GBP/USD posted sharp losses last week, losing 120 pips as Brexit reality bit. The pair closed just above the 1.31 level. This week’s key event is Preliminary GDP. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

The biggest blow to the pound came with the special release of PMIs: they showed the Brexit shock at its worst, with services PMI plunging deep into contraction zone. Unemployment Claims remained steady and easily beat the forecast. In the UK, CPI improved to 0.5%, beating the estimate. British employment numbers were strong, as Claimant Count Change posted a negligible gain and Average Earnings Index improved to 2.3%, a 7-month high. In the US, construction numbers were steady, as Building Permits and Housing Starts met expectations. .

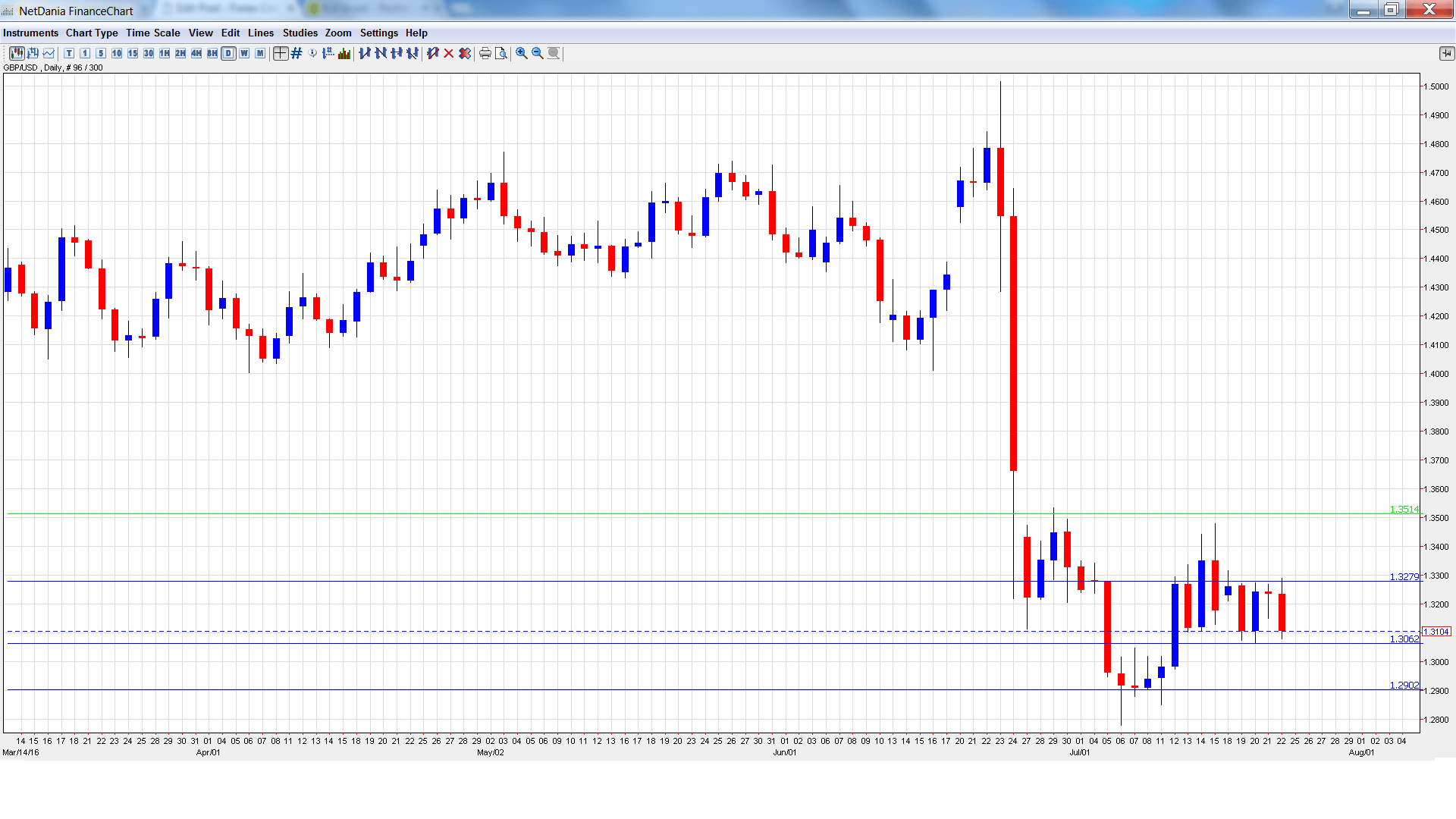

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 10:00. The indicator continues to lose ground, but the readings are steadily improving. In June, the indicator improved to -2 points, compared to -8 points in the previous release. This easily beat the forecast of -10 points. The estimate for the July release stands at -6 points.

- BBA Mortgage Approvals: Tuesday, 8:30. This event provides a snapshot of the level of activity in the housing sector. In May, the indicator improved to 42.2 thousand, beating expectations. A weaker reading is expected in the June release, with a forecast of 40.2 thousand.

- Preliminary GDP: Wednesday, 8:30. Preliminary GDP, the first of three GDP reports, is the key event of the week. An unexpected reading can have a sharp impact on the direction GBP/USD. Final GDP for Q1 posted a gain of 0.4%, below the initial readings. Preliminary GDP is expected to post a gain of 0.5% in the second quarter.

- CBI Realized Sales: Wednesday, 10:00. This consumer spending indicator dropped to 4 points in June, well short of the forecast of 9 points. The downward trend is expected to continue in July, with an estimate of 2 points.

- Nationwide HPI: Thursday, 6:00. This housing price index has been steady, posting three straight readings of 0.2%. The estimate for the July reading stands at a flat 0.0%.

- GfK Consumer Confidence: Thursday. 23:05. Strong consumer confidence often translates into consumer spending, a key driver of economic growth. The indicator plunged to 9 points in June, its sharpest drop in December 2013. Another sharp decline is expected in July, with the estimate standing at -7 points.

- Net Lending to Individuals: Friday, 8:30. This indicator is linked to consumer spending levels, as increased borrowing usually translates into stronger consumer spending. The indicator jumped to GBP 4.3 billion, well above the estimate of GBP 2.9 billion. Little change is expected in the June release.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3229 and quickly touched a high of 1.3315. The pair dropped to a low of 1.3062, testing support at 1.3064 (discussed last week). GBP/USD closed the week at 1.3104.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We start with resistance at 1.3514. This line has held firm since late June. 1.3426 is next. 1.3276 has strengthened in resistance following strong losses by GBP/USD.

1.3142 is a weak resistance line.1.3064 is an immediate support level. 1.2902 is next. The lowest level since 1985 is 1.2790 and that is the final line for now.

I am bearish on GBP/USD.

The BoE stood pat in July, but will likely cut rates in August in order to cushion the economic fallout from Brexit. With speculation rising that the Fed could raise rates in 2016, monetary divergence favors the US dollar.

Our latest podcast is titled Oil down, gold up and the upcoming Fed-fest

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.