- The British economy avoided a recession in the third quarter.

- The dollar held steady after hawkish remarks from US Fed Chair Jerome Powell.

- The UK economy experienced a 0.2% growth in September.

The GBP/USD price analysis on Friday displayed a modest bullish trend, with the British pound making a measured recovery. This uptick followed the release of data indicating that the UK economy narrowly evaded a recession in the third quarter. However, the US dollar’s continued strength limited the pound’s upside.

-Are you looking for forex robots? Check our detailed guide-

Britain’s sluggish economy showed no growth in the July-to-September period. Notably, there was a 0% change in gross domestic product (GDP) in the third quarter. It was contrary to the anticipated 0.1% decline in a Reuters poll of economists.

Moreover, such a decline could have marked the beginning of a recession. Meanwhile, the economy experienced a 0.2% growth in September alone. Furthermore, the report revised downward to 0.1% the figure for August, initially reported at 0.2%.

The figure was a positive surprise as the Reuters poll had predicted no change in GDP for September. Additionally, the ONS highlighted that Britain’s economy was 1.8% above its late 2019 level. It shows a post-COVID recovery stronger than Germany’s but significantly lagging behind the United States. The US economy has expanded by over 7% from its pre-pandemic state.

Meanwhile, the dollar held steady after hawkish remarks from US Fed Chair Jerome Powell reduced hopes for an interest rate peak. On Thursday, Powell and other US Federal Reserve officials said they were uncertain about whether interest rates have reached a level that keeps inflation low.

GBP/USD key events today

The pair will likely keep moving in response to the UK GDP data, as there are no other significant events for the day.

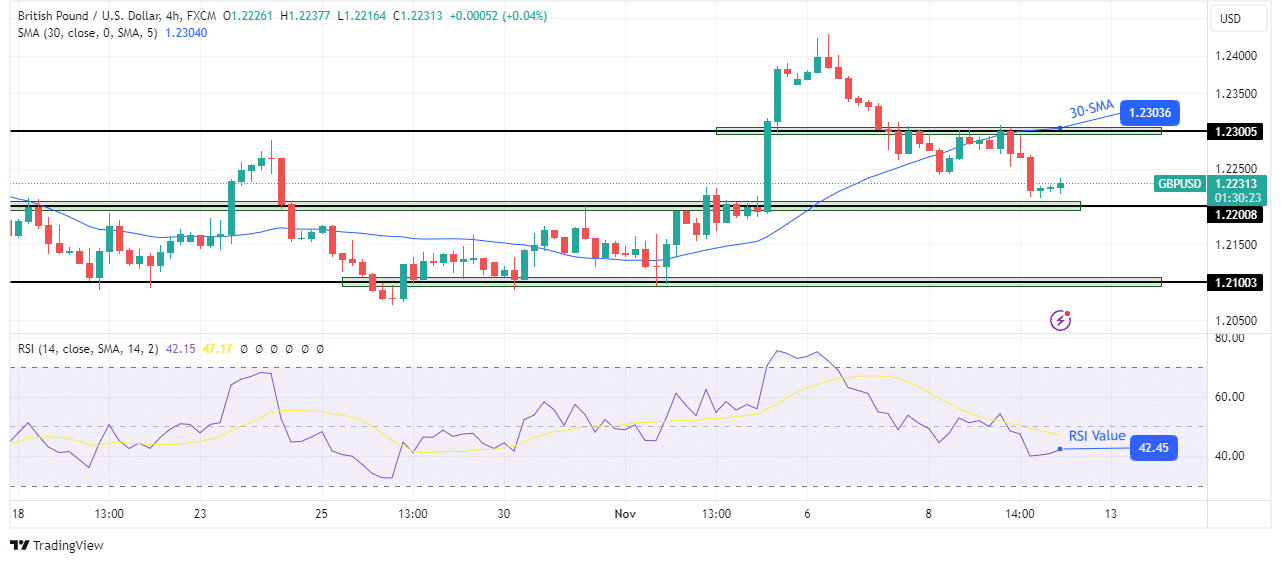

GBP/USD technical price analysis: Bearish bias emerges as price breaks 30-SMA barrier.

The bias for GBP/USD price on the 4-hour chart is bearish as the price has dipped below the 30-SMA. Additionally, the RSI now trades in bearish territory below 50. Bears took over and broke below the 1.2300 key level. Then, the price retested this level before dropping.

-Are you looking for the best CFD broker? Check our detailed guide-

Currently, the price is approaching the 1.2200 support level, and bears look strong enough to break below. A break below this level would strengthen the new bias as the price would start making lower lows. Furthermore, bears will target the next support level at 1.2100.