GBP/USD lost 100 points last week. The pair closed at 1.2160. There are 11 events this week. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

Donald Trump disappointed markets with a press conference that was heavy on theatrics and light on substance. In the UK, Manufacturing Production posted a strong gain of 1.3%, but the pound was unable to take advantage against the dollar.

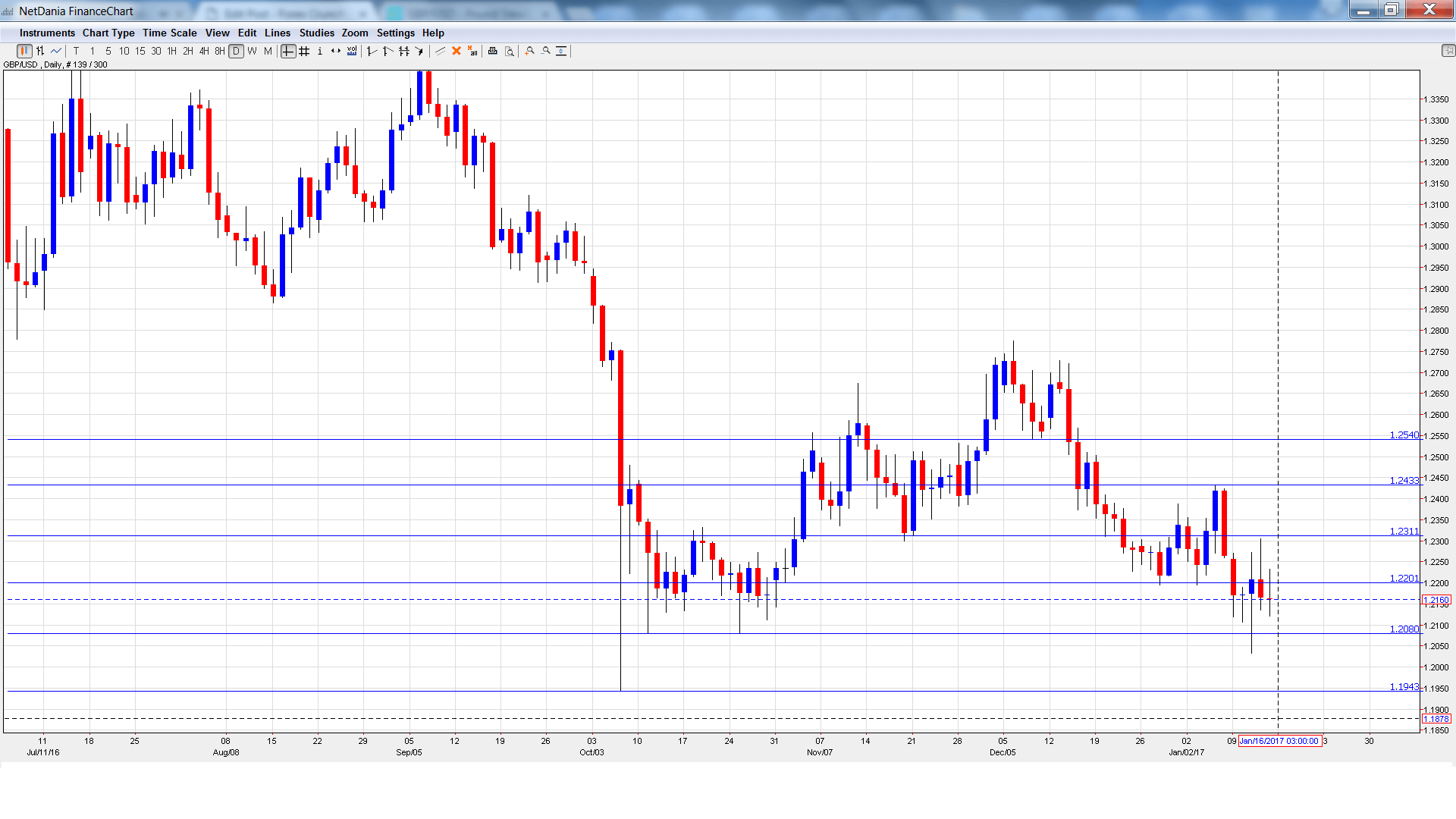

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:01. This housing inflation index provides a snapshot of the level of activity in the housing sector. The index has posted two straight declines.

- BoE Governor Mark Carney Speech: Monday, 18:30. Carney will deliver remarks at the London School of Economics. A speech which is more hawkish than expected is bullish for the British pound.

- CPI: Tuesday, 9:30. CPI is one of the most important indicators and should be treated as a market-mover. The index improved in November, posting a gain of 1.2%, edging above the forecast of 1.1%. The upward swing is expected to continue in December, with an estimate of 1.4%.

- PPI Input: Tuesday, 9:30. This indicator measures the price of goods and raw materials purchased by manufacturers. The indicator sagged in November, posting a decline of 1.1%, weaker than the forecast of -0.4%. The markets are expecting a strong turnaround in the December report, with a gain of 2.2%.

- RPI: Tuesday, 9:30. RPI includes housing costs, which are not included in the CPI report. The index climbed to 2.2% in November, edging above the forecast of 2.1%. The upswing is expected to continue in December, with an estimate of 2.3%.

- CB Leading Index: Tuesday, 14:30. This index is based on 7 economic indicators, and has posted two consecutive gains of 0.1%.

- Prime Minister Theresa May Speech: Tuesday, Tentative. May will speak in London about Article 50, the mechanism for triggering Britain’s departure from the UK. Traders should treat the speech as a market-mover.

- Average Earnings Index: Wednesday, 9:30. This wage growth indicator is a key employment event and is closely monitored by analysts. The index improved to 2.5% in October, beating the estimate of 2.3%. The upward swing is expected to continue in November, with an estimate of 2.6%.

- Claimant Count Change: Wednesday, 9:30. This indicator slipped to 2.4 thousand in November, short of the forecast of 6.2 thousand. The estimate for the December report stands at 4.6 thousand.

- RICS House Price Balance: Thursday, 00:01. The index has been moving higher since July and improved to 30% in November. The markets are expecting a higher reading in December, with an estimate of 32%.

- Retail Sales: Friday, 9:30. Retail Sales is the primary gauge of consumer spending and an unexpected reading can have a sharp impact on the movement of GBP/USD. The indicator slipped ot 0.2% in November, matching the forecast. The markets are braced for a decline of 0.1% in the December report.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2256 and dropped to a low of 1.2033, testing resistance at 1.2201. The pair then reversed directions and climbed to a high of 1.2305, as resistance held at 1.2311 (discussed last week). GBP/USD closed the week at 1.2160.

Live chart of GBP/USD:

Technical lines from top to bottom

We begin with resistance at 1.2540.

1.2433 is next.

1.2311 has switched to a resistance role following sharp losses by GBP/USD last week.

1.2201 is an immediate support line.

1.2080 is protecting the symbolic 1.20 level.

1.1943 has provided support since October 2016.

1.1844 is the final support line for now.

I am bearish on GBP/USD.

The US economy enters 2017 in excellent shape and the inauguration of Trump at the end of the week could raise expectations for fiscal stimulus, boosting the US dollar.

Our latest podcast is titled Trump Train or Donald Derailed?

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.