GBP/USD rebounded last week, gaining 130 points. The pair closed at 1.2455. This week’s key events are the PMI reports. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

British Second GBP for Q3 posted a gain of 0.5%, matching expectations. In the US, durable goods orders were sharp and UoM Consumer Sentiment beat expectations.

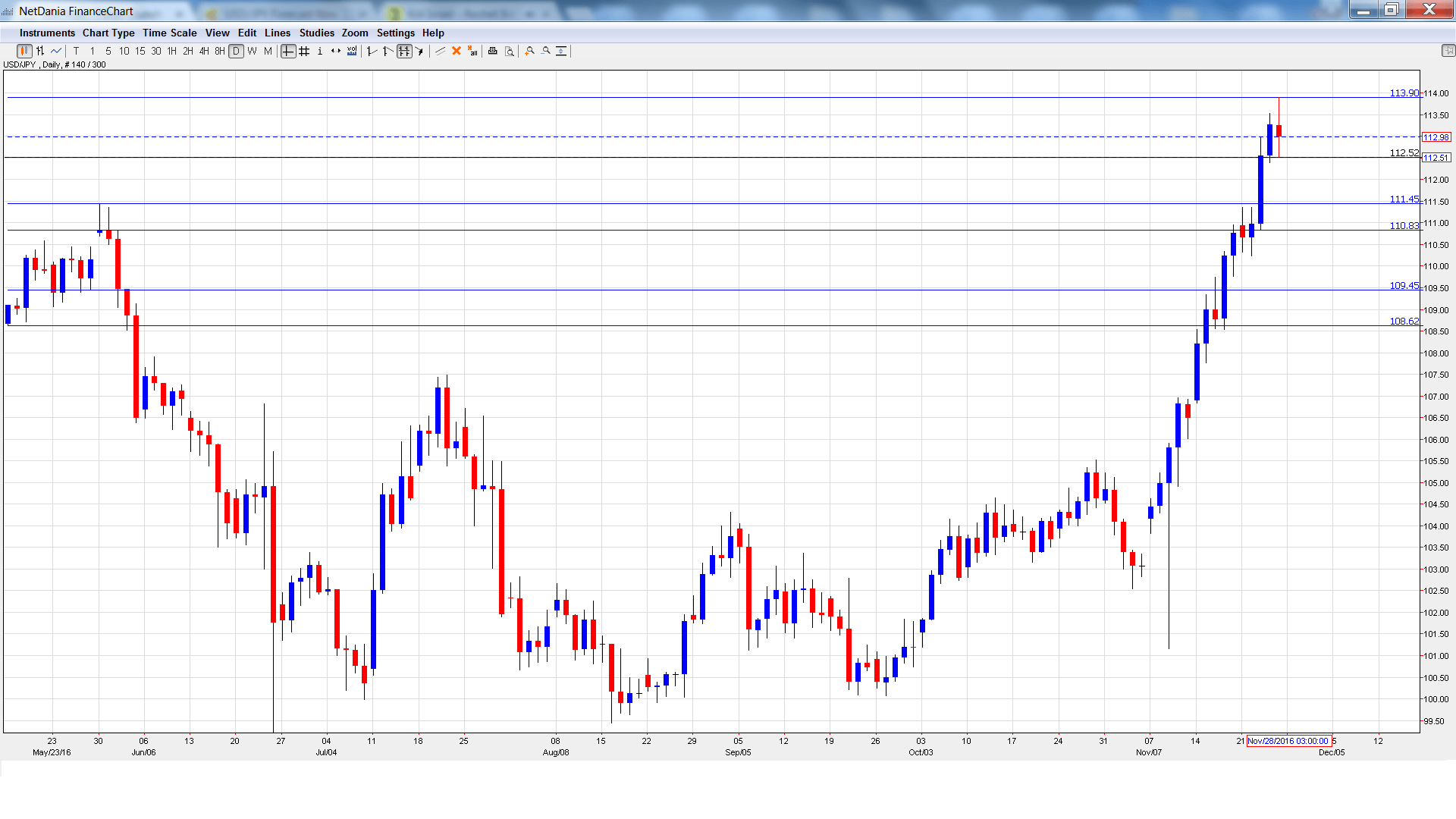

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Nationwide HPI: Tuesday, 29th-30th. This housing inflation indicator dipped to 0.0% in October, short of the forecast of 0.2%. The estimate for November stands at 0.2%.

- Net Lending to Individuals: Tuesday, 9:30. Borrowing levels are positively correlated with spending levels. The indicator climbed to GBP 4.7 billion in September, and is expected to rise to GBP 4.8 billion in October.

- GfK Consumer Confidence: Wednesday, 00:01. The indicator continues to point to weak consumer confidence. The index dropped to -3 points in October and is expected to drop to -4 points in November.

- Bank Stress Test Results: Wednesday, 7:00. This test is used to gauge the stability of the banking sector and capital reserve adequacy. Previous tests have indicated a strong banking sector.

- BoE Financial Stability Report: Wednesday, 7:00. This semi-annual report provides an analysis of the stability of the British financial sector. Analysts will be especially interested in what the report has to say about the Brexit decision and the expected impact on the economy.

- Manufacturing PMI: Thursday, 9:30. The index continues to point to expansion in the manufacturing sector. The indicator came in at 54.3 points in October and little change is expected in the November report.

- Construction PMI: Friday, 9:30. This indicator improved to 52.6 in October, pointing to slight expansion in the construction sector. The forecast for the November report stands at 52.3.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2322 and quickly dropped to a low of 1.2311, as support held at 1.2272 (discussed last week). The pair then reversed directions and climbed to a high of 1.2512. GBP/USD closed the week at 1.2455.

Live chart of GBP/USD:

Technical lines from top to bottom

We start with resistance at 1.2865.

1.2778 is next.

1.2612 was a cushion back in 1985.

1.2448 is a weak support line. It could see further action early in the week.

1.2272 is next.

1.2143 has been a cushion since late November.

I am neutral on GBP/USD.

With a December hike from the Fed a virtual certainty, sentiment towards the greenback is favorable. At the same time, the pound received a boost as the BoE did not lower rates in November, as the bank acknowledged that its forecasts regarding fallout from Brexit were overly-pessimistic.

Our latest podcast is titled Eyeing OPEC – Critical crude

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.