GBP/USD reversed directions last week, losing 130 points. The pair closed at 1.2884. This week’s highlights are Average Earnings Index and Claimant Count Change. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

In the UK, Brexit jitters increased as all three PMIs reported softer growth in May and missed estimates. In the US, the Federal Reserve minutes pointed to division over the timing of the balance sheet reduction and concerns about low inflation. There was mixed news on the employment front, as Nonfarm Payrolls rebounded to 222 thousand, but wage growth remained weak.

Updates:

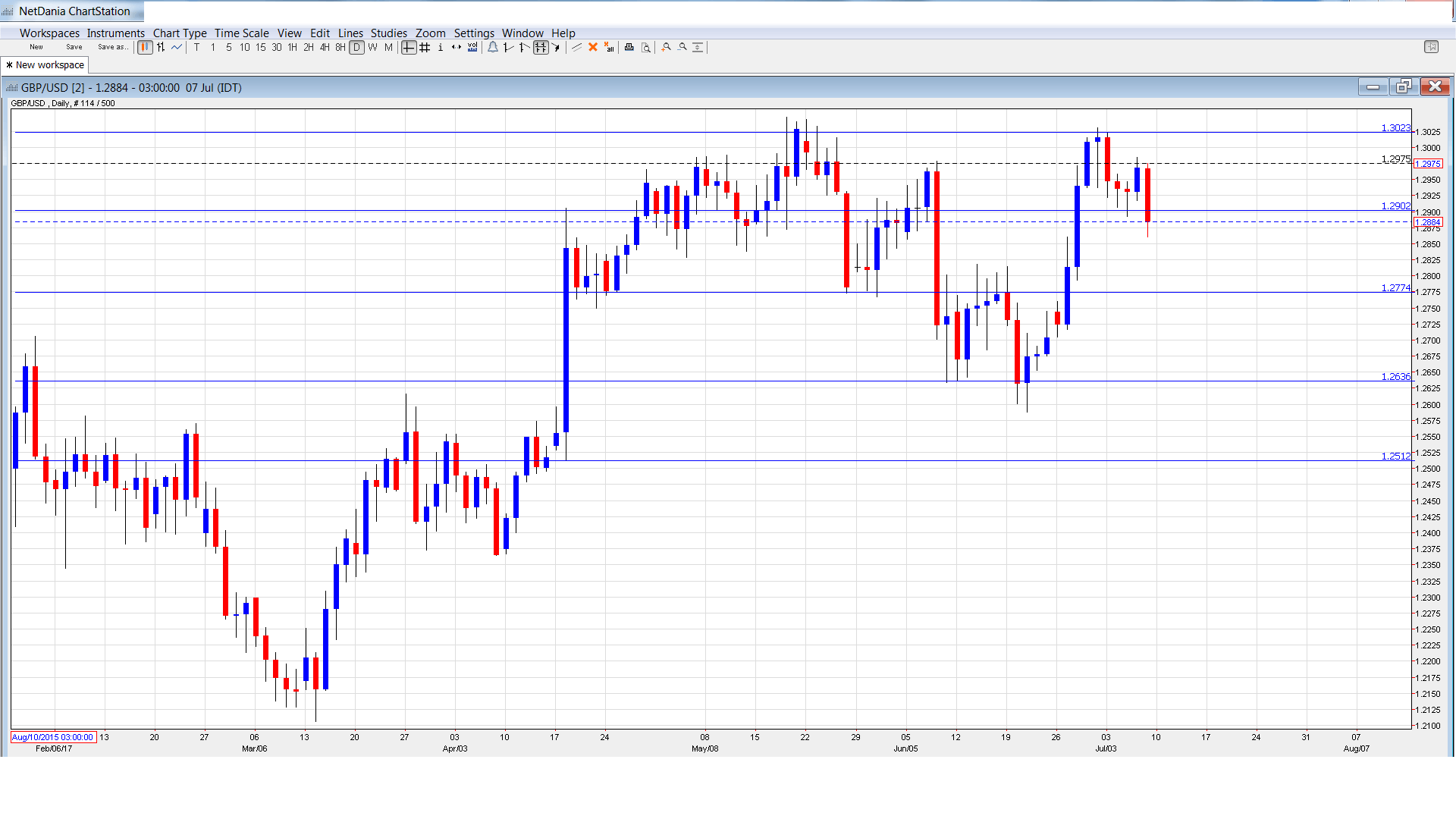

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:01. This retail sales indicator has struggled, with four declines in the past five months. In May, the indicator posted a decline of -0.4%.

- MPC Member Ande Haldane Speaks: Tuesday, 10:00. Haldane will participate in a panel at a BoE event in London. A speech that is more hawkish than expected is bullish for the pound.

- MPC Member Ben Broadbent Speaks: Tuesday, 11:00. Broadbent will speak at an event in Aberdeen. The markets will be looking for clues regarding the BoE’s future monetary policy.

- CB Leading Index: Tuesday, 13:30. The indicator has posted two straight declines. Will the index bounce back in the May report?

- Average Earnings Index: Wednesday, 8:30. Wage growth softened to 2.1% in April, short of the forecast of 2.4%. The downward trend is expected to continue in May, with an estimate of 1.8%.

- Claimant Count Change: Wednesday, 8:30. This indicator should be treated as a market-mover. In May, the indicator came in at 7.3 thousand, better than the forecast of 12.5 thousand. The estimate for June stands at 10.4 thousand. The unemployment rate is expected to remain at 4.6%.

- RICS House Price Balance: Wednesday, 23:01. The indicator continues to weaken, and came in 17% in May, shy of the estimate of 20%. The downward forecast is expected to continue in June, with an estimate of 15%.

- BoE Credit Conditions Survey: Thursday, 8:30. Credit levels are carefully monitored, as they are closely linked to spending levels. The quarterly report provides details about secured and unsecured lending to the private sector.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3015 and quickly climbed to a high of 1.3023, testing resistance at 1.3020 (discussed last week). The pair posted considerable losses at the end of the week, dropping to a low of 1.2861. GBP/USD closed the week at 1.2884.

Live chart of GBP/USD:

Technical lines from top to bottom

1.3347 has held in resistance since September 2016.

1.3238 is next.

1.3112 has held in resistance since September 2016.

1.3020 is protecting the 1.30 line.

1.2902 is the next support line.

1.2775 has switched to a support role following losses by GBP/USD.

1.2636 was a cushion in June.

1.2512 is the final support line for now.

I am neutral on GBP/USD.

The British economy is showing some signs of fatigue and this could weigh on the pound. The Fed is on record that it will raise interest rates a third time in 2017, but the markets have their doubts, as inflation remains weak and second quarter numbers in the US have not impressed.

Our latest podcast is titled Where are the wage hikes?

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.