- GBP/USD is attempting to stabilize after falling amid the US-related market sell-off.

- The downfall in UK output and Brexit issues suggest sterling may extend its slump.

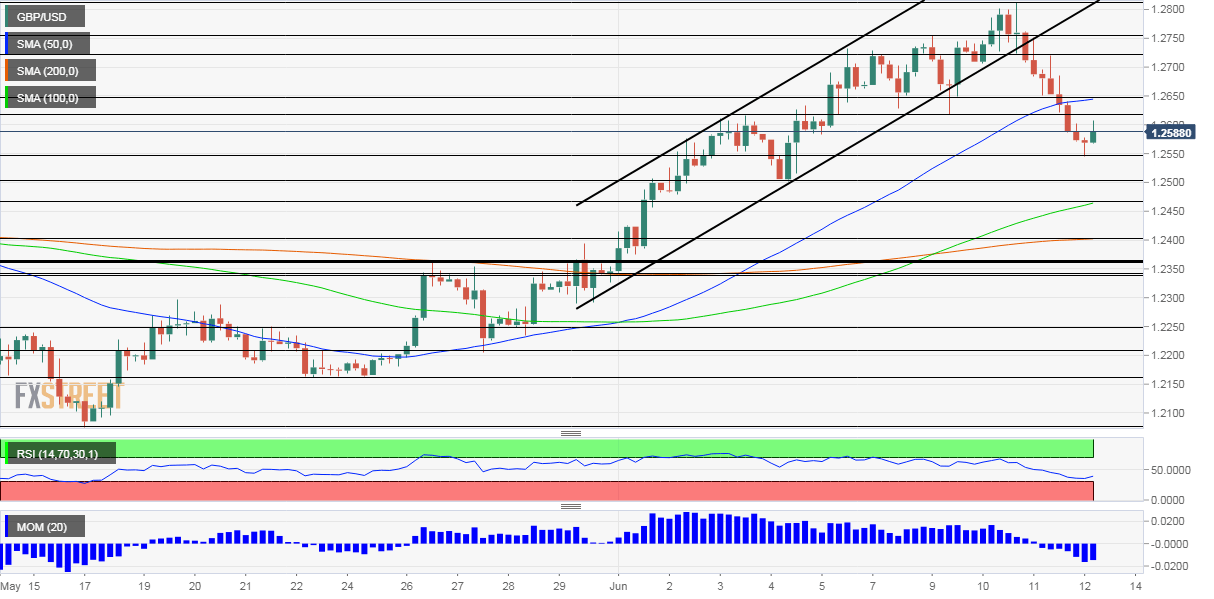

- Friday’s four-hour chart is pointing to further falls for the currency pair.

Cabin fever – coronavirus and the lockdown are taking its toll. The UK economy created by 20.4% in April, worse than expected, and a horrible figure in absolute terms. Manufacturing output collapsed by 24.3%, a considerable miss in comparison to around 15% projected.

The Gross Domestic Product figures have weighed on sterling and may have a longer effect as forecasts are downgraded for the second quarter and the full year – now that economists have a sense of how the shuttering affects the economy.

Britain is only gradually loosening the restrictions – as coronavirus cases are falling, yet a stubbornly slow pace. Trust in the government has dropped amid criticism from within and without about Prime Minister Boris Johnson’s handling of the crisis.

The pound has also been pounded by Brexit. While both sides agreed to intensify talks, London will formally tell Brussels that it is unwilling to extend the transition period beyond year-end. The UK left the EU on January 31 but maintains most rights and obligations.

If negotiations are not fruitful, Britain will fall back to unfavorable World Trade Organization terms in 2021. Mutual accusations about the gridlock have been weighing on sterling.

Trouble brewing in America

Cable collapsed on Thursday due to a mood change in US markets – stocks fell by the most since March amid concerns of a second wave of coronavirus. The safe-haven US dollar found fresh demand, cutting short long days of retreat. Cases have been rising in the past two weeks in over a dozen states, including California, Florida, and Texas.

Markets have finally taken note as an official in Houston said the city is on the “precipice of disaster” and as a football stadium is being readied for use as a makeshift hospital. Treasury Secretary Steven Mnuchin said the US will not lock down the economy and claimed testing and tracing capacity has improved.

Even if everything remains open – President Donald Trump will hold a rally where participants are asked to waive liability for potential coronavirus contraction – activity may not fully resume. The University of Michigan’s preliminary estimate of Consumer Sentiment is due out on Friday, with a small improvement expected.

Consumer Sentiment Preview: Optimism and how to get it

COVID-19 concerns come on top of pessimism from the Federal Reserve, which sees a return to pre-pandemic output not before 2022. Investors seem unconvinced by the bank’s unequivocal commitment to support the economy.

Back to risk-off mood? Get all the Fed details with our experts’ point of view!

Overall, volatility has risen and Friday may feature considerable movements.

GBP/USD Technical Analysis

Momentum on the four-hour chart has turned to the downside, and cable dropped below the 50 Simple Moving Average. The Relative Strength Index remains below 70 – outside overbought conditions.

All in all, bears are in control. and the recent rise from the lows looks like a dead cat bounce – a minor increase before the next fall.

Support awaits at 1.2545, the daily low, followed by 1.25, which was a trough last week. Next, 1.2470 is where the SMA 100 hits the price and it is followed by 1.24.

Resistance is at 1.2575, a recent swing low, followed by 1.2650, which is where the 50 SMA hits the price. Further above, 1.2720 capped a recovery attempt.