- GBP/USD has been advancing amid Brexit optimism and Fed support.

- Lack of details on Brexit, weak UK data, and coronavirus are reasons to doubt the rally.

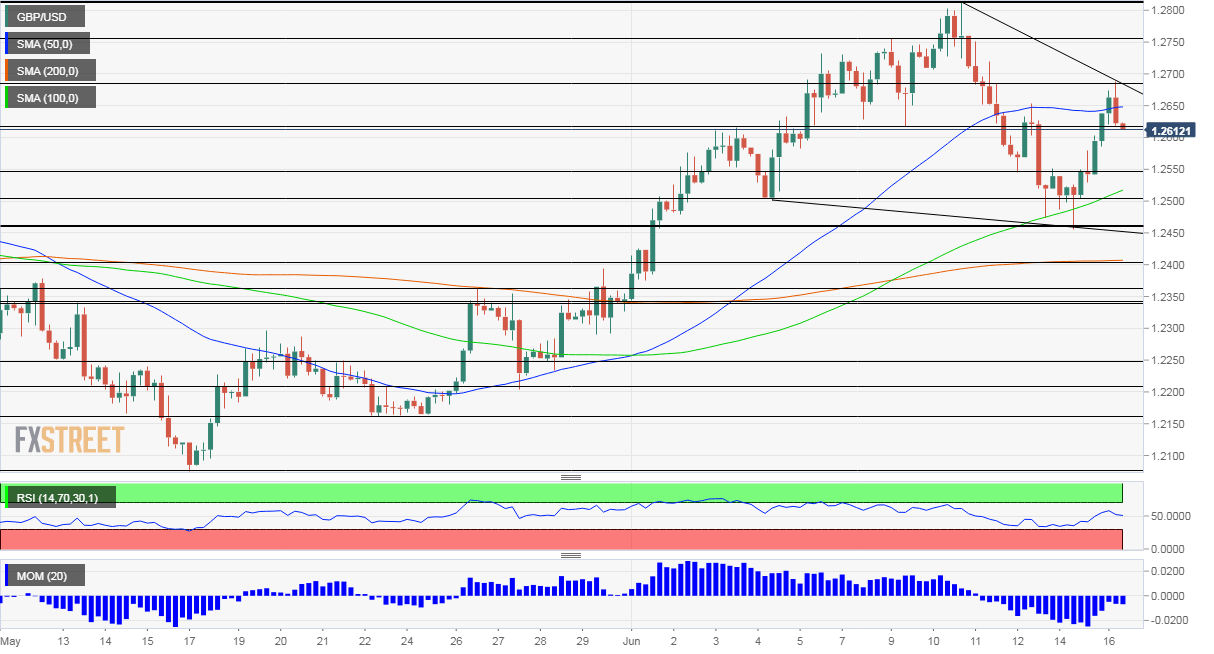

- Tuesday’s four-hour chart is painting a mixed picture.

“The tiger is the tank” – Prime Minister Boris Johnson has contributed a new expression to the English language when referring to optimism about Brexit talks. After an hourlong videoconference with European Commission President Ursula von der Leyen and other EU officials, both sides agreed to work toward a deal.

GBP/USD has advanced on the PM’s optimism and also as the US Federal Reserve announced it would buy corporate bonds in markets – and also from firms. The Fed’s move is not a game-changer, as it had already laid out the plan back in March, but it then proposed buying Exchange Traded Funds rather than direct buying. Nevertheless, stocks jumped and the safe-haven dollar was sold off.

Can cable continue climbing? There are three reasons to cast doubts.

1) Brexit – where are the details?

While both Brussels and London praised the online meeting, they provided no details about the sensitive topics such as trade and fisheries. They did announce a general timetable – resuming talks on June 29 in a different format and striving to approve an accord in October’s EU Summit.

However, without concessions from both sides, it is hard to see the optimism holding up.

The UK left the EU on January 31 but maintains most rights and obligations through the end of the year. Lacking an accord, Britain defaults to unfavorable World Trade Organization terms in 2021.

2) Labor market struggles

The headline Unemployment Rate surprised by remaining at only 3.9% in April – refusing to rise for now. Yet that lagging indicator does not tell the full story. The Claimant Count Change jumped by 528,000 in May, worse than expected. Moreover, April’s applications were revised up to over 1 million. That means the number of the jobless is set to rise.

Around 9,1 million positions were furloughed. The government’s successful scheme to keep people working will not last forever.

To add insult to injury, Wage growth ground to 1% in April, worse than 1.4% projected, and 2.3% recorded in March. Decelerating salary growth does not bode well for the service-dependent economy.

3) Coronavirus concerns

The UK still suffers from a stubbornly high curve in comparison to peers in the continent, despite improvement. The pace of reopening is slower and may lead to more economic damage. That may weigh on sterling.

Source: Financial Times

COVID-19 is rampant also in the US, with infections and hospitalizations still advancing in around 20 states, including Texas and Florida. Markets were distracted by the Fed’s announcement but may return to worrying about new lockdowns – or weak consumption despite stores being open.

Retail sales figures for May are set to show a rebound after a fall in April.

See Retail Sales Preview: Deferred consumption or cancellation?

Overall, pound/dollar’s rally may run into trouble.

GBP/USD Technical Analysis

Cable failed to conquer the 50 Simple Moving Average on the four-hour chart and slipped back down. It still trades above the 100 and 200 SMAs, but momentum remains to the downside. All in all, bears remain in the lead.

Initial support is at 1.2615, a swing low from last week. Some support awaits at 1.2550, which was a temporary trough last week. The round 1.25 level was a cushion in early June, and 1..2460 is the weekly low.

Resistance is at 1.2687, the daily high, followed by 1.2750, which held GBP/USD last week. June’s high of 1.2815 is the next level to watch.

More Why EUR/USD may rally, where to find the key to gold move, lots more – Interview with Richard Perry