The British pound suffered heavy losses recently against the Swiss franc as we posted earlier. Now it looks like the GBPCHF pair is forming a breakout pattern, which if breached might ignite swing moves in the near term. There is a major release lined up in the UK, as the retail sales data will be published. The market is not expecting any gain this time, but instead the forecast is slated for a decline of 0.6% in December 2014, compared with the preceding month. Let us see how the outcome shapes and affects the British pound pairs in the short term.

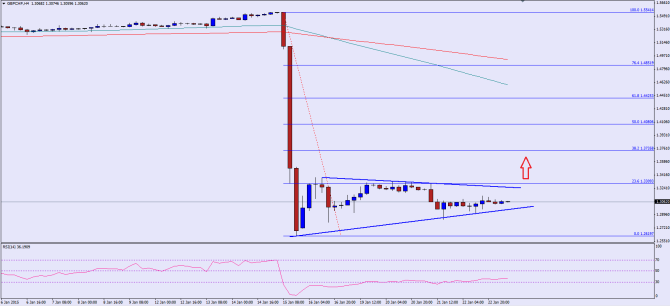

There is a monster contracting triangle formed on the 4 hour chart of the GBPCHF pair, which is likely to act as a catalyst for the pair moving ahead. The most important resistance formed is around the 23.6% fib retracement level of the last major drop from the 1.5540 high to 1.2619 low. The triangle upper trend line is also coinciding with the mentioned fib level. It would be interesting to see whether the pair can move towards the resistance area or not. A break above the triangle might call for a major correction in the GBPCHF pair, which can even exceed towards the 1.3800 level. The 4 hour RSI is still around the oversold area, which means correction is possible.

Alternatively, there is also a possibility of a break below the triangle support. In that situation a retest of the post SNB event low is likely moving ahead.

Overall, one might consider buying with a break above the triangle resistance as long as it is trading inside the triangle.

————————————-

Posted By Simon Ji of IKOFX