GBP/USD remains under intense pressure even as EUR/USD manages to stage a recovery of sorts. Are more falls coming?

Here is their view, courtesy of eFXnews:

Since the Conservative party conference in Birmingham just under two weeks ago the market has progressed again through the five stages of “Brexit grief” into acceptance of a Hard Brexit.

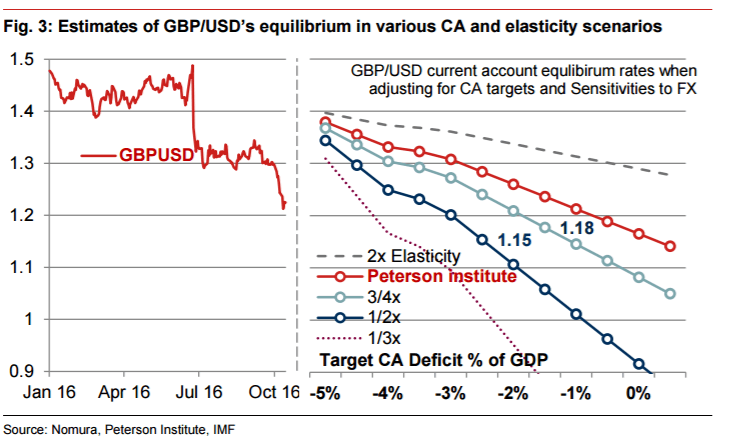

The rhetoric from ministers with “red lines” on immigration has considerably lowered the possibility of a “Soft Brexit” in the market’s pricing and we have moved more towards the “Clean Break” or “Hard Brexit” outcome. With the market’s acceptance of this it has naturally seen GBP suffer. But it is more than just that. It has changed the dynamic we see between UK rates markets and FX that leads us to conclude that we have not yet seen the bottom in GBP, with portfolio inflows less likely to provide the necessary inflows to the UK to plug the current account deficit

We have strategically been short GBP all throughout this time initially targeting 1.25 in GBP/USD before the flash crash, then targeting 1.20 in its aftermath.

From these levels it is less attractive for some to enter fresh shorts, but given the new market dynamic we continue to recommend selling GBP initially to 1.20 and further and for EUR/GBP to break above 0.92.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

We head yet again into another weekend with potential for further political headlines. At some point there may be some good news that leads to a GBP positioning squeeze higher (as the market is very short GBP). The current High Court case on parliament’s ability to vote on Article 50 is a likely headline risk if it rules in favour of a vote being required. What is also an interesting question will be how much of a squeeze? Prior to the flash crash we would have said a considerable amount (3-4% perhaps), but now with many short positions in the exotic options space likely to have been cleared out perhaps it won’t be such a position squeeze. Over the last few sessions we are inclined to say that GBP has been trading in a way that would imply that short-term positioning is a lot cleaner.

So if there is any rally it should be shortlived and will be used by the market as an opportunity to sell at better levels unless of course it is due to a complete reversal of position from politicians on the current “Hard Brexit” stance.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.