- GBP/USD has been attempting recovery after Wednesday’s dollar storm.

- Upbeat UK virus data and the Fed’s lack of inflation fears may boost cable.

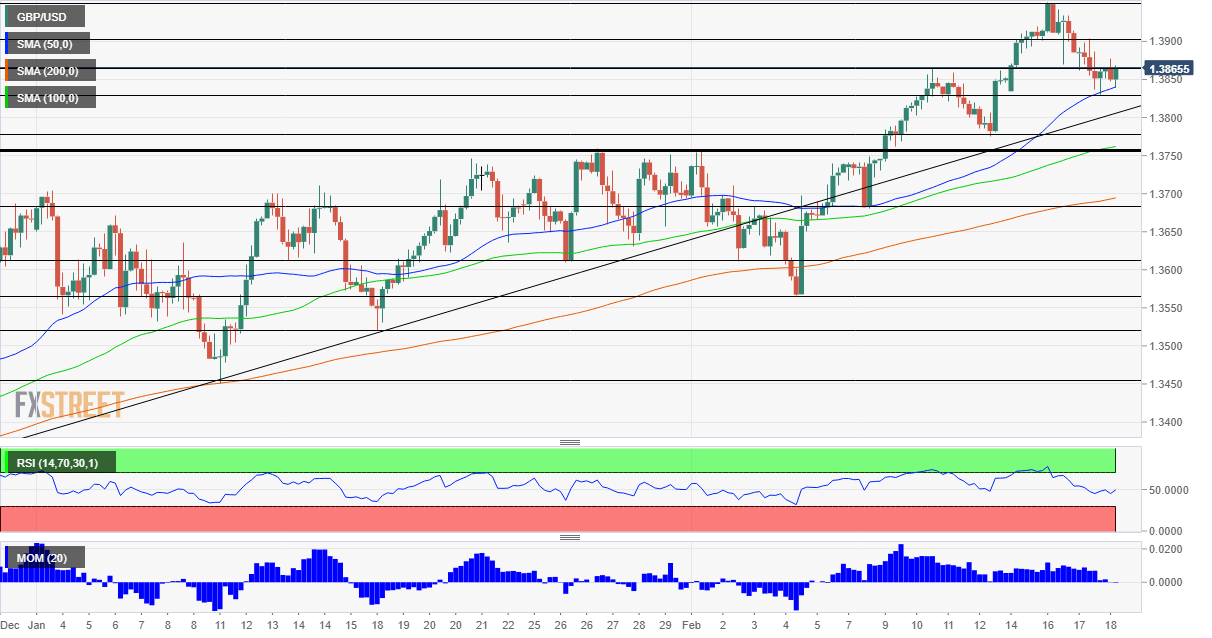

- Thursday’s four-hour chart is showing bulls are in control.

Never underestimate the American consumer – a leap of 5.3% in January’s retail sales has smashed all estimates, more than compensated for previous disappointment and boosted the dollar. But, can the greenback continue higher? Not so fast, and not necessarily against the pound.

While some seasonal factors have skewed the shopping data, the narrative is that the previous stimulus checks boosted spending and that maybe the US economy does not need additional funds. According to this thinking, President Joe Biden would struggle to pass his proposed $1.9 trillion covid relief program and that means less debt issuance. In turn, Treasury yields may drop off their highs, and make the dollar less attractive.

Another Joe – Democratic Senator Joe Manchin of West Virginia – opposes some of the president’s measures and may also cause the final package to squeeze.

If that does not bring the dollar down, perhaps the Federal Reserve’s sanguine approach to inflation would take some of the air out of the rally. The world’s most powerful central bank sees any rise in prices as temporary and even blessed – contrary to current market concerns. If investors become fully convinced that rate hikes and tapering of bond-buys remain distant, that could also weigh on the currency.

Apart from news related to Biden’s economic package, US jobless claims are on the agenda on Thursday. After dipping below 800,000, another slide is on the cards, yet US unemployment remains at high levels.

See US Initial Jobless Claims Preview: Can they help the dollar?

