GBP/USD was looking for a new direction after that dovish hike from the BOE and as Brexit talks are trying to get out of the ditch. The upcoming week features three top-tier publications: inflation, jobs, and retail sales. Here are the key events and an updated technical analysis for GBP/USD.

The British government lost two ministers due to various scandals. Brexit talks are not going anywhere fast. However, some positive data from the manufacturing sector as well as USD weakness helped the pair maintain the range. The weakness in the greenback is due to issues with passing the tax reform.

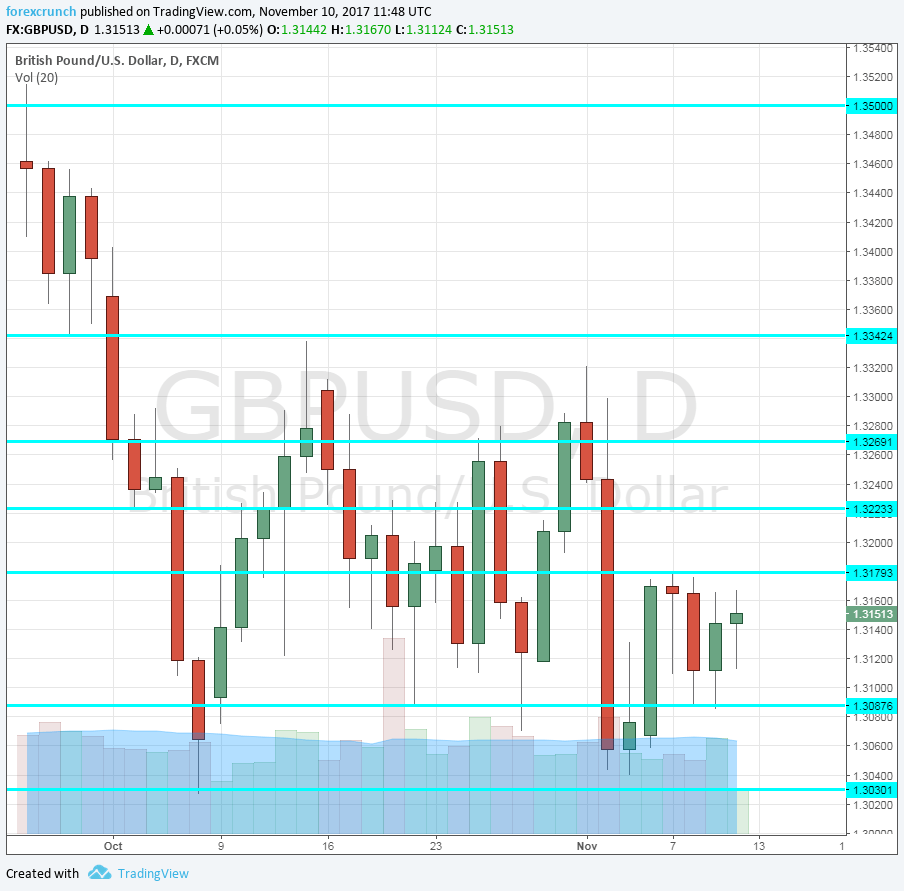

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:01. This House Price Index is the earliest one available and therefore moves markets. A rise of 1.1% was reported in October, and now we get the fresh data for November.

- Inflation report: Tuesday, 9:30. BOE Governor Mark Carney said that inflation would peak in October 2017 according to the BOE’s forecasts. We will now see if it exceeds the 3% level seen in September, the top of the BOE’s target range of 1-3%. Core CPI reached 2.7% while the Retail Price Index advanced to 3.9%. PPI Input rose by 0.4% m/m. The weakness of the British pound following the EU Referendum last year is the main contributor to higher prices. Headline CPI is expected to rise to 3.1% y/y. Core CPI is predicted to tick up to 2.8%, the RPI to 4.1%, the HPI to 5.2%, and PPI Input to rise by 0.8%.

- Mark Carney talks, Tuesday, 10:00. The Governor of the Bank of England will be speaking alongside other heavyweights such as the Fed Chair Yellen, the ECB’s Draghi and the BOJ’s Kuroda in Frankfurt. He could provide some insights on how the Old Lady sees the economy.

- Jon Cunliffe talks, Tuesday, 17:30. The Deputy Governor of the BOE is due to deliver a speech in Oxford and may shed some light on the recent decision to raise rates but to singal no huge moves afterward.

- Jobs report: Wednesday, 9:30. The number of jobless claims (Claimant Count Change) ticked up 1.7% in September, slightly better than expected. We will now get fresh figures for October. The unemployment rate remained very low in August: 4.3%. Most importantly, the average earnings index is eyed: wages increased by 2.2% y/y in August. While this is off the lows, the pace of salary rises still lags behind inflation. Weak wages will probably take center-stage once again. The Claimant Count Change is forecast to rise by 2.4K, annual wages to slow to 2.1% and the unemployment rate to remain unchanged at 4.3%.

- CB Leading Index: Wednesday, 14:30. This composite index is based on indicators that have already been released but still serves as an overview of the economy. A drop of 0.1% was reported in August. We will now receive the data for September.

- Retail sales: Thursday, 9:30. After three upbeat months, the volume of sales slipped by 0.8% in September, causing a slide in the pound. Are consumers becoming more sensitive to higher prices? The updated data for October also feeds into Q4 GDP. A rise of 0.2% is on the cards now.

GBP/USD Technical Analysis

Pound/dollar made attempts to advance early in the week but seemed pressured by resistance at 1.13180 (mentioned last week).

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.35 was the post-Brexit high and remains the top level.

It is followed by 1.3370 which capped the pair several times in 2016. The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

Our latest podcast is titled Yield curve blues and sparks in oil

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!