- GBP/USD’s recovery has stalled after the worrying rise in UK jobless claims.

- The future of the furlough scheme and the US fiscal impasse are high on the agenda.

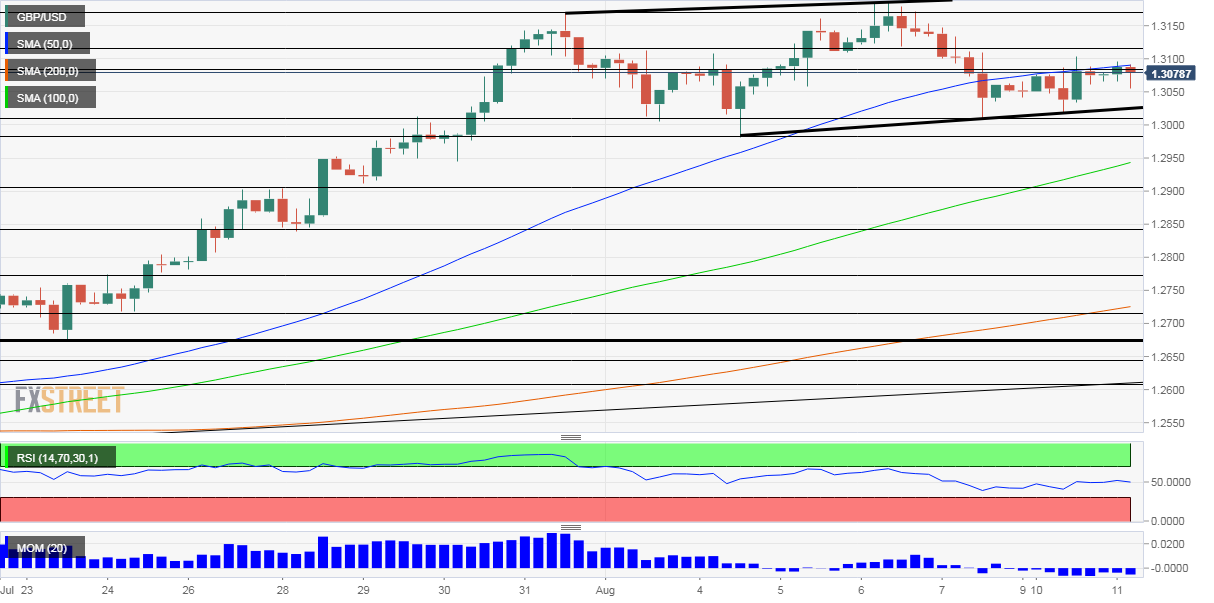

- Tuesday’s four-hour chart is showing cable continuing trading in an uptrend channel.

“I’ve always been clear that we cannot protect every job” – Chancellor of the Exchequer Rishi Sunak, in response to the UK’s labor figures. While the unemployment rate remained at 3.9% in June – an impressively low level – jobless claims climbed by 94,400 in July, far above 10,000 projected.

The government’s furlough scheme has successfully kept workers attached to their jobs in these coronavirus times, yet it is set to expire in October, creating an “employment cliff.”

The unexpected application increase and Sunak’s words have stymied sterling’s recovery attempt – which was based on dollar weakness. The safe-haven dollar suffered diminishing demand, moving in the opposite direction of stocks. Markets advanced after President Donald Trump touted cutting capital gains tax – claiming it would boost jobs after previously saying it will not help the middle class.

On the other hand, skepticism is growing about the president’s previous economic moves – signing executive orders to stimulate the economy and stir up fiscal relief talks. Apart from doubts about the legality of the moves, it is unclear if his attempt to resume the payment of federal unemployment claims will work.

The executive order decrees that part of the payment comes from states – which are heavily indebted and may be unable to fork out new funds. Moreover, lawmakers have yet to agree on a new round of talks.

Trump’s comments on the trade deal have been shrugged off by markets. He said it “means very little” to him, days before the US and Chinese negotiators meet to take stock of the deal. Any signs it could break down would hurt equities and boost the dollar.

Second-quarter Gross Domestic Product figures are due out from the UK on Wednesday. Ahead of that publication, two independent figures have shown that consumption is back on track, providing some support for sterling. The British Retail Consortium has shown an increase of 4.3% yearly in sales in July while Barclaycard said spending was down 2.6% yearly, both representing stability after the collapse during the lockdown.

Will GBP/USD traders see the glass half full or half-empty? Fundamentals still tend to the downside.

GBP/USD Technical Analysis

Pound/dollar is trading within an uptrend channel but remains capped below the 50 Simple Moving Average on the four-hour chart and momentum remains to the downside.

The uptrend support line awaits at 1.3125, and it is followed by 1.3005, the weekly low. August’s trough of 1.2985 and 1.29 are next.

Resistance is at 1.3105, which was Monday’s high, followed by 1.3170, a peak in late July. August’s peak of 1.3183 and 1.32 are next.

More What is driving the dollar up again is as much big player positioning as any single data set