GBP/USD reversed directions last week, losing 110 points. The pair closed at 1.2560. It’s a busy week, with 13 events on the schedule. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

In the UK, Services PMI beat the estimate, but Manufacturing Production disappointed with a sharp decline. It was a good week in the US, as key economic indicators continue to impress. ISM Non-Manufacturing PMI beat expectations and UoM Consumer Sentiment jumped and easily beating the estimate.

Updates:

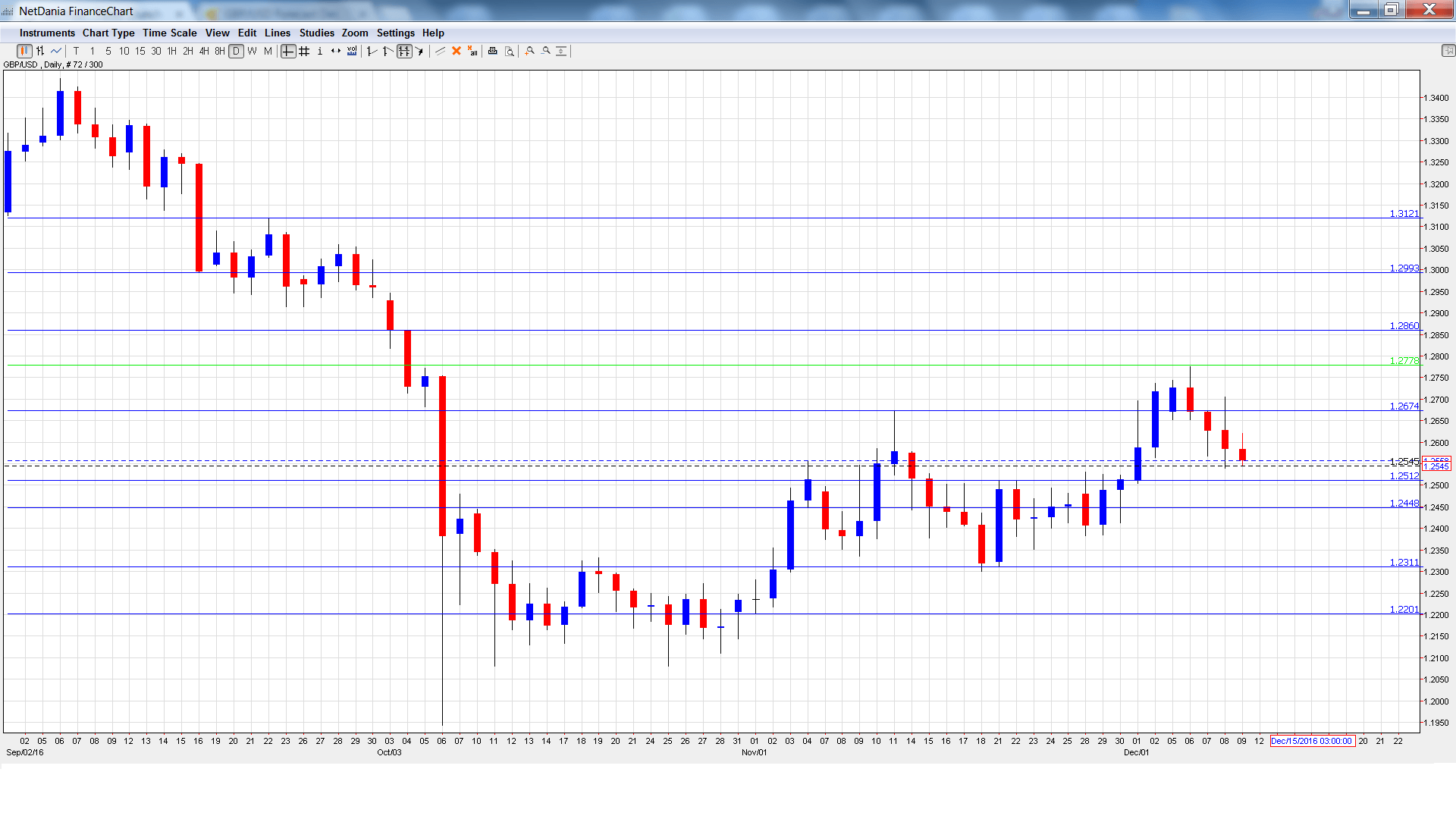

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- RIghtmove HPI: Monday, 00:01. This indicator provides a snapshot of the level of activity in the housing sector. The index posted a decline of 1.1% in November. Will we see an improvement in the December report?

