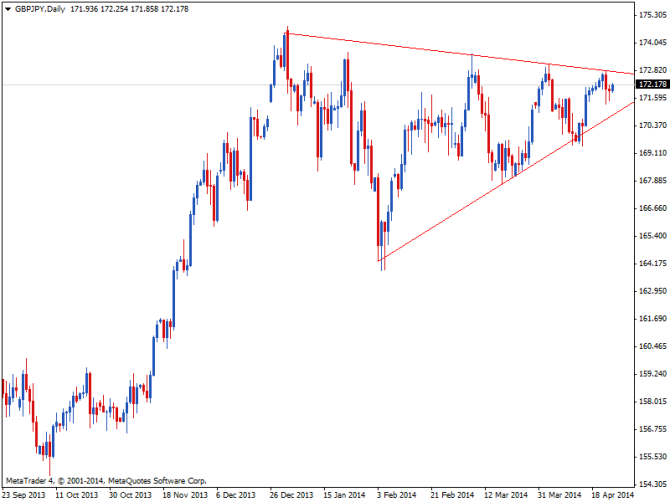

For over a quarter, GBP/JPY has been moving in a consolidation pattern that has been getting tighter and tighter, possibly prime for a breakout in either direction. A symmetrical triangle pattern can be seen on the daily forex time frame, as the price made higher lows and lower highs in the past few months.

The pair is still finding resistance at the top of the triangle in the meantime, as the minutes of the latest BOE (Bank of England) monetary policy meeting showed that not all policymakers were upbeat with their economic forecasts. Inflation remained a huge concern, as the annual CPI reading for March stood at 1.6%. This is far off the central bank’s 2% target and is its lowest figure since October 2009.

Bleak inflation figures suggest that the BOE is in no position to tighten monetary policy just yet, as this places them at a bigger risk of seeing a decline in price levels. This also cast doubts on whether the BOE would be able to hike rates before the UK general elections next year, as BOE Governor Carney claimed.

Then again, Carney has always been one of the more hawkish central bankers around, just as he was when heading the Bank of Canada. At that time, Canadian data showed signs of a slowdown yet Carney kept maintaining his rate hike bias.

The minutes of the latest BOE meeting seem to suggest the same, as policymakers also expressed concerns about the labor market. Several officials pointed out that the jobless rate no longer paints an accurate picture of the jobs situation and that measures of market slack should also be considered when making monetary policy decisions.

On the other side of the coin, the Japanese yen seems to be enjoying support from risk aversion for now. Data from Japan has been remarkably resilient, with the latest round of CPI figures showing another rise in price levels. This could push GBP/JPY back to the bottom of the triangle for another test of support.

For now though, the path of least resistance for this pair is still to the upside in the event that a breakout occurs. The BOE is still relatively hawkish compared to the Bank of Japan, which is still open to further easing if the latest sales tax hike winds up hurting overall economic growth.