- GBP/USD has extended its recovery after upbeat UK data, USD weakness.

- BOE and Brexit speculation is set to move the pound.

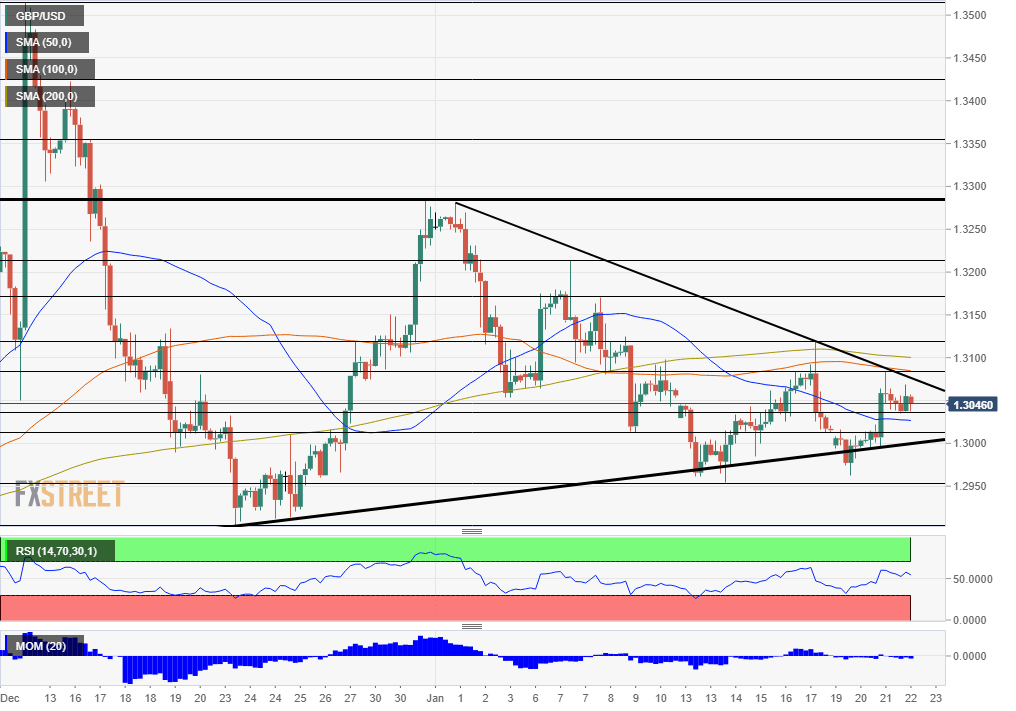

- Wednesday’s four-hour chart is painting a mixed picture.

Is the pound out of the woods? That is the impression that those observing the recent bounce in GBP/USD may get. Average Hourly Earnings stabilized at 3.2% annually in November, beating expectations for a deceleration to 3.1%. Pound/dollar jumped to 1.3080 and has maintained most of its gains.

Nevertheless, this surge may only have served as a selling opportunity. The beat in wages was minimal, it is somewhat outdated – referring to November and not December – and officials at the “Old Lady” seem determined to lower borrowing costs.

One last publication awaits the BOE – Markit’s preliminary Purchasing Managers’ Indexes for January. The forward-looking gauges may be the make or break moment for the bank.

See UK PMIs preview: Cementing the BOE rate cut? Five GBP/USD scenarios

Beyond the BOE

GBP/USD has also been benefiting from the US dollar’s weakness. The greenback gained ground on Tuesday after the news of the first coronavirus case was reported in America. However, the dollar retreated as Chinese authorities held a press conference, pledging to take all necessary measures to contain the disease. Further headlines related to the outbreak are set to move markets.

Sterling seems to ignore a report in The Telegraph, saying that the EU will offer the UK an unfavorable trade deal post-Brexit – inferior to accords signed with Canada and Japan. The report comes ahead of tense talks that are set to begin shortly.

The UK officially leaves the EU on January 31 but will remain a de-facto member until the transition period expires at year-end. Without a new agreement, Britain will trade with the bloc under the World Trade Organization (WTO) terms – and that worries businesses.

Overall, BOE, Brexit, and the coronavirus are in the spotlight.

GBP/USD Technical Analysis

Pound/dollar is squeezed between the long-term uptrend support line – accompanying it since early November – and downtrend support, which is there since late December. The currency pair is trading closer to uptrend resistance.

How will it exit this wedge? GBP/USD has recaptured the 50 Simple Moving average but trades below the 100 and 200 SMAs. Momentum is moderate to the downside and the Relative Strength Index is stable. All in all, the picture is mixed.

Support awaits at the daily low of 1.3035, followed by 1.3010, which was a swing low in last week. It is followed by 1.2950, 2020 low, and 1.29, the trough around Christmas.

Resistance awaits at 1.3080, which was Tuesday’s high, followed by 1.3120, a peak seen last week. 1.3175 and 1.3210, both swing high from early January, are next.