Sterling has not been shining as Hard Brexit fears took over. The team at SocGen reasons for a short trade, under conditions.

Here is their view, courtesy of eFXnews:

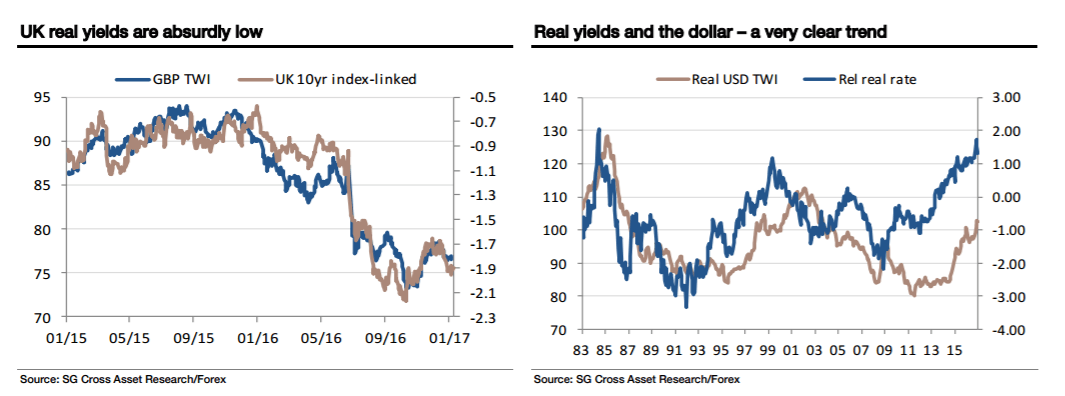

Maintaining my current infatuation with real yields as FX drivers, there’s a surprisingly good correlation, still, between the value of Sterling and UK real yields (no spreads, just the UK 10-year Linker). UK real yields have been drifting lower this year and are back down at -1.9%. Does it matter that, just for now, the UK economy is weathering the prospect of leaving the European single market better than expected, if the real yield offered to those who finance the country’ s near 6% GDP current account deficit is -1.9%?

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

From here, I’m not really sure there’s much more downside to sterling on a 12-month view, but that’s only because I don’t think those real yield levels are sustainable.

I prefer to be short linkers than short GBP/USD here, but as long as the bond market keeps real yields so far below zero, we like short GBP/USD but keep a tighter stop (1.23) to manage the risk.*

*SocGen hit target on short GBP/USD earlier this week circa 1.2150.