- GBP/USD has been on the back foot as weaker parts of economic indicators take priority.

- US retail sales, BOE speculation, and coronavirus figures are of interest.

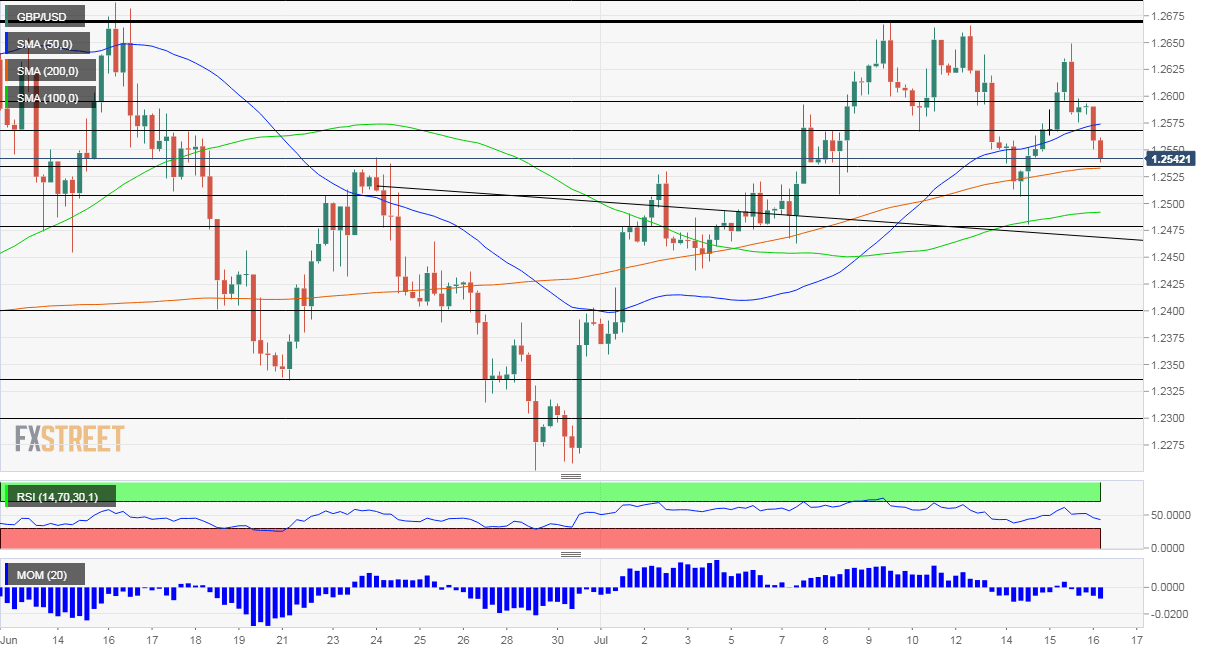

- Thursday’s four-hour chart is showing bears are gaining ground.

The rosy glasses are gone – and markets are experiencing a reality check or a sobering up. Investors seem to focus on the negatives in every development rather than clinging onto the positives – and that may push the pound even lower.

The UK unemployment rate remained at 3.9% in May – an excellent level in absolute terms and beating expectations once again. The Claimant Count Change also surprise with a drop of around 28,000, instead of rising.

However, average earnings are now down 0.3% year over year, ending an era of pay rises. GBP/USD has been extending its losses following the publication, focusing on the negatives and the potential for disinflation.

Andrew Bailey, Governor of the Bank of England, told MPs that interest rates will remain depressed for at least two more years. The BOE’s borrowing cost stands at 0.10% and setting a negative rate is still “under review.” Further speculation about going negative could send sterling lower.

Earlier in the day, China reported that Gross Domestic Product rebounded by 11.5% in the second quarter and 3.2% yearly. Both figures exceeded estimates. Yet again, stocks dropped as the world’s second-largest economy also saw a drop of 1.8% in June’s retail sales – showing that consumers remain hesitant.

Will US retail sales also disappoint? Figures for June are forecast to reflect an ongoing recovery as the US continued its reopening early on before some states suffered from a resurgence of the virus. Given the recent reactions, investors may find one piece of data or another to worry about.

The reaction to hopes about a COVID-19 vaccine has also changed. Less than two days after Moderna’s progress in developing communication sent global shares soaring, a similar report by AstraZeneca and the University of Oxford failed to inspire investors. An upcoming publication in The Lancet is set to show that the vaccine candidate offers double protection – both antibodies and T-cells.

While the UK coronavirus curve continues falling, infections and deaths in the US are on the rise. Record cases have been reported in California and Texas, and other states are also struggling to keep up. America’s cases have surpassed 3.5 million and mortalities top 137,000.

Overall, reasons to worry have always been out there for investors to see, and they are finally having a reality check. Will this last? That remains an open question.

GBP/USD Technical Analysis

Momentum on the four-hour chart has turned negative and GBP/USD dropped below the 50 Simple Moving Average. However, it continues trading above the100 and 200 SMAs.

All in all, bears are gaining ground but are not in full control.

Support awaits at 1.2535, which is where the 200 SMA hits the price and just below the daily low. The next line to watch is 1.2510, a swing low from last week, followed by the weekly trough of 1.2480.

Some resistance is at 1.2565, which was a low point last week, followed by 1.595, a line that worked in both ways in recent days. The triple top of 1.2670 is significant resistance.