- CB Leading Index: Monday, 14:30. This index is based on 7 economic indicators, but is a minor event as most of the data has already been released. This minor indicator posted a weak gain of 0.1% in September, after two straight readings of 0.0%.

- CPI: Tuesday, 9:30. CPI is the primary gauge of consumer inflation and should be treated as a market-mover. The index edged lower to 0.9% in October, shy of the forecast of 1.1%. The estimate for October stands at 1.1%.

- PPI Input: Tuesday, 9:30. This inflation indicator surged 4.6% in October, crushing the estimate of 1.6%. The markets are braced for a decline of 0.4% in the November report.

- RPI: Tuesday, 9:30. RPI includes housing costs, which are excluded from CPI. The indicator remained steady at 2.0% in October, short of the estimate of 2.3%. Little change is expected in the November report, with a forecast of 2.1%.

- Average Earnings Index: Wednesday, 9:30. Wage growth is a key component of the labor market. The indicator has posted three straight gains of 2.3%, and an identical gain is expected in the October reading.

- Claimant Count Change: Wednesday, 9:30. Claimant Change is one of the most important indicators and an unexpected reading can have a strong impact on GBP/USD. In October, the indicator jumped to 9.8 thousand, well above the estimate of 1.9 thousand. The estimate for November stands at 6.2 thousand. The unemployment rate is expected to remain at 4.8%.

- Retail Sales: Thursday, 9:30. Retail Sales is the primary gauge of consumer spending. The indicator sparkled in October with a gain of 1.9%, well above the estimate of 0.5%. However, the markets are braced for a small gain of 0.2% in the November report.

- Official Bank Rate: Thursday, 12:00. The BoE is expected to maintain rates at 0.25%. The MPC will release the vote breakdown for the November rate decision, when the bank held rates. The markets are predicting that the vote for that decision was a unanimous 9-0 vote.

- Monetary Policy Summary: Thursday, 12:00. This summary is released on a monthly basis. This report contains discusses economic conditions and could provide clues about the BoE’s future monetary policy.

- Asset Purchase Facility: Thursday, 12:00. The BoE’s asset-purchase program is expected to remain at 435 billion pounds. The voting breakdown for the November decision (which remained at 435 billion pounds) is expected to be a unanimous 9-0 vote.

- CBI Industrial Order Expectations: Friday, 11:00. This indicator is surveys manufacturers for their expectations of order volume. The indicator continues to show expectations of decreasing volume, but the November reading of -3 points was much better than the previous release of -17 points. The forecast for December is -5 points.

- BoE Quarterly Bulletin: Friday, 12:00. This report includes market research and analysis and commentary on domestic international economic issues.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2669 and climbed to a high of 1.2775, as resistance held at 1.2778 (discussed last week). The pair then reversed directions and dropped to a low of 1.2540. GBP/USD closed the week at 1.2560.

Live chart of GBP/USD:

Technical lines from top to bottom

1.3121 was a cap in September.

1.2993 follows.

1.2860 has provided resistance since early October.

1.2778 held firm as the pair pushed higher before retracting.

1.2674 was a cap in November.

1.2512 is a weak support level.

1.2448 is next.

1.2311 has been a cushion since late November.

1.2201 is the final support line for now.

I am bearish on GBP/USD.

With the Fed likely to hike rates for the first time in a year this week, sentiment towards the greenback is favorable. This could translate into gains for the US dollar.

Our latest podcast is titled From the Crude Cut to Draghi’s Drag

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.