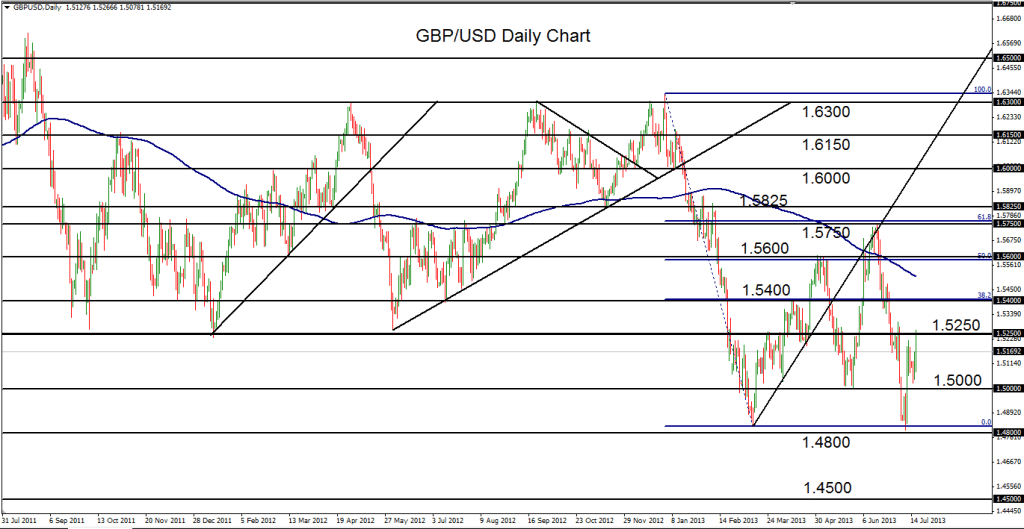

July 17, 2013 – GBP/USD (daily chart) has tentatively backed off and retreated from key resistance around the 1.5250 price region after rising just above this level in early Wednesday trading. This rise to resistance occurs after price bounced off a double bottom low last week around the 1.4800 price region, correcting the steep bearishness that had been in place since mid-June. Despite this upside correction, the directional trend bias for GBP/USD continues to be bearish in line with the overall downtrend since the very beginning of the year. The current retreat from resistance could serve as an initial catalyst for a potential resumption of the downtrend. This directional bias would be strengthened on a re-break below the major 1.5000 figure, and confirmed on a breakdown below the double bottom low around 1.4800. In this event, the next major support objective to the downside resides around the 1.4500 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.