- GBP/USD has been extending its gains amid an upbeat market mood.

- UK tax developments and the ISM Manufacturing PMI are eyed.

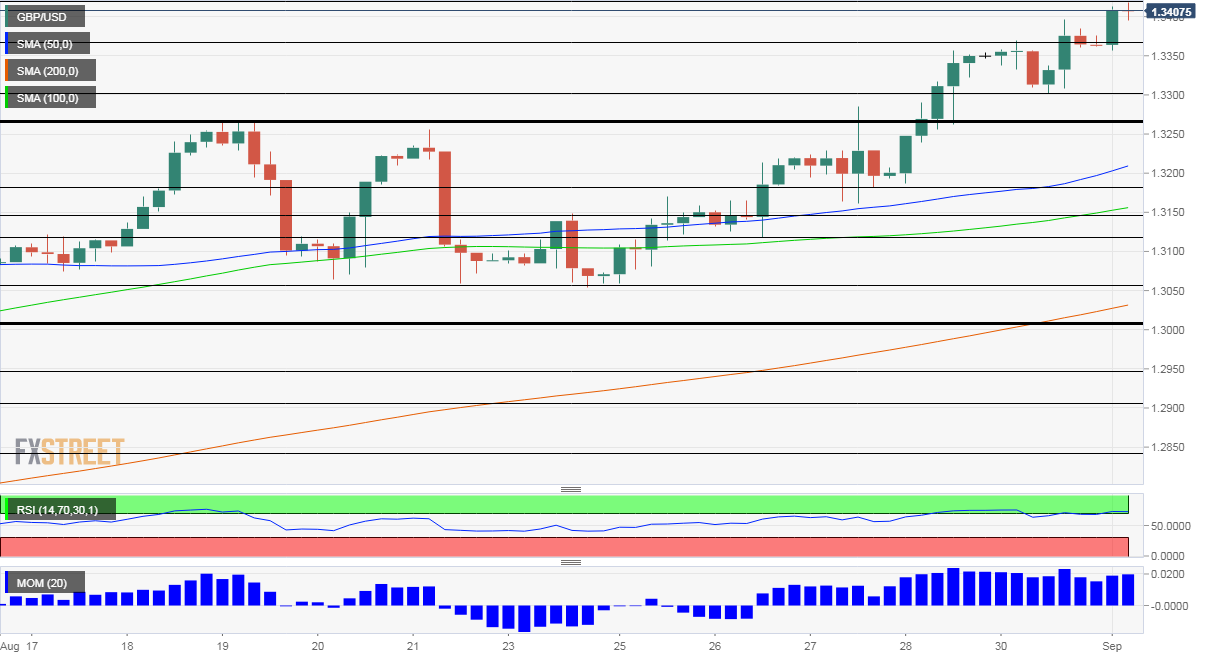

- Tuesday’s four-hour chart is pointing to overbought conditions.

Keep selling the dollar and carry on – that has been the way to go in August and the first day of September is no different. GBP/USD continues shrugging off UK concerns and takes full advantage of the upbeat market mood and the sell-off of the safe-haven greenback.

The latest cheerful news for investors has come from AstraZeneca – based in Britain, but on course to launch a 50,000-strong trial for its coronavirus vaccine candidate in the US. The project is considered one of the world’s most advanced ones and hopes for resolving the crisis are sending stocks up and the dollar down.

Reports about Apple’s elevated manufacturing of iPhones and the upbeat Chinese Manufacturing Purchasing Managers’ Index have also helped boost sentiment.

Yet most importantly, the underlying reason for the current trends comes from Federal Reserve. The effect of the bank’s dovish shift – allowing inflation to overheat before raising rates – continues in full force.

The ISM Manufacturing PMI is set to guide the dollar on Tuesday. This forward-looking gauge of the industrial sector also serves as a hint toward Friday’s all-important Non-Farm Payrolls.

See Markets are Fed-dependent as ever, reaction to elections could surprise – Interview with Lior Cohen

Back in Britain, the final Markit/CIPS Manufacturing PMI edged lower from 55.3 to 55.2 points in August. More importantly, Brexit talks remain stuck but investors seem to have priced that in. It seems that only an announcement of a breakup of negotiations could send sterling lower, but that seems unlikely.

Rishi Sunak, Chancellor of the Exchequer, is set to announce means to plug a hole in the government’s coffers – tax hikes. According to some reports, he will announce a levy on gasoline, while others expect an increase in corporate taxes.

An announcement is due out as early as Tuesday. The higher the toll, the worse for sterling. A minor increase could allow for further gains.

Nevertheless, it seems that the uptrend is here to stay and any drop due to downbeat British news – unless catastrophic – would be temporary and a buying opportunity.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is above 70 – indicating overbought conditions, while momentum remains positive and the 50, 100, and 200 Simple Moving Averages remain well below the current price. That implies a temporary correction.

The fresh 2020 high of 1.3440 is the immediate resistance line. It is followed by the December 2019 peak of 1.3510, followed by 1.3610, last seen in May 2018.

Support awaits at 1.3360, a temporary cap on the way up, followed by 1.33, the weekly low. The next lines to watch are 1.3265 and 1.3180.

More Markets are Fed-dependent as ever, reaction to elections could surprise – Interview with Lior Cohen