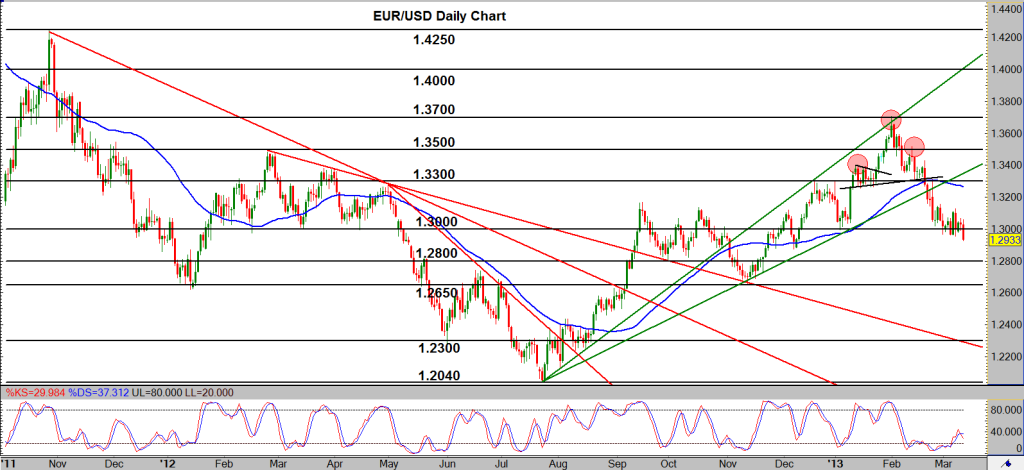

EUR/USD (daily chart) as of March 13, 2013 has consolidated its recent declines by fluctuating around key 1.3000 support for the last two weeks. This occurs after price formed a head-and-shoulders reversal pattern with its high around 1.3700, and then broke down strongly below a major prior support level around 1.3300 in late February. That breakdown provided indication of a potential change in the trend bias, disrupting the previous uptrend that had been in place for the prior seven months.

Since falling to the major 1.3000 support level more than a week ago, the pair has consolidated around this price area, but has pushed towards a continuation of the new bearish trend. Today’s bearishness has helped to clarify that directional bias by dropping further down towards 1.2900. On a trend continuation of this bearish momentum, downside price targets reside first around the 1.2800 and then 1.2650 support levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.