- GBP/USD has fallen off the highs as markets “sell the fact” of Biden’s victory.

- Brexit talks resume and headlines are set to stir sterling.

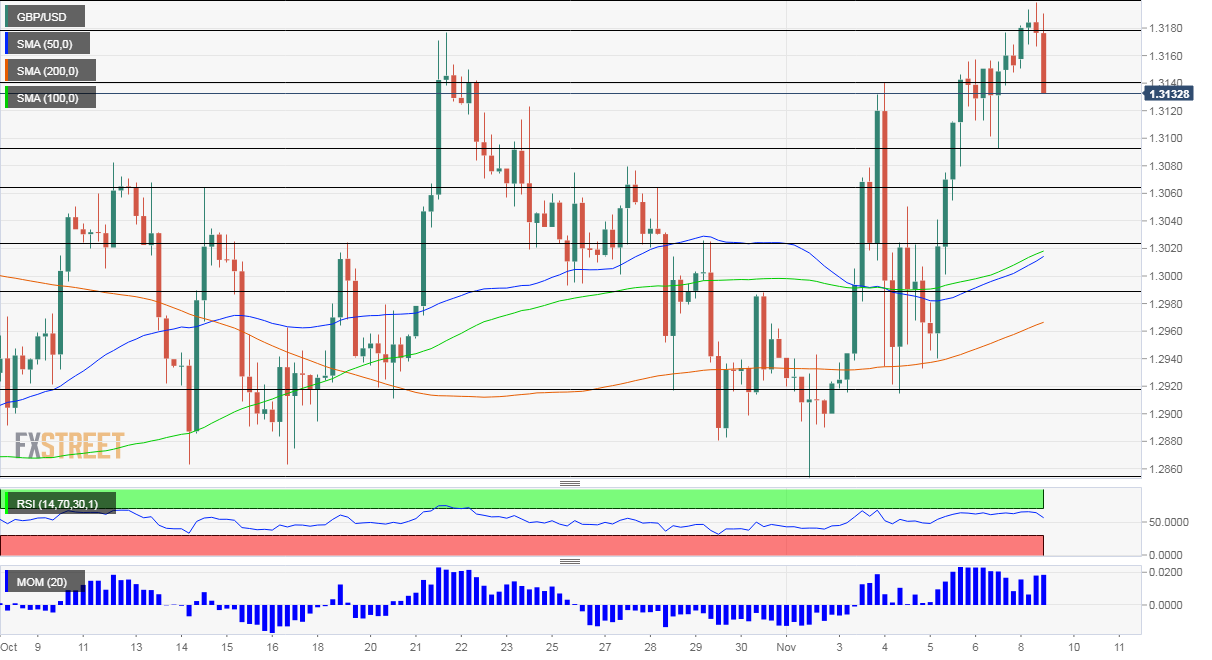

- Monday’s four-hour chart is showing bulls are in control.

“It’s Joe” – said one of Britain’s papers, announcing the victory of Democratic candidate Joe Biden in the US Presidential Elections. The networks, including Republican-leaning Fox News, have called the result for the former Vice-President over the weekend.

Markets have been pricing in such a call and after extending their gains, some profit-taking is seen. The same goes for GBP/USD, which advanced until a “buy the rumor, sell the fact” move came into play. The safe-haven dollar has been under pressure as investors began factoring a delayed result rather than a contested election.

President Donald Trump has not conceded and repeated unsubstantiated claims of fraud. Legal challenges have been mostly futile, but with slow vote counting, there is still an outside chance of a dispute. The count continues, but the focus is likely to shift to Biden’s transition plans.

Later on, the political focus is likely to shift to two runoff races in Georgia, which are set to determine control of the Senate. If Democratic candidates win both tight elections, they could push through a higher stimulus package.

See 2020 Elections: Biden wins also per Fox, markets set to focus on Georgia’s Senate races

Brexit in focus

In the British context, Democrats have previously wanted UK Prime Minister Boris Johnson of endangering the Good Friday deal in Northern Ireland.

The Brexit Withdrawal Agreement aimed to keep the border between NI and the Republic of Ireland by creating a different customs regime in NI – separating it from the rest of Britain. Johnson’s Internal Market Bill (IMB) knowingly violates the accord and will come before the House of Lords on Monday. The upper chamber cannot veto the bill but can return it to the House of Commons and delay it.

The IMB is one of the thorny issues left to resolve in EU-UK talks about future relations alongside fisheries and states. Johnson and European Commission President Ursula von der Leyen spoke over the weekend but failed to achieve a breakthrough. Nevertheless, talks between the negotiating teams resume on Monday in London.

Both sides aim to reach a deal by November 15 – a self-imposed deadline – and the only genuine cutoff date is December 31, when the transition period expires. Brexit headlines are set to rock the pound.

While issues remain, officials have expressed optimism. Moreover, Biden’s victory could push Johnson to compromise and seal the deal. The PM would probably prefer to start relations on good terms, needed to secure a US-UK trade deal.

Coronavirus is on the backburner but may return to the limelight. US cases are surging – consistently surprising the 100,000 infections/day mark. In the UK, the covid curve is flattening but mortalities are on the rise.

GBP/USD Technical Analysis

Pound/dollar is off the highs but trades above the 50, 100, and 200 Simple Moving Averages, and momentum is to the upside. The recent slide is pushing the Relative Strength Index lower, further away from overbought conditions.

Some resistance awaits at 1.3140, a swing high from last week. It is followed by 1.3180, October’s high, and then by 1.32, a round number.

Support is at 1.3095, a recent low, followed by 1.3065, a peak during October. The next lines are 1.3020 and 1.2990.