- GBP/USD has been falling after the Fed’s refusal to add stimulus.

- The BOE may join in with a worried message and fully reverse the Brexit-related rally.

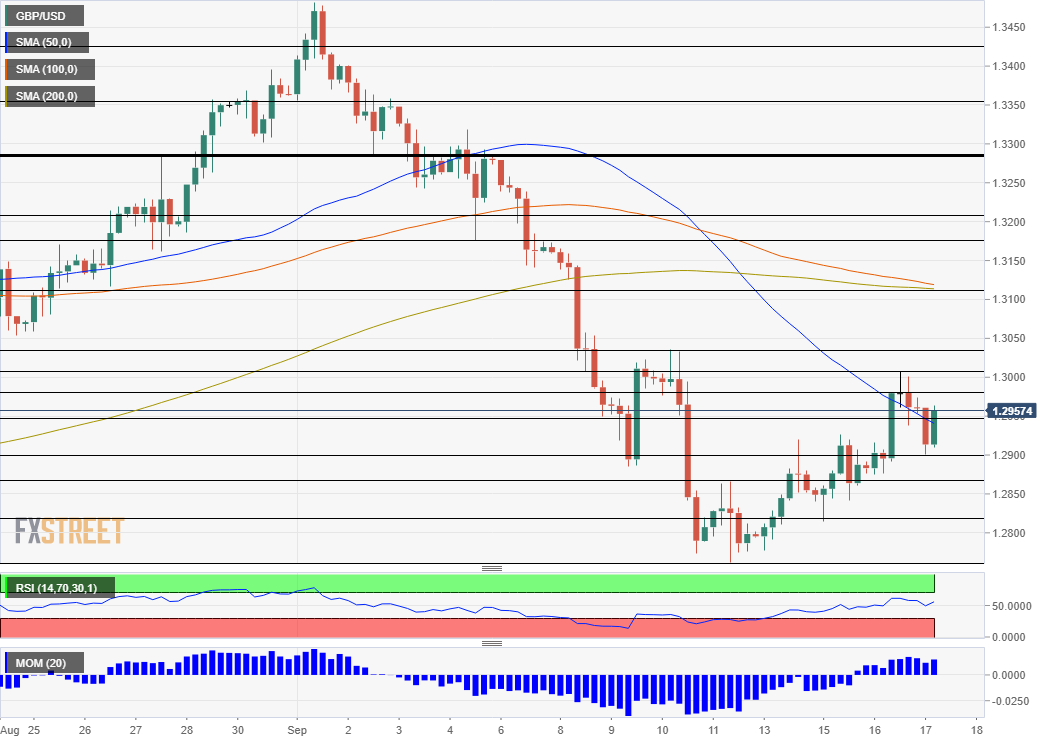

- Thursday’s four-hour chart is painting a mixed picture.

The Brexit bonanza has proved short-lived – Pound bulls prematurely celebrated Prime Minister Boris Johnson’s climbdown before the Federal Reserve sent the safe-haven dollar higher. Now it is the Bank of England’s turn to move cable – and potentially tilt it lower.

Unpacking cable’s moves

PM Johnson agreed to compromise with the “rebels” in his Conservative Party by agreeing to more robust parliament oversight over the Internal Markets bill. This legislation – which is set to receive the House of Commons’ approval next week – knowingly violated the Brexit accord with the EU.

Will Brussels accept the modified version of the bill? The block previously laid down an ultimatum to the UK – rescind the legislation by the end of the month or face sanctions.

The pound advanced in response to Johnson’s climbdown but was unable to hold above 1.30 after the Fed conveyed a worrying message. While the world’s most powerful central bank raised 2020 growth forecasts, it downgraded the one for 2021. More importantly, Federal Reserve Chairman Jerome Powell said the current level of bond-buying is appropriate, disappointing investors.

He also indicated fiscal stimulus would be useful. That may come earlier than expected following weak retail sales. Weekly jobless claims figures are eyed later in the day.

See Retail Sales Analysis: Miserable figures good for gold as fiscal help could come sooner

Investors had already priced in low borrowing costs for several years and yearned for more cash injections from the bank. Stocks – already off their highs – extended their falls and the safe-haven dollar saw fresh demand.

See:

- Fed Quick: No news is good news for the dollar, at least until Congress moves

- The Fed in September: Quicksand at the zero bound

BOE – seeing the glass half empty?

The Fed’s peers on the other side of the pond have their say now. Andrew Bailey, Governor of the Bank of England, is projected to leave the interest rate unchanged at 0.1% and the Quantitative Easing program at £745 billion.

Markets will be watching the bank’s fresh assessment of the economy moving forward. On the one hand, the recovery beat estimates and unemployment remains low at 4.1% in July. On the other hand, uncertainty about Brexit, the furlough scheme, and the virus – as Northeastern England is hit by new restrictions – may weigh on the outlook.

Pessimism from the BOE may break the tie between Brexit optimism and Fed pessimism, potentially sending the pound down.

See BOE Preview: Fast recovery or trio of troubles? Bank’s tone to set pound’s direction

GBP/USD Technical Analysis

Pound/dollar is benefiting from upside momentum on the four-hour chart but is struggling to recapture the 50 Simple Moving Average. The Relative Strength Index is stable, indicating a lack of conviction.

Support awaits at 1.29, the daily low, followed by 1.2865, a swing high last week. Next, 1.2820 and 1.2765 are eyed.

Resistance is at 1.2980, a support line from last week, followed by Wednesday’s peak of 1.3010. The next lines to watch are 1.3040 and 1.3110.

More: 2020 Elections: How stocks, gold, dollar could move in four scenarios, nightmare one included