleased with the advance in the economy. A state of full employment is very near.

More: FOMC minutes provide room for hikes, balance sheet reduction

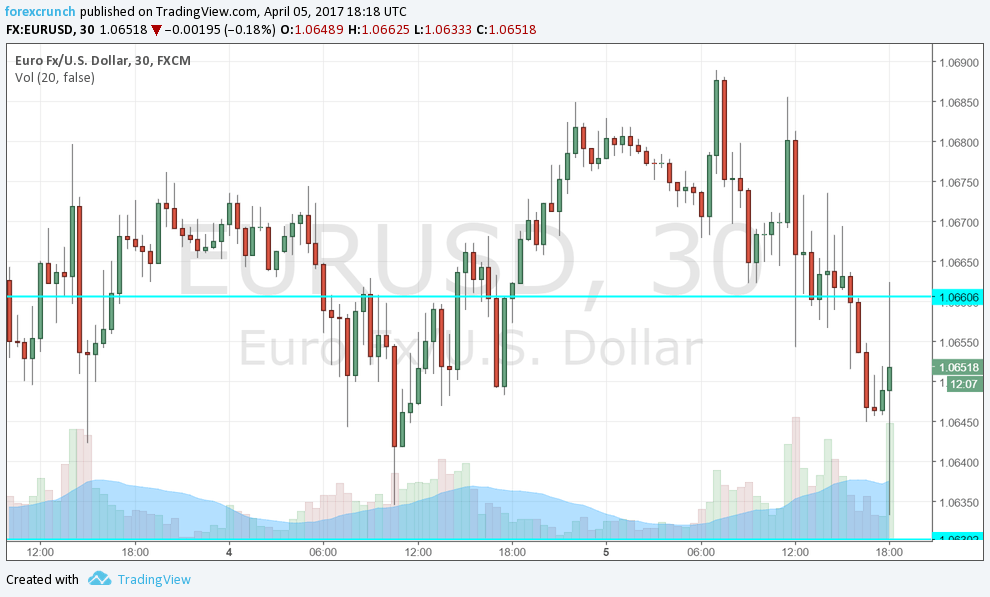

The US dollar enjoyed a temporary spike, with EUR/USD making a second attempt at 1.0630, creating a double-bottom. However, the move did not extend.

Many participants discussed the implications of the rise in equity prices over the last months. Did they intend to cool down the stock market? Perhaps, but they also warn about a risk to their outlook should there be a sharp correction.

Regarding fiscal policy, the members seem more cautious: they are waiting for news from the Administration and see the impact coming only next year, in 2018.

Here is the double-bottom on the EUR/USD chart: