After the monumental flash crash of the pound, other currencies can get carried away. The team at Credit Suisse lays out the case for a collapse in EUR/USD:

Here is their view, courtesy of eFXnews:

We take the opportunity this week to cut our 3m EURUSD forecast to 1.10 from 1.15, leaving the 12m target unchanged at 1.05.

We have long feared that the UK vs EU tensions could become a problem in 2017, not least if they highlight divisions within the rest of the EU going into key elections in France and Germany next year. As GBP is suffering through its divorce, EUR cannot deny its own failings that helped end the marriage.

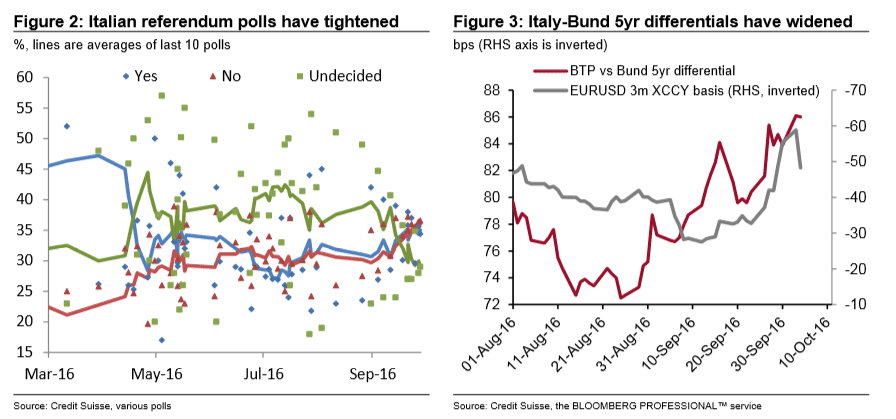

Italy’s December 4 constitutional referendum is another key factor consider, with latest polls showing the “No” note in the lead. As Figure 3 shows, Italy – Germany yield differentials are widening again despite the ever-present ECB balance sheet support for European bond markets. And while European banking problems have taken a back seat this week, they are not off the agenda to the degree needed to tighten up the EUR basis again.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

In light of and in addition to the discussion above, we see a number of scenarios that could lead to a sudden shift lower in EURUSD:

1. Article 50 being triggered before end-March 2017 in an acrimonious environment.

2. A related or separate pickup in euro area political and / or financial risk.

3. A rise in US inflation expectations / resumption of Fed rate hike cycle (not one and done).

4. The ECB introducing new easing measures even as the market now focuses on tapering.

5. The passage of USD political risk leads to a renewed bid for USD as the global currency of choice.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.