GBP/USD reversed directions and posted modest gains this week. The pair closed at 1.2776. There are 7 events this week. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

British inflation levels continue to rise, but wage growth and unemployment rolls missed their estimates. As well, retail sales posted a second decline in three months, raising concerns about consumer spending. This hurt the pound, but the currency rebounded as three members of the BoE voted to raise rates, although the majority prevailed and the BoE held rates at 0.25%. Over in the US, the Fed raised rates and the rate statement was more hawkish than expected, disregarding lower inflation.

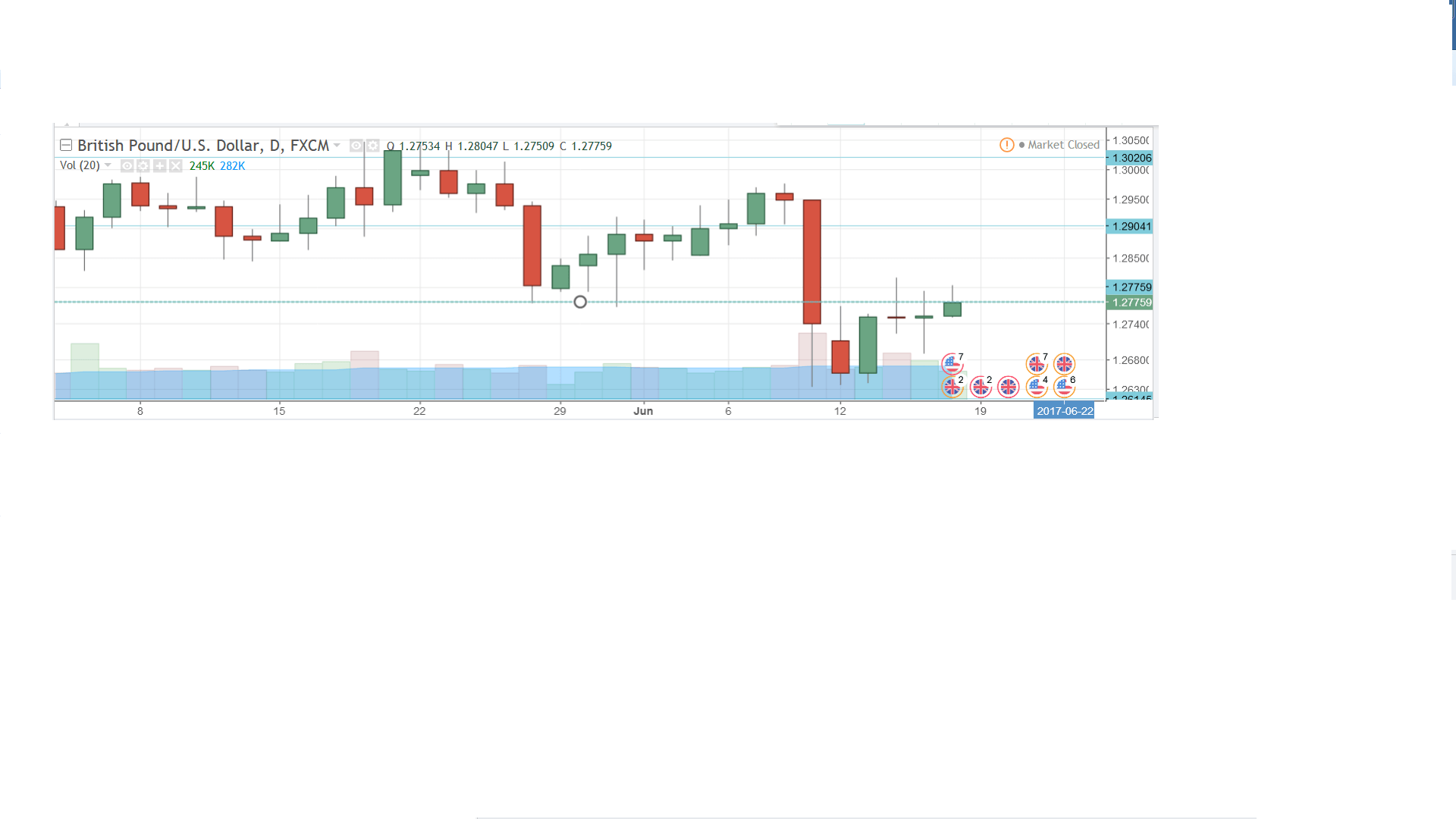

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This housing inflation indicator edged up 1.2% in May, up from 1.1% a month earlier.

- BoE Governor Mark Carney Speaks: Tuesday, 7:30. Carney will deliver a speech in London. Analysts will be looking closely for any hints of a rate hike later this year.

- Public Sector Net Borrowing: Wednesday, 8:30. The budget deficit ballooned to GBP 9.6 billion in April, above the forecast of GBP 8.0 billion. The deficit is expected to narrow to GBP 7.3 billion in May.

- MPC Member Andy Haldane Speaks: Wednesday, 11:00. Haldane will speak at an event in Yorkshire. As the chief economist of the BoE, his comments are closely watched by the markets.

- CBI Industrial Order Expectations: Thursday, 10:00. The indicator improved to 9 points in May, crushing the estimate of 4 points. The forecast for June stands at 7 points.

- 30-y Bond Auction: Thursday, Tentative. The 30-y yield has been dropping, and came in at 1.79% in the March auction. Will we see an upswing in June?

- MPC Member Kristin Forbes Speaks: Thursday, 18:00. Forbes will speak at an event at the London Business School. A speech which is more hawkish than expected is bullish for the British pound.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2713 and dropped to a low of 1.2639. The pair then dropped to a low of 1.2639, as support held at 1.2616 (discussed last week). GBP/USD recovered and closed the week at 1.2776.

Technical lines from top to bottom

1.3247 has held in resistance since September 2016.

1.3112 marked a low point in June 2016 as the pound crashed after the Brexit vote.

1.3020 is protecting the symbolic 1.30 level.

1.2902 is next.

1.2775 is providing support just below the line of 1.2776, where the pair closed the week.

1.2616 is next.

1.2512 has provided support since April.

1.2404 is the final support level for now.

I am bearish on GBP/USD.

The UK political landscape remains fluid, and the start of Brexit negotiations could get off to a rocky start. The US economy remains strong, and the Fed’s upbeat rate statement marked a significant vote of confidence in the US economy.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.