- GBP/USD is retreating from the highs in response to fraught Brexit talks.

- Concerns about tax hikes are also pounding the pound.

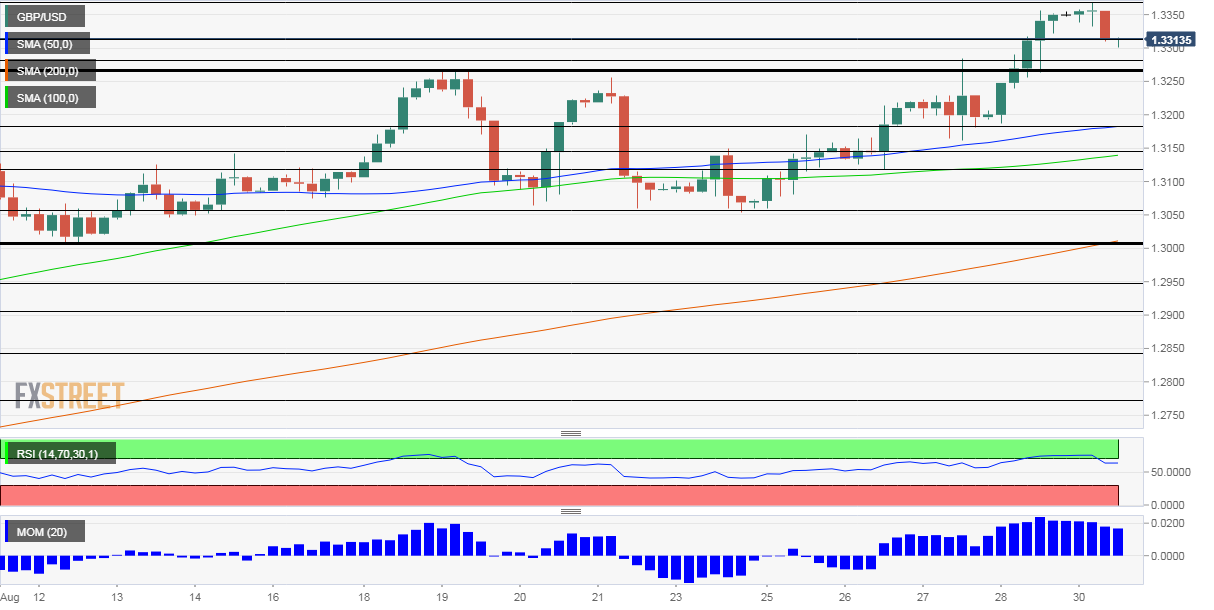

- Monday’s four-hour chart is showing that the currency pair remains overbought despite profit-taking.

GBP/USD is suffering from a hangover – even before the long bank holiday weekend ends.

First, Brexit has returned from the beach and the backburner to center stage and sterling is suffering. French Foreign Minister Jean-Yves Le Drian said that Brexit talks are stuck due to the UK’s “intransigent and unrealistic attitude.” His words came after David Frost, the UK’s chief negotiator, said that he is ready to walk away from the negotiating table.

The Brexit transition period expires in exactly four months and if there is no accord, Britain reverts to unfavorable World Trade Organization rules. While there is still time to clinch a deal, the acrimonious atmosphere is weighing on the pound.

The second thing tanking sterling is taxes – Chancellor of the Exchequer Rishi Sunak is reportedly mulling raising around £30 billion in various ways, plugging a hole in UK finances. Apart from investors’ dismay at the idea, fellow Conservative MPs have expressed anger at these prospects.

Despite having a large majority in parliament, Prime Minister Boris Johnson depends on support from his backbenchers, especially after a poll showed opposition Labour catching up with his party. Growing criticism – mostly about handling coronavirus but also about reopening schools and taxes – is making Johnson’s job harder.

The third reason for the downfall is profit-taking. Pound/dollar took full advantage of dollar weakness on Friday, soaring to the highest since December 2019 and exceeding the gains of peers such as the euro.

The greenback declined following the Federal Reserve’s dovish policy change – prioritizing full employment at the expense of allowing inflation to overheat. That means keeping interest rates lower for longer, dollar negative. After Federal Reserve Chairman Jerome Powell announced the change last week, Vice Chair Richard Clarida will speak later on Monday.

Overall, there are good reasons to see cable continuing its downside correction.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is still around 70 – indicating overbought conditions. That implies the correction is not over just yet. Momentum remains to the upside and GBP/USD is still above the 50, 100, and 200 Simple Moving Average, signaling that in the bigger scheme of things, the uptrend remains intact.

Some resistance is at 1.3220, which was a temporary cap on the way up. More importantly, the fresh 2020 high of 1.3370 is strong resistance. Above that, the post-election peak of 1.3510 awaits GBP/USD.

Support is at 1.3265, a peak in mid-August, and it is followed by 1.3180 1.3150, and 1.3120 – all stepping stones on the way up.

More Markets are Fed-dependent as ever, reaction to elections could surprise – Interview with Lior Cohen