- A survey indicated a slower growth rate in Britain’s private sector in July.

- Speculators have established their most valuable bullish bet on sterling since 2014.

- Economists expect the US Federal Reserve to raise its benchmark overnight interest rate by 25bps.

Today’s GBP/USD price analysis is slightly bullish. After a seven-session losing streak, the pound recorded its first day of gains. Notably, the pound weakened against the dollar on Monday due to a survey indicating a slower growth rate in Britain’s private sector during July.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The S&P Global/CIPS composite Purchasing Managers’ Index revealed a preliminary reading of 50.7. However, this was a significant drop from June’s 52.8, representing the largest month-on-month decline in 11 months.

Despite this extended losing streak, speculators have established their most valuable bullish bet on sterling since 2014. This is according to the US market regulator’s weekly data.

One contributing factor to the inflow of funds into the pound this year has been its yield advantage over US Treasuries. Just three weeks ago, two-year gilt yields were trading at their highest premium compared to two-year Treasuries since mid-2011, at 45 basis points. However, that gap has now narrowed to parity.

Elsewhere, economists expect the US Federal Reserve to raise its benchmark overnight interest rate by 25bps. Consequently, it would bring it to the 5.25%-5.50% range. Most of these economists also believe this will be the final increase during the ongoing tightening cycle.

Analysts and investors have been continually surprised by the resilient economy and historically low unemployment. This has persisted for over a year since the Fed initiated one of its most aggressive rate-hiking campaigns.

GBP/USD key events today

Investors are awaiting the CB consumer confidence report from the US. This report will show the level of confidence in the US economy.

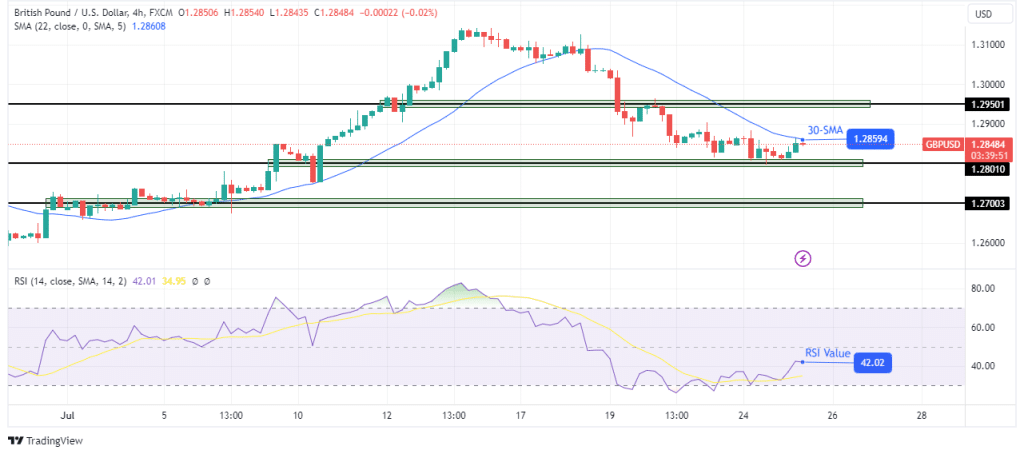

GBP/USD technical price analysis: Looming reversal at the 30-SMA resistance.

The pound has found support at the 1.2801 level on the charts and has rebounded to retest the 30-SMA. However, the bias remains bearish, with the price still slightly below the SMA and the RSI below 50. In a bearish trend, the 30-SMA should act as resistance.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Therefore, the price will likely bounce lower to retest the 1.2801 support. A break below this support will likely lead to a drop in the price to the 1.2700 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money