GBP/USD rebounded strongly last week as the pair climbed 230 points. The pair closed at 1.3175. There are a number of key events this week, highlighted by CPI and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

The pound received a huge boost last week, courtesy of the Bank of England, which surprised the markets and did not lower interest rates. In the US, retail sales looked good, but inflation levels remained low and consumer confidence slipped.

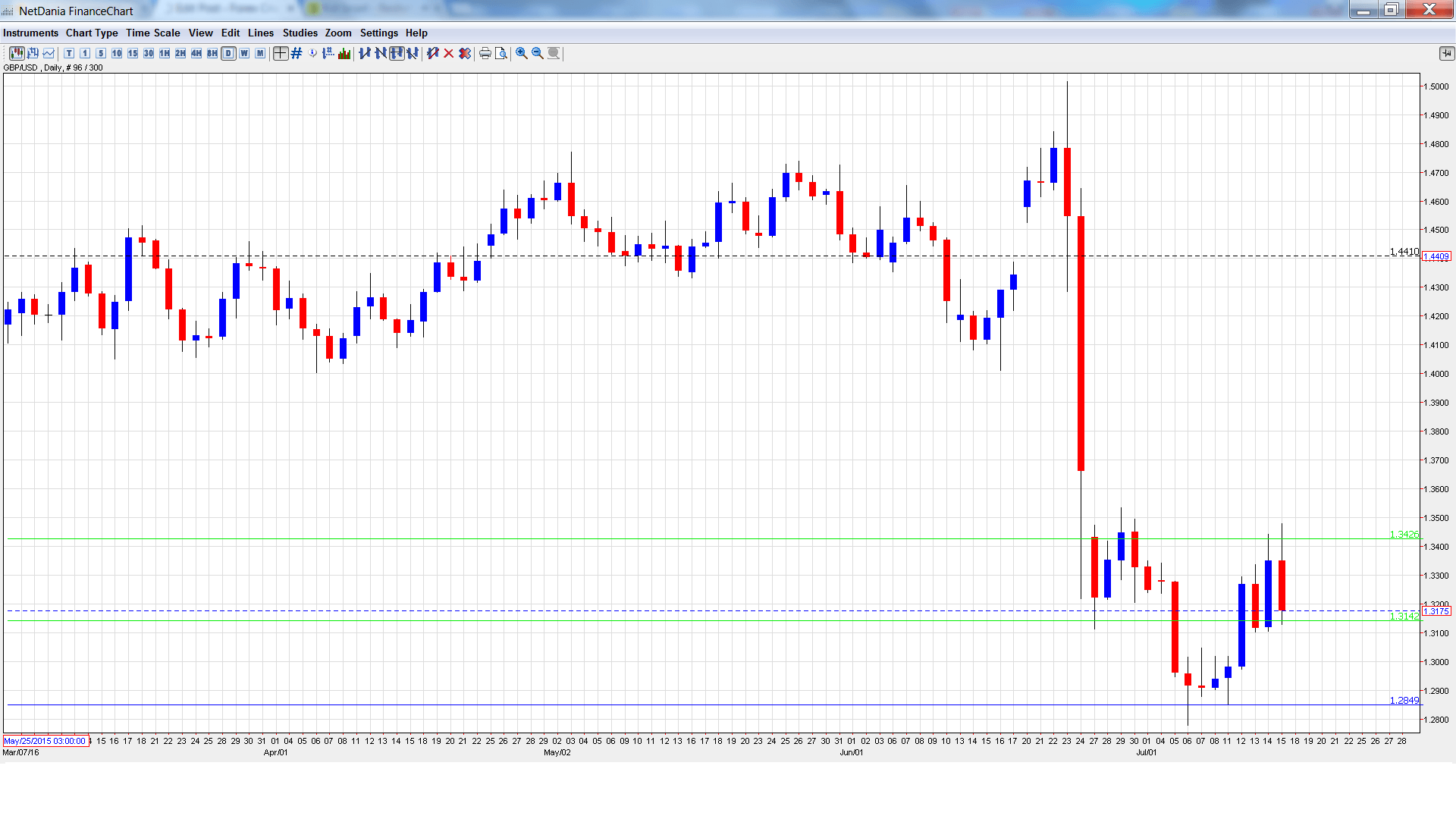

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This housing price index provides a snapshot of activity in the housing sector. The indicator posted a respectable gain of 0.8% in June, compared to the previous reading of 0.4%.

- MPC Member Martin Weale Speaks: Monday, 8:15. Weale will speak about Brexit at an event in London. The markets will be looking for clues about a possible rate hike in August.

- CPI: Tuesday, 8:30. CPI is the primary gauge of consumer inflation, and is closely tracked by the BoE. The index has been steady, posting four gains of 0.3% in the past five months. The June reading is expected to edge up to 0.4%.

- PPI Input: Tuesday, 8:30. This important manufacturing indicator posted an excellent gain of 2.6% in May, well above expectations. The estimate for the June report stands at 0.9%.

- RPI: Tuesday, 8:30. RPI includes housing costs, which are excluded from the CPI report. The index posted improved to 1.4% in May, within expectations. The markets are expecting an identical reading June.

- BOE Deputy Governor Ben Broadbent Speaks: Tuesday. 14:05. Broadbent will testify before the Economic Affairs Committee. A speech which is more hawkish than expected is bullish for GBP/USD.

- Average Earnings Index: Wednesday, 8:30. This employment indicator measures the change in wage growth. The index has posted two straight gains of 2.0% and the estimate for May stands at 2.3%.

- Claimant Count Change: Wednesday, 8:30. This key indicator can have a strong impact on the movement of GBP/USD. The indicator posted a negligible loss of 0.4 thousand in May, within expectations. The markets are braced for a weak reading of 4.1 thousand in June.

- Retail Sales: Thursday, 8:30. Retail Sales is the primary gauge of consumer spending and should be treated as a market-mover. The indicator posted a gain of 0.9% in May, well above the forecast of 0.3%. The markets are braced for a downturn in June, with a an estimate of -0.4%.

- Public Sector Net Borrowing: Thursday, 8:30. The deficit jumped to GBP 9.3 billion in May, marking a 6-month high. The estimate for the June reading stands at GBP 9.3 billion.

- Manufacturing PMI: Friday, 8:30. The week wraps up the week with this key event. The indicator improved to 52.1 points in June, beating the forecast of 50.0 points. This was the indicator’s strong indicator in five months. The markets are braced for a contraction in the upcoming reading, with an estimate of 49.0 points.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2941 and quickly touched a low of 1.2849, as support held at 1.2840 (discussed last week). The pair then reversed directions and climbed to a high of 1.3480 late in the week. However, GBP/USD was unable to consolidate at these levels and closed the week at 1.3175.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

With the pound posting sharp gains, we start at higher levels:

1.3600 was tested in resistance in late June immediately after the Brexit vote which sent the pound reeling.

1.3514 is next.

1.3426 was tested in resistance as the pound pushed close to the 1.35 line before retracting.

1.3276 is an immediate resistance line.

1.3142 is providing weak support. It could see action early in the week.

1.3064 is protecting the symbolic 1.30 line.

1.2849 is next. This line was tested earlier in the month as the pound dipped below the 1.28 level.

1.2720 is the final support level for now.

I am bearish on GBP/USD.

The BoE stood pat in July, but there’s no way getting around the Brexit shock to the British economy, so the central bank will need to take action. The markets are now expecting a rate cut in August. US numbers have been solid although a rate hike is unlikely in Q3.

In our latest podcast we explain helicopter money and discuss how Carney Marked up the pound.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.