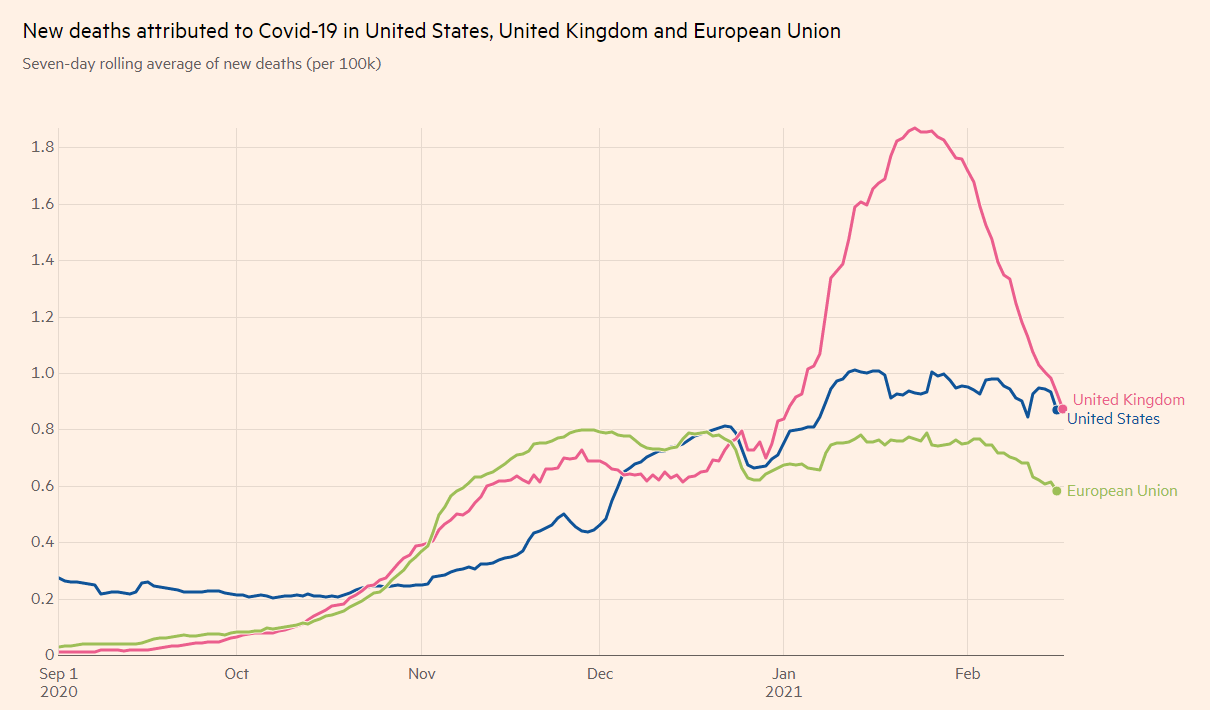

Across the pond, UK COVID-19 statistics continue falling sharply, raising expectations for a rapid reopening of the economy. Pressures are mounting on Prime Minister Boris Johnson to enable the economy to pick up, also as Britain’s vaccination campaign is nearing a quarter of the population – the highest percentage in a large country.

Source: FT

Moreover, the UK’s approach to vaccination – stretching the time between the first and second shots – seems vindicated. New research by Pfizer and BioNTech shows that a single jab is 93% effective after two weeks, allowing to push back the second dose beyond the recommended regimen of 21 days.

All in all, pound/dollar has room to recover.

GBP/USD Technical Analysis

While momentum on the four-hour chart has waned, GBP/USD has bounced off the 50 Simple Moving Average and remains above the 100 and 200 SMAs. All in all, bulls are in the lead.

Cable is struggling with the 1.3850 level that capped it last week. The next resistance level is 1.39, which provided support earlier this week. The 2021 peak of 1.3950 is the next level to watch before 1.40.

Support awaits at 1.3830, the weekly low, followed by 1.3770, a swing low that was seen last week. Further down, 1.3750 and 1.3685 await GBP/USD.

See US Federal Reserve Minutes: Watch what we do and what we say