- In response to strong inflation and dismissive replies from central banks, the GBP/USD rolled on.

- Covid headlines, the reopening of the UK and the US infrastructure negotiations stand out.

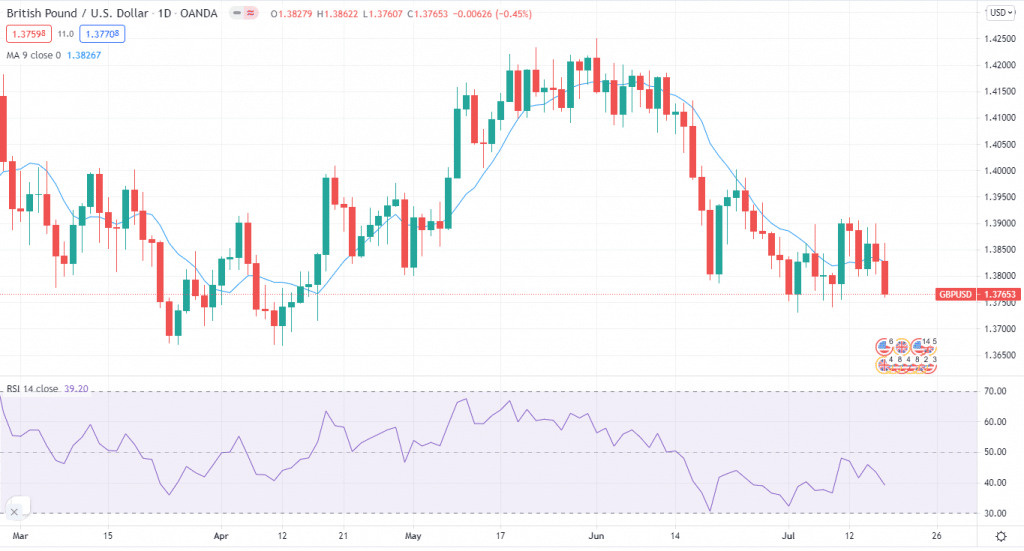

- The daily chart for the next week paints a mixed picture.

On Friday, July 16, the GBP/USD forecast saw a downturn throughout the day as the pair reached below the 1.37-mark. The cable finishes the day with 1.3764.

-Are you interested to find high leverage brokers? Check our detailed guide-

GBP/USD fundamental forecast

Despite a difficult week for the GBP/USD, the Pound is still supported by predictions of a more hawkish Bank of England.

The build-up to the August MPC meeting is gaining traction as markets boost their odds that the BOE will begin modifying its monetary policy to better adjust to current economic conditions.

In the UK, daily coronavirus infections, hospitalizations, and deaths may have a greater impact on health than previously thought.

If health-care services are put under strain, the Prime Minister may do another U-turn. But, on the other hand, if vaccination rates are high enough to turn the tide, sterling might shine.

Inflation in the United States is undeniably rising – the headline Consumer Price Index increased by 5.4 percent year on year in June, while Core CPI increased by 4.5 percent, both above expectations.

In the last week Fed meeting, Jerome Powell said that while inflation is expected to continue high for several months, it is temporary and will subside. Furthermore, he stated that the economy is still “a ways off” from making “substantial further progress” “” the Fed’s euphemism for assessing whether to cut its bond-buying strategy.

Given that the Fed is still printing $120 billion each month, the dollar has lost ground.

What’s next to watch in GBP/USD?

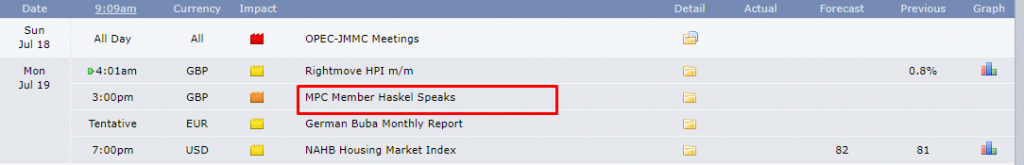

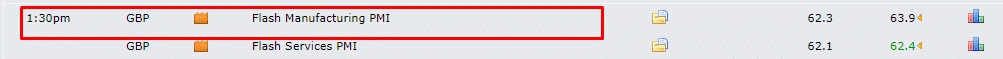

Looking ahead to next week’s UK calendar, we’ll get another BOE member, Haskel, speaking on Monday, and then little else until the June retail sales and PMIs are released on Friday.

For the US economic calendar, we have an initial jobless claim on Thursday.

GBP/USD technical analysis: key levels in action

GBP/USD remained in a range above 1.3730 last week, and the initial bias remains neutral for the upcoming week.

-Looking for high probability free forex signals? Let’s check out-

On the downside, a breach of 1.3730 will restart the fall from 1.4248, as the third leg of the consolidation from 1.4240, to the 1.3668 support and perhaps lower. On the upside, a break of 1.4000 will shift the bias back to the upside for a retest of the 1.4240 to 1.4280 resistance zone.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.