GBP/USD posted strong gains last week, climbing 180 points. The pair closed the week at the1.44 line. This week’s highlight is Preliminary GDP. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

The pound shrugged of weak UK numbers, as jobless claims and retail sales missed expectations. In the US, jobless claims dropped sharply, but manufacturing and housing reports were softer than expected.

Updates:

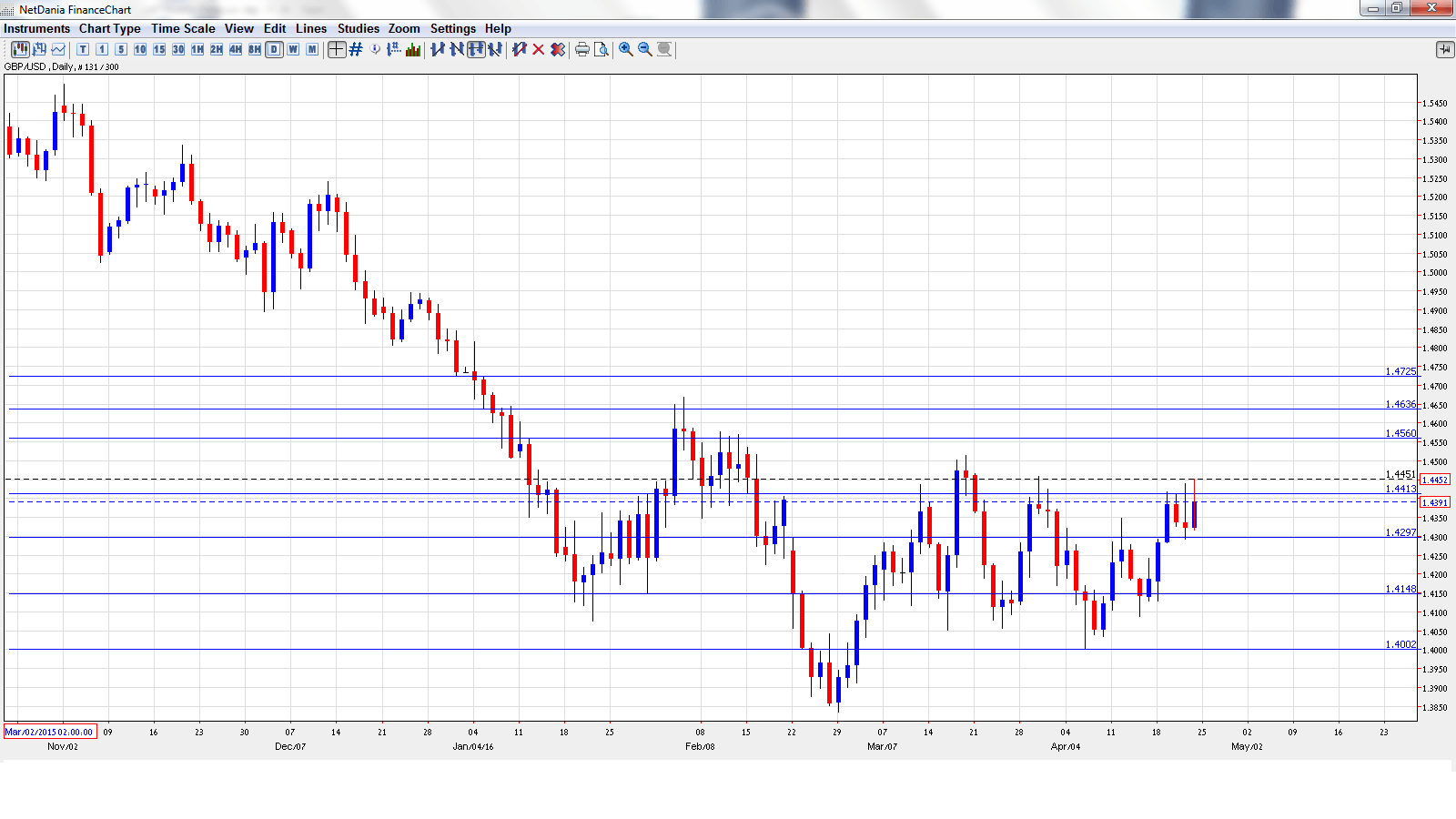

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 10:00. The indicator continues to post declines, indicative of pessimistic expectations about the manufacturing sector. The indicator came in at -14 points in March, and the markets are braced for a sharp decline of -17 points in April.

- BBA Mortgage Approvals: Tuesday, 8:30. This indicator provides a snapshot of the health of the UK housing sector. The indicator softened to 45.9 thousand in February, short of the estimate. The estimate for the March report stands at 46.1 thousand.

- Preliminary GDP: Wednesday, 8:30. This is the key event of the week, and should be treated as a market-mover. Final GDP for Q4 in 2015 came in at 0.6%, above the forecast of 0.5%. The estimate for Preliminary GDP for Q1 stands at 0.4%.

- CBI Realized Sales: Wednesday, 10:00. The indicator has been steadily losing ground and dropped to 7 points in March, well short of the estimate of 12 points. The markets are expecting a strong turnaround in April, with an estimate of 15 points.

- Nationwide HPI: Thursday, 6:00. This housing inflation index jumped 0.8% in March, beating the estimate of 0.5%. The markets are expecting a softer April, with a forecast of 0.4%.

- GfK Consumer Confidence: Thursday, 23:05. An increase in consumer confidence often translates into stronger consumer spending, a key driver of economic growth. The indicator has been stuck at zero for the past two readings, missing the estimate each time. The estimate for the April report is -1 points.

- Net Lending to Individuals: Friday, 8:30. The indicator slipped to GBP 4.9 billion in February, shy of the estimate of GBP 5.1 billion. Little change is expected in the March reading, with an estimate of GP 5.0 billion.

- MPC Member Jon Cunliffe Speaks: Friday, 12:00. Cunliffe will speak at an event in Brussels. A speech which is more hawkish than expected is bullish for the pound.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4220. The pair dropped to a low of 1.4128, testing support at 1.4148 (discussed last week). The pair then reversed directions and climbed to a high of 1.4450. GBP/USD closed at the week at 1.4404.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

With GBP posting strong gains last week, we start at higher levels:

There is resistance at 1.4725.

1.4635 has been a resistance line since early February.

1.4562 is next strong resistance.

1.4413 was a cap in January.

1.4297 was tested in resistance for a second straight week

1.4148 was tested in support for a second straight week. This line was a cushion in late January.

The round number of 1.40 continues to provide support. It was last breached in March.

I am bearish on GBP/USD.

The pound posted strong gains last week, but US fundamentals remain stronger than those of the UK, so we could see a downward correction from GBP/USD. It’s very unlikely that the Fed will make a move next week, but if inflation levels improve, a June rate is a good possibility.

In our latest podcast we ask: is China out of the woods?

